When it comes to the stock market, should investors trust the recommendations of Wall Street analysts, or are these ratings merely a mirage that vanishes when probed?

Before delving into the reliability of brokerage recommendations and how to leverage them, let’s inspect what the Wall Street heavyweights have to say about PepsiCo (PEP).

PepsiCo currently bears an average brokerage recommendation (ABR) of 2.00, falling within the “Buy” category on a scale of 1 to 5, based on the actual recommendations provided by 18 brokerage firms. This data suggests a favorable stance towards the stock.

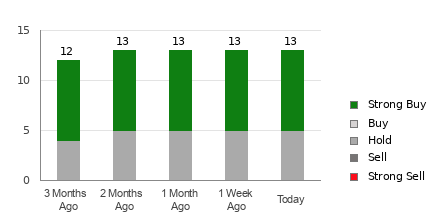

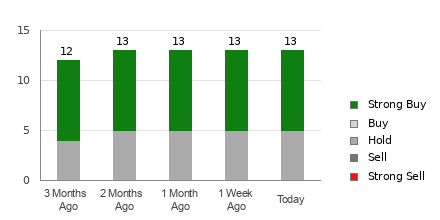

Wall Street Realty: Trending PEP Recommendations

Check price target & stock forecast for PepsiCo here>>>

While an ABR of 2.00 beckons buy-in caution is advisable. Analytical studies have revealed limited brokerage success in selecting lucrative stocks. The inherent bias of brokerage analysts fostered by their institutional interests, with a tendency to issue more “Strong Buy” than “Strong Sell” ratings, casts doubt over their objectivity.

One viable solution is to utilize the Zacks Rank, a well-regarded proprietary stock rating tool, which classifies stocks from #1 (Strong Buy) to #5 (Strong Sell) with a track record validated by external sources. Cross-validating ABR with the Zacks Rank may present a more profitable investment strategy.

Deciphering Confusion: Zacks Rank vs. ABR

As with any investment metric, comprehending the nuances between the ABR and Zacks Rank is crucial. ABR is computed from broker recommendations, typically displayed in decimals, while the Zacks Rank is founded on quantitative models centering on earnings estimate revisions, denoted in whole numbers.

While analysts’ ABR ratings often exhibit overt optimism, the Zacks Rank hinges on earnings estimate trends, which have demonstrated a substantial correlation with short-term stock movements.

Furthermore, the refresh rate differs between ABR and Zacks Rank. Given the ABR’s potential staleness, Zacks Rank’s agility in capturing rapid earnings adjustments offers a more timely insight into future stock performance.

Is PepsiCo A Worthy Investment?

Upon scrutinizing the earnings estimate revisions for PepsiCo, the Zacks Consensus Estimate for the current year clings steadfastly at $7.55 over the past month.

With analysts maintaining stable projections for the company’s earnings, echoed by an unchanged consensus estimate, this could indicate a stock poised for alignment with the broader market in the short term.

Despite the ABR echoing a “Buy” sentiment, the Zacks Rank flags PepsiCo with a #3 (Hold) status, warranting some measured circumspection.

Should investors take a leap of faith based on Wall Street’s bullish views? Or should they peer deeper into the looking glass of finance to ascertain the veracity of these claims? The decision is in the hands of the investor.

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.