Tesla’s Stock Surges: A Bright Spot in the Auto Industry

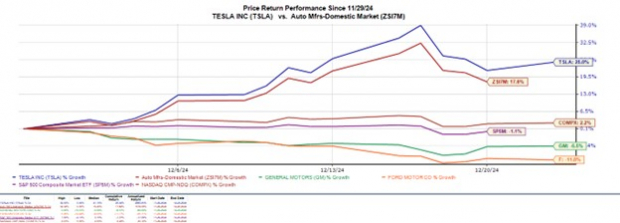

Tesla TSLA is shining brightly, with shares rising +25% in December and over +75% year to date. This strong performance stands in stark contrast to the broader indexes and competitors like General Motors GM and Ford F.

As the new year approaches, investors are considering whether to join this upward trend and if Tesla should be part of their portfolios.

Image Source: Zacks Investment Research

Factors Driving Investor Excitement for TSLA

Analysts are optimistic about Tesla due to the company’s ambitious plans for long-term growth, including the advancement of Full Self-Driving (FSD) technology and the introduction of robotaxis.

The recent re-election of Donald Trump also adds to this enthusiasm, as he appointed Tesla CEO Elon Musk as a co-leader for a new government efficiency initiative.

Although Musk won’t officially be in the President’s cabinet, the Trump administration’s support for electric vehicles has raised hopes for Tesla’s operational benefits.

Examining Tesla’s Growth Forecast

According to Zacks estimates, Tesla’s total sales are projected to rise by 3% in fiscal 2024, with further growth of 17% expected in FY25, reaching $117.58 billion.

However, annual earnings are anticipated to fall to $2.47 per share this year, down from $3.12 in 2023. Positive news is on the horizon, with FY25 EPS expected to climb 32% to $3.26 per share.

Image Source: Zacks Investment Research

Recent Changes in Earnings Estimates

Supporting the increase in Tesla’s stock price, the earnings per share (EPS) estimates for FY24 and FY25 have risen by 10% and 8% respectively over the last two months.

Image Source: Zacks Investment Research

Conclusion on TSLA’s Investment Potential

With a Zacks Rank #1 (Strong Buy) reflecting the trend of favorable earnings revisions, Tesla appears to be a strong investment option moving into 2025. Potential government support under the Trump administration could further strengthen this outlook.

Zacks Announces Top 10 Stocks for 2025

Are you interested in early insights into our top picks for 2025?

History shows their performance could be remarkable.

Since 2012, when Sheraz Mian became the head of the portfolio, the Zacks Top 10 Stocks have gained an impressive +2,112.6%, far exceeding the S&P 500’s +475.6%. Sheraz is currently analyzing 4,400 companies to find the best 10 stocks to invest in for 2025. Don’t miss your opportunity to discover these stocks when they are released on January 2.

Want Zacks Investment Research’s latest recommendations? Download our report on 5 Stocks Set to Double for free.

Tesla, Inc. (TSLA): Free Stock Analysis Report

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.