Datadog: A Rising Star in Cloud Monitoring and Security

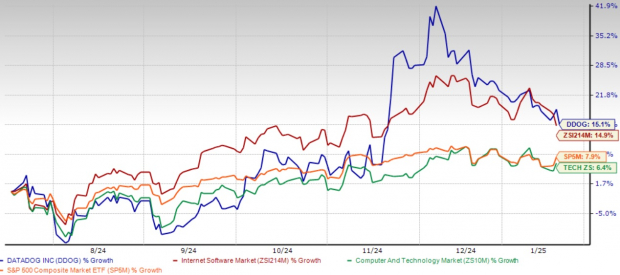

Datadog (DDOG) has established itself as a strong contender in the cloud monitoring and security market, with its stock appreciating by 15.1% over the past six months. Operating alongside industry giants such as New Relic, Dynatrace, and Splunk, Datadog has carved out its niche with a unique unified platform and extensive multi-cloud integrations.

Central to Datadog’s strategy is its capability to deliver comprehensive visibility into multi-cloud infrastructures. The company’s strong integrations with Amazon (AMZN), Alphabet (GOOGL), and Microsoft (MSFT) Azure allow businesses to monitor, analyze, and optimize their entire cloud ecosystem from a single platform. This integrated approach proves invaluable as more companies adopt hybrid and multi-cloud strategies, thereby enhancing flexibility and minimizing vendor dependency.

Recent Performance Overview

Image Source: Zacks Investment Research

Diverse Product Range Boosts Growth

The company’s achievements can be linked to its diverse product lineup and commitment to innovation. Out of its 23 products, 15 have exceeded $10 million in annual recurring revenue (ARR). Notably, their expansion into MongoDB database monitoring covers all five major database types: MongoDB, Postgres, MySQL, SQL Server, and Oracle. This positions Datadog as a one-stop solution provider for modern cloud environments.

Harnessing Artificial Intelligence for Expansion

Datadog is successfully tapping into the potential of artificial intelligence. AI-oriented clients now account for over 6% of ARR, a significant increase from 2.5% a year earlier. This segment contributed about 4 percentage points to year-over-year growth in the third quarter, indicating its solid presence in AI infrastructure monitoring. Approximately 3,000 customers utilize Datadog’s AI integrations, with hundreds already leveraging its LLM observability products, reflecting strong market demand for its AI-based solutions.

Strong Customer Metrics and Valuation Insights

Datadog’s enterprise-level strategy is yielding impressive outcomes, as around 3,490 customers now generate ARR of $100,000 or more, compared to 3,130 a year ago. These high-value customers contribute approximately 88% of total ARR. Platform adoption metrics reveal a positive trend, with 83% of customers engaging with two or more products, 49% with four or more, and 26% utilizing six or more products—an increase from 21% last year.

While the stock is priced at a forward 12-month price-to-sales (P/S) ratio of 14.41—higher than the broader Zacks Internet – Software industry—this valuation seems reasonable given Datadog’s robust revenue growth and expanding customer base.

Evaluating Datadog’s Valuation

Image Source: Zacks Investment Research

Financial Strength and Future Projections

As of September 30, 2024, Datadog boasts a strong financial position with $3.2 billion in cash and marketable securities. The non-GAAP operating margin rose to 25% in the third quarter of 2024, reflecting enhanced operational efficiency. For the upcoming fourth quarter, management expects revenues between $709 million and $713 million, signaling a continued growth trend. The full-year revenue forecast for 2024 is projected at $2.656 billion to $2.660 billion, underscoring the company’s solid market standing.

The Zacks Consensus Estimate for 2024 revenues and earnings stands at $2.66 billion and $1.76 per share, respectively. This forecasts year-over-year improvements of 24.9% for revenues and 33.3% for earnings, with the earnings estimate rising by a penny in the past month.

Image Source: Zacks Investment Research

For the latest EPS estimates and surprises, check the Zacks Earnings Calendar.

Strategic Initiatives for Growth

Datadog’s innovative Cloud SIEM has made significant strides, with major clients like Lenovo, FanDuel, Carvana, and the University of Alabama at Birmingham adopting the solution. The introduction of Datadog OnCall has generated considerable interest among customers, further solidifying its position in cloud service management. Ongoing innovation in AI observability and security continues to differentiate Datadog from its competitors.

Looking Forward: Investment Outlook for 2025

As we approach 2025, Datadog presents several enticing investment angles. Firstly, its designation as a Leader in Gartner’s Magic Quadrant for Observability Platforms for the fourth consecutive year underscores its industry dominance. Secondly, the company’s strong presence in AI infrastructure positions it well amid growing AI adoption. Lastly, its continuous product expansion and integration initiatives promise sustained competitive edges in the market.

Investment Perspective

With its strong market position, innovative product development, expanding AI capabilities, and solid financial metrics, Datadog stock offers an appealing buying opportunity for 2025. The company’s adept execution of its growth strategy and its presence in the burgeoning cloud monitoring sector suggest a positive trajectory ahead. A stable net revenue retention rate in the mid-110s and increasing enterprise clientele lend further clarity to its future growth potential.

For investors eager to penetrate the cloud computing and AI infrastructure markets, Datadog stands as a robust investment option. The company’s wide-ranging product suite, strategic growth in critical areas, and healthy financial state render it a noteworthy addition for growth-focused investors. Cautious investors should assess their risk tolerance, but Datadog’s strong fundamentals and market prospects position it as a compelling buy for 2025. The current Zacks Rank for DDOG stock is #1 (Strong Buy). You can find the full list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss your opportunity to invest early in our 10 top stocks for 2025. Curated by Zacks Director of Research Sheraz Mian, this handpicked portfolio has been remarkably successful. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks has gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has meticulously analyzed 4,400 companies covered by the Zacks Rank to identify the best 10 stocks to buy and hold through 2025. You can still discover these newly released stocks with great potential.

See New Top 10 Stocks >>

For the latest recommendations from Zacks Investment Research, you can download 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.