Investors often rely on the verdicts of Wall Street analysts before determining the fate of a stock. The influence of these so-called financial gurus in the media can sway stock prices, but do these recommendations hold any real weight?

Before we delve into the validity of these recommendations and how to leverage them to your advantage, let’s dissect Wall Street’s sentiment towards Rio Tinto (RIO).

Wall Street Analyst Insights on RIO

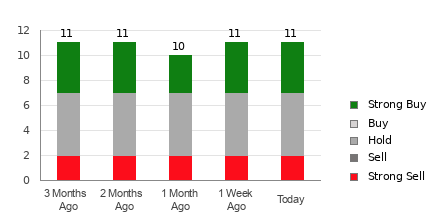

Currently, Rio Tinto boasts an average brokerage recommendation (ABR) of 1.50, teetering between Strong Buy and Buy on a scale ranging from 1 to 5. An analysis of the recommendations from 12 brokerage firms contributed to this figure, with a solid 75% giving a resounding endorsement through a Strong Buy rating.

Deciphering Brokerage Recommendations for RIO

The ABR signals an affirmative stance on Rio Tinto, but solely banking on this metric may not offer complete clarity. Research indicates that reliance on brokerage recommendations may not always steer investors towards stocks poised for substantial price appreciation.

Why, you ask? Well, the inherent bias of brokerage firms towards stocks they cover often results in a predominantly positive rating from analysts. Studies reveal a glaring discrepancy: for every “Strong Sell” recommendation, there are five “Strong Buy” ratings handed out. Thus, these endorsements may not always align with the interests of retail investors, providing scant insight into a stock’s future price trajectory.

Zacks Rank, a trusted stock rating tool with a proven track record, classifies stocks into five categories from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) and serves as a reliable predictor of a stock’s future price performance. Cross-referencing the ABR with the Zacks Rank could serve as a prudent strategy for making sound investment decisions.

Key Distinctions Between ABR and Zacks Rank

While both the ABR and Zacks Rank occupy a scale of 1 to 5, their underlying methodologies diverge fundamentally.

Broker recommendations lay the foundation for the ABR, typically reflected in decimal form (e.g., 1.28). Conversely, the Zacks Rank relies on a quantifiable model driven by earnings estimate revisions, represented by whole numbers from 1 to 5.

Brokerage analysts, swayed by their employers’ vested interests, tend to lean towards optimistic ratings that may overreach the actual merits of the stock. In contrast, the Zacks Rank’s emphasis on earnings estimate revisions presents a more accurate depiction of a stock’s potential performance, as validated by empirical research linking short-term price movements to these trends.

Moreover, the Zacks Rank ensures a balanced distribution of its five ranks across all stocks, reflecting the ongoing updates stemming from brokerage analysts’ earnings estimate shifts, thereby offering timely insights into future stock prices.

Assessing RIO’s Investment Viability

Scrutinizing Rio Tinto’s earnings estimate revisions, the Zacks Consensus Estimate for the current year has undergone a 1.1% downturn over the last month to $8.07.

An overwhelming consensus among analysts, aligning on a downward trajectory for the company’s earnings outlook, has led to a Zacks Rank #4 (Sell) designation for Rio Tinto. For an overview of today’s Zacks Rank #1 (Strong Buy) stocks, check this list.

Therefore, it might be advisable to view Rio Tinto’s ABR equivalent with a degree of skepticism.

Curious about the Next Best Investment?

A recent unveiling: Experts distill 7 premier stocks from a pool of 220 Zacks Rank #1 Strong Buys, dubbing these selections “Most Likely for Early Price Pops.” Since 1988, this elite list has outperformed the market by over 100% with an average annual gain of +24.0%. Explore these promising picks here.

The opinions and viewpoints expressed here belong solely to the author and may not mirror those of Nasdaq, Inc.