“`html

Tesla’s Stock Performance: Surprising Gains Amid Industry Challenges

Investors have largely shifted their focus away from Tesla (NASDAQ: TSLA) in 2024, captivated instead by artificial intelligence (AI) stocks like Nvidia and Palantir. Tesla’s CEO, Elon Musk, has diverted attention to various business and political pursuits in recent quarters. As excitement around electric vehicles (EVs) diminishes and industry growth stagnates, both shareholders and Musk himself seem to be losing interest in the company.

However, it’s worth noting that Tesla’s stock has doubled, surging 100% over the past 12 months. The company holds an impressive market capitalization of $1.3 trillion as it prepares to announce its fourth-quarter earnings on January 29. Should investors consider buying shares before this report? Let’s delve into the details.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Challenges: Slowing Revenue Growth and Profit Margins

To evaluate Tesla’s stock, we must first consider its sales performance. Once a powerhouse in unit deliveries, Tesla has faced a slowdown in 2024. Its trailing-12-month deliveries dipped lower than in 2023, signaling a significant stall possibly due to reduced market share in the EV sector, particularly in the United States.

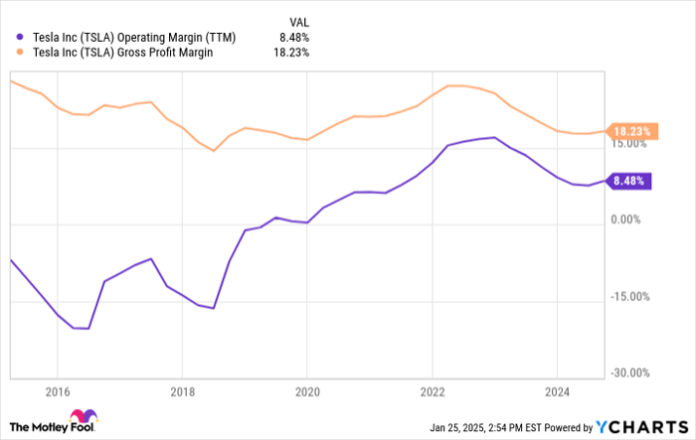

Moreover, Tesla has enacted substantial price cuts to stimulate sales. For the 12 months ending in Q3 2024 (with Q4 results on the horizon), Tesla reported a gross margin of 18% and an operating margin of just 8.5%. This operating margin is about half of what the company achieved a few years ago, raising concerns about its financial health.

Given these price reductions and declining delivery numbers, we should not expect a significant turnaround in Tesla’s Q4 financial results. Revenue growth is likely to remain weak, and profit margins probably will continue to lag behind previous levels.

Future Aspirations: Ambitious Yet Unclear Growth Plans

Currently, Tesla’s EV segment struggles, prompting investors to highlight the company’s broader ambitions beyond just car manufacturing. Tesla is exploring solar technology, commercial battery cells, self-driving technology, the Cybercab, and even AI plus humanoid robotics.

While these initiatives sound promising, skepticism arises regarding their potential impact on Tesla’s financial performance in the foreseeable future. The company has long promised self-driving vehicles and robotaxis, yet these have yet to materialize. The humanoid robot, known as Optimus, appears conceptually strong, but its practical implementation seems distant. Reports suggest that demonstrations surrounding Optimus may have exaggerated the state of Tesla’s technology in this area.

One pressing concern is Tesla’s minimal investment in AI. Elon Musk has established a separate entity called xAI, securing $6 billion in funding. The question remains: will Musk’s AI focus benefit Tesla, or will it predominantly support this new initiative? If it’s the latter, it may hinder Tesla’s operations.

TSLA Operating Margin (TTM) data by YCharts

Should You Invest in Tesla Stock Now?

Considering the current landscape, optimism about Tesla’s prospects appears unfounded. While the EV sector falters, it remains uncertain how meaningful the company’s new ventures will be, or if they will even come to fruition under Musk’s leadership.

The most striking concern among investors is Tesla’s valuation. The stock currently has a price-to-earnings ratio (P/E) of 111, nearly four times the average for the S&P 500. This valuation belongs to a company that is not experiencing rapid growth and is witnessing shrinking margins, with limited diversification in its operations.

Regardless of whether Tesla meets or misses its earnings per share (EPS) forecasts—and its immediate stock price reactions—investors seeking long-term holds may find Tesla stock a risky choice at current levels. Cautious discernment suggests it may be wise to refrain from purchasing shares before the upcoming Q4 earnings update.

Consider This Opportunity for Potential Lucrative Returns

If you’ve ever felt you missed a chance to invest in top-performing stocks, this is for you.

Occasionally, our expert team of analysts issues a “Double Down” stock recommendation for companies poised for significant growth. If you’re anxious about missing your chance, now might be your opportunity to invest before it slips away. The historical data is compelling:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $369,816!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,191!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $527,206!*

Right now, we’re issuing “Double Down” alerts for three outstanding companies, with limited time to capitalize on this opportunity.

Learn more »

*Stock Advisor returns as of January 21, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia, Palantir Technologies, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`