The Significance of Brokerage Recommendations

Confronted with the decision of whether to engage with a stock, investors habitually seek validation from analyst recommendations. But how impactful are these Wall Street verdicts on the share price?

Before diving into the reliability of brokerage advice, let’s uncover the sentiment pulsating through the corridors of power at Advanced Micro Devices (AMD)

A Bird’s Eye View of Brokerage Recommendations for AMD

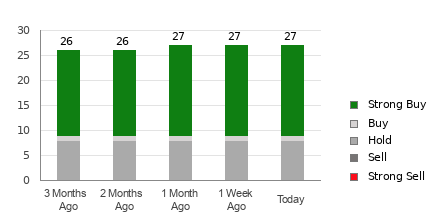

AMD currently boasts an average brokerage recommendation (ABR) of 1.35, a metric formulated from ratings by 30 brokerage firms. This places it between a Strong Buy and Buy, reflecting the collective sentiment of analysts.

An examination of the 30 recommendations underlying the ABR unveils a staggering 80% Strong Buy and 3.3% Buy, painting an overwhelmingly positive picture for the semiconductor manufacturer.

Deciphering the Reliability of Brokerage Recommendations

While the ABR advises investing in AMD, a word of caution is warranted. Numerous studies have exposed the limited efficacy of brokerage guidance in predicting stocks with potential price increases. The analysts’ predisposition towards positively skewing ratings on stocks they cover calls into question the objectivity of their recommendations.

The counsel here is not to bask in the glow of brokerage recommendations but to use them astutely in tandem with corroborative research or robust indicators.

Zacks Rank: A Beacon of Reliability

Enter the Zacks Rank, a credibility-coated tool that categorizes stocks into five distinct groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), exuding a sheen of trustworthiness that is verifiably audited.

Unlike the ABR, the Zacks Rank derives strength from quantifiable earnings estimate revisions. Herein lies the crux—where brokerage analysts stumble, the Zacks Rank triumphs in unearthing the real potential of a stock.

A Contrast in Clarity: ABR vs. Zacks Rank

While both the ABR and Zacks Rank cower within the 1-5 range, their essence diverges like two branches of a river. The ABR is a leaf swaying to the whims of brokerage recommendations, while the Zacks Rank stands tall, upheld by a sturdy trunk of earnings estimate revisions.

Where brokerage ratings dawdle, the Zacks Rank surges forth, swiftly mirroring changes in earnings estimates with the promptness of a sunbeam slicing through the morning haze.

The Verdict for AMD: A Symphony of Optimism

As per the Zacks Consensus Estimate, Advanced Micro’s forecast for the ongoing year has swelled by 0.4% in the past month, now resting at $2.65.

The harmonious chorus of analysts, harmonizing in their upward EPS estimate revisions, has rendered a resounding Zacks Rank #2 (Buy) for Advanced Micro, a bullish echo that reverberates throughout the stock market.

It’s a confluence of factors that accentuates the appeal of AMD as a viable investment, with the Buy-equivalent ABR further strengthening the case.

Explore Zacks Rank #1 (Strong Buy) stocks here

Before you march forward, the final decision rests in your hands. Validate and contemplate—revel in the wisdom of the Zacks Rank but temper it with your own astute research. As the curtains part on this theatrical performance, the spotlight now shifts to the stage of your investment portfolio.