Don’t worry — if you are looking at GoPro (NASDAQ: GPRO) stock, you have not missed the opportunity to buy.

Its shares are down roughly 55% over the past year and over 95% from their high-water mark in 2015. With the stock now trading at around $1.70 each, there’s plenty of time to buy in. You just have to believe that GoPro can broaden its business model and remain a stand-alone public company.

Here’s what you need to know.

GoPro has awesome technology

The core GoPro product is an unusually rugged camera that thrill seekers can comfortably take with them while they do dangerous things — things that would probably destroy other cameras and would likely be deadly to your cellphone.

The list of frightening human activities that have been captured on a GoPro, and shared on the company’s YouTube channel, includes jumping out of a plane, skiing down a cliff, and kayaking through rapids, among other things, some of which are hard to explain because they are so wild.

Image source: Getty Images.

The GoPro product has historically been a very purpose-built item with a rather niche audience. For most people a cellphone has more than enough power and ruggedness to capture important moments like birthdays, weddings, and graduations. Sure, you might drop the phone, but you don’t need to worry about it falling thousands of feet from the sky, tumbling down a mountain, or sinking to the bottom of a river.

This fact is a problem, because it limits GoPro’s addressable market. No matter how cool a GoPro is, most people aren’t likely to be interested in paying big bucks for a hard-as-nails camera when their cellphone will do just fine.

Although the company was once a Wall Street star, investor adoration cooled off pretty quickly. The stock is down more than 95% from the all-time highs it achieved in 2015. One of the really big problems is that GoPro hasn’t found a way to turn a consistent profit. In fairness, the company sells consumer discretionary items, so its sales are seasonal. But this is a known fact, and management hasn’t been able to structure the business around it.

GPRO data by YCharts

GoPro’s next chapter?

The big decision investors have to make here is whether or not GoPro has a sustainable business. The company’s early history and financial results suggest that may not be the case. However, management is trying to shift its approach. There are two pieces to the story.

First, GoPro has been building out a subscription business. Essentially, it offers customers storage and editing services for a fee. This is a higher-margin business than selling devices, and it provides annual continuity in areas like income thanks to the subscription model being used. In the first quarter of 2024 the number of subscribers increased 6% year over year. The bad news is that the number was down from the fourth quarter of 2023, and roughly flat with the third quarter of that year.

The subscription business has grown materially since it was started, but there’s a very real chance that it has reached a plateau. If that were to be the case, GoPro’s future would look a lot less appealing.

That’s where the second big management shift comes in. Historically, GoPro sold a lot of cameras on its own. It has been pushing harder to sell cameras through other retailers. This broadens the company’s reach, but it doesn’t change the niche aspect of the product.

That is why GoPro is also, to quote the company, “developing a broader range of products that more specifically meet the needs of our customers, while also targeting entirely new market segments.” The hope is likely that a broader product lineup will allow GoPro to sell more cameras to more people and use that as a funnel to get more subscribers. It’s not a bad plan, but it isn’t yet clear that it will work.

Only aggressive investors should buy GoPro

At the end of the day, GoPro is an unprofitable company with a niche product that’s working on revamping its business so it has broader customer appeal. That’s a risky proposition and only risk-tolerant investors will want to jump aboard.

But the big issue to wrap your head around here is whether or not you believe GoPro can actually update its business model in a way that allows it to be sustainably profitable. If it can’t do that, GoPro probably isn’t worth toying with today.

Should you invest $1,000 in GoPro right now?

Before you buy stock in GoPro, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and GoPro wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

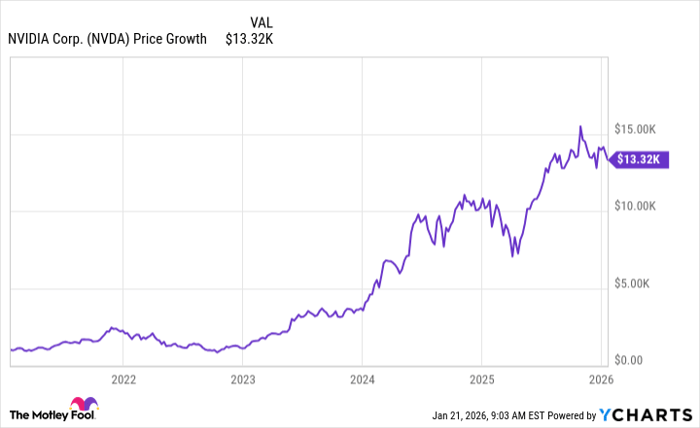

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.