Rivian’s Stock Potential: Could Recovery Be on the Horizon?

Rivian (NASDAQ: RIVN) is facing challenges, recently seeing its share price cut in half in 2024. The stock is at risk of dropping below $10 per share. For investors willing to take on risk for potentially high returns, this could be an opportunity worth considering. However, it’s essential to understand the situation before taking action.

Two Reasons Why Rivian Might Rebound

Rivian’s stock has been struggling, and its stagnant revenue growth illustrates the challenges it faces. Like many in the electric vehicle sector, including Tesla (NASDAQ: TSLA), Rivian has seen slowed sales this year.

Earlier in the year, Tesla saw a decline in revenues, while Rivian still managed to report double-digit sales growth. As Tesla recovered and outpaced Rivian in quarterly sales growth, both companies contend with lower-than-expected demand for electric vehicles.

Nevertheless, there are two developments that could signal a turnaround for Rivian.

First, Rivian aims to reach positive gross margins by the end of the year. Currently, it loses $32,000 on each vehicle sold, a notable improvement but still a significant hurdle to overcome. If Rivian can meet this target, investors may respond positively, as it would show the company can sell vehicles at a profit and extend its financial viability.

Second, the introduction of Rivian’s mass-market vehicles—the R2, R3, and R3X—is set to radically change its market position. Priced under $50,000, these models could replicate the success seen by Tesla with the Model Y and Model 3. Rivian’s revenue has already surged by over 1,000% since its IPO in 2021, reaching $5 billion earlier this year, but stagnant sales could change with the launch of these new models by the end of the decade.

Should Rivian achieve positive gross margins and successfully launch these new offerings, it stands to gain significantly on par with Tesla.

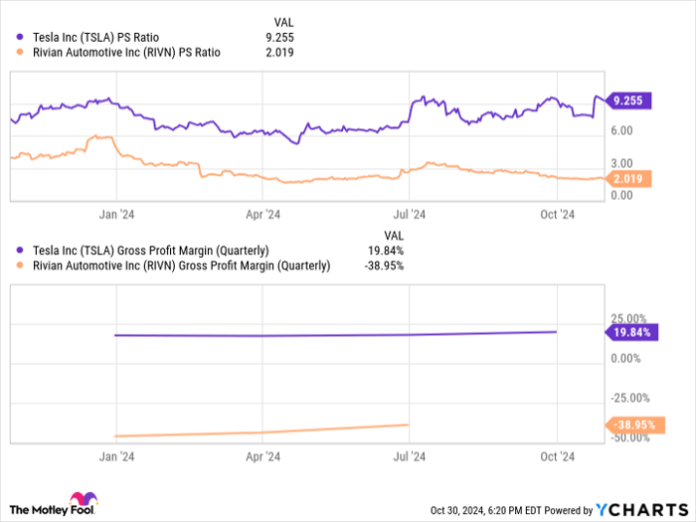

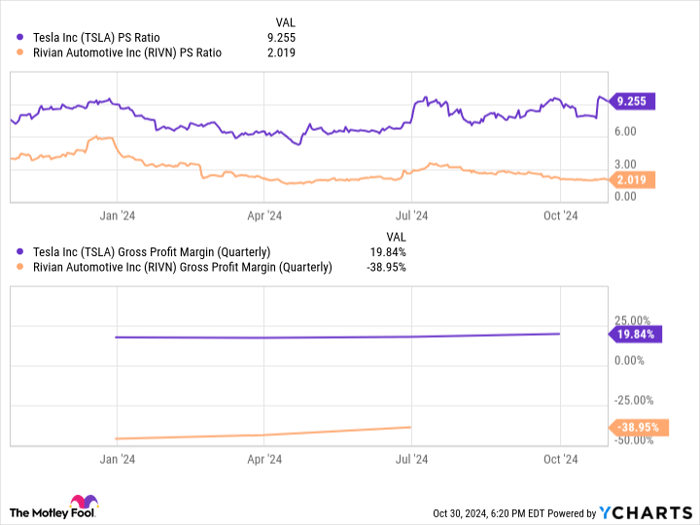

TSLA PS Ratio data by YCharts.

Understanding the Risks Before Investing

Investors considering Rivian should approach with caution and be prepared for volatility. This is not a straightforward investment opportunity.

First, the company’s ability to achieve positive gross margins this year is uncertain, despite management’s confidence. Previous efforts to improve margins have produced gradual gains. While improvement is likely over the next year, failing to meet targets could jeopardize Rivian’s sustainability in a competitive market.

Secondly, the new models—the R2, R3, and R3X—aren’t expected to reach consumers until 2026, with some variants possibly delayed until 2027. This lack of immediate catalysts makes Rivian primarily a long-term investment.

Even so, Rivian’s current valuation appears attractive, trading at an 80% discount to Tesla on a price-to-sales basis. For aggressive growth investors, this might be a strong entry point before shares potentially drop below $10. It’s advisable to dollar-cost average should prices continue downward in 2024.

Seize a New Investment Opportunity

If you feel you missed out on successful stocks in the past, here’s your chance.

On rare occasions, our expert analysts identify a “Double Down” stock—an indication they believe certain companies are poised for significant gains. If you think you’ve missed your opportunity to invest in Rivian, now might be the time to reconsider.

- Amazon: A $1,000 investment in 2010 would now be worth $22,292!*

- Apple: A $1,000 investment in 2008 would be worth $42,169!*

- Netflix: A $1,000 investment in 2004 would now be worth $407,758!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and opportunities like this can be rare.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.