Nvidia (NASDAQ: NVDA) once again demonstrated why it is a top semiconductor stock. Last week, it delivered the report for its fiscal 2025’s first quarter (which ended April 30), revealing triple-digit percentage revenue growth for yet another quarter and insatiable demand for its most powerful chips.

The stock price boost inspired by those results has taken its market cap to about $2.6 trillion, a 230% yearly rise. In the wake of such an increase, many investors who haven’t already bought in must wonder whether they have missed the boat, or whether they can still profit from this remarkable growth story. Let’s see.

The new state of Nvidia

Nvidia is spearheading what it calls the next industrial revolution.

As late as the end of fiscal 2022, most of the company’s revenue had come from gaming. However, by that time, Nvidia had spent many years developing graphics processing units (GPUs) for both gaming and data centers. Thanks to artificial intelligence (AI) and deep learning, it increased the speed and capabilities of its processors while making itself an AI innovator.

When the public debut of ChatGPT sparked a wave of demand for generative AI, tech companies — and investors — discovered that 10,000 of Nvidia’s most powerful GPUs were providing the computing power to support the model. That revelation caused demand for its AI-capable chips to surge to unprecedented levels.

Rivals began developing competing AI chips. AMD released its MI300 line, claiming it was faster than Nvidia’s H100 and upcoming H200 GPUs. But customers seem to have dismissed such assertions, and Nvidia continues to innovate. Nvidia said its latest platform, dubbed Blackwell, can run trillion-parameter large language models at as little as 4% of the cost and energy consumption of its Hopper platform.

And the company asserts that the cost savings for some other computationally intensive applications are even greater. Such advances show Nvidia’s determination to remain the leader in the AI chip business. With a market share of at least 80%, its dominance is unlikely to end anytime soon.

Where Nvidia stands financially

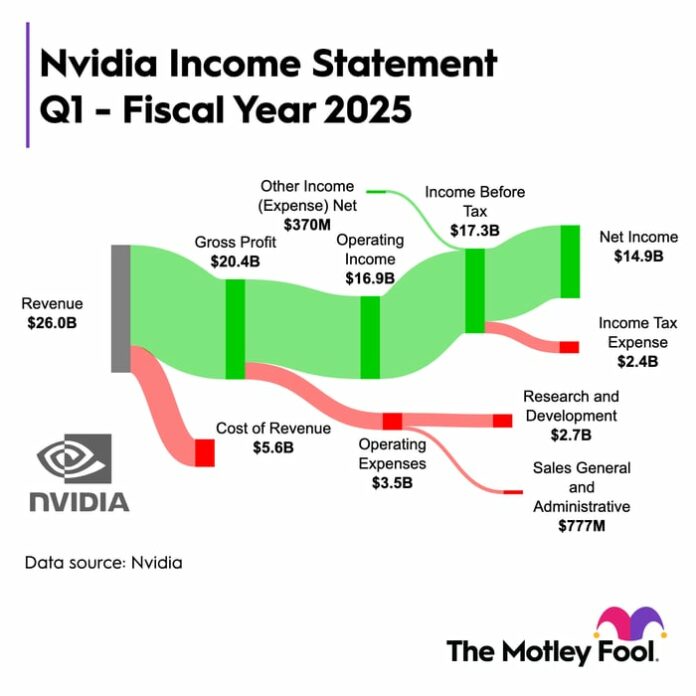

The fiscal Q1 2025 report appears to confirm the chipmaker’s market leadership. In the period, revenue rose 262% year over year to $26 billion. Almost $23 billion of that came from the data center segment, where revenue rose 427%. That’s a dramatic change for a company that earned the majority of its revenue from selling into the gaming market until two years ago.

Image source: The Motley Fool.

During that time, operating expenses climbed by only 39%. Consequently, its net income of $15 billion increased 628% over the previous year.

Amid these results, Nvidia stock surged past the $1,000 per share mark. That prompted the company to approve a 10-for-1 stock split, effective June 7. It last split 4-for-1 in July 2021.

Those share price gains elevated Nvidia’s valuation, but it may not be as high as some assume. Its P/E ratio of 87 is not cheap, but with a profit growth rate well into the triple-digit percentages, that may not deter investors. Its forward P/E ratio of 38 seems to confirm this value proposition. Although Nvidia has logged some impressive gains, its climb could still have a long way to go.

Considering the high demand for its AI-capable chips and valuation, it is likely not too late to buy Nvidia. It has benefited from unprecedented growth, and since demand for its AI chips far exceeds the supply, it should continue growing its revenue and profits rapidly, and the stock appears poised to move higher for the foreseeable future.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $703,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 28, 2024

Will Healy has positions in Advanced Micro Devices. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.