Riding the Interest Wave: How JPMorgan Chase Thrived in Tough Times

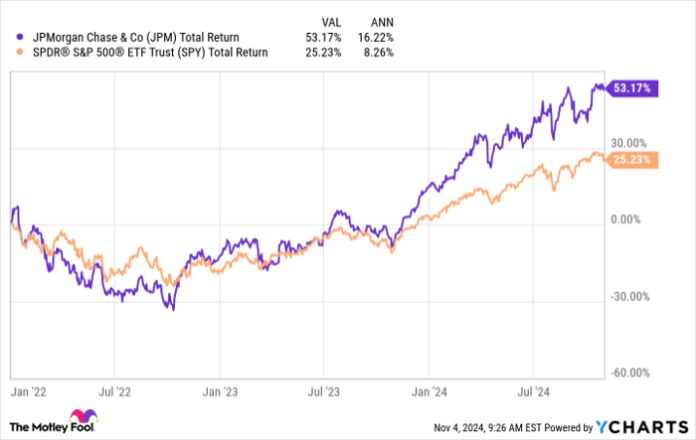

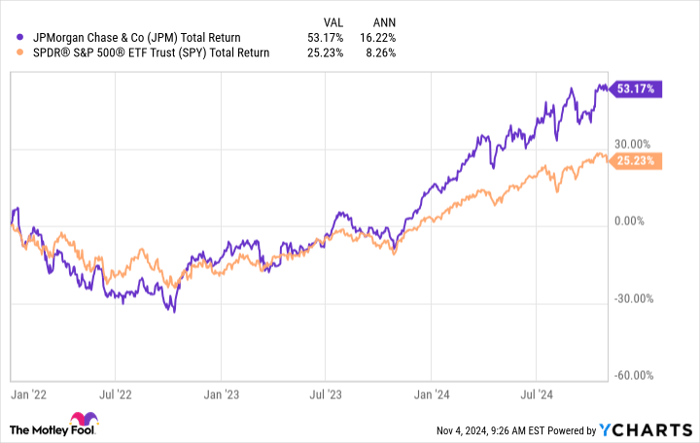

JPMorgan Chase (NYSE: JPM) has established itself as one of the top banks in the U.S. as it faces rising interest rates and economic uncertainty. Since early 2022, just ahead of the Federal Reserve’s rate hikes, this bank has provided investors with impressive annualized returns of over 16%. In contrast, the SPDR S&P 500 ETF Trust saw returns about half of what its stock achieved during this timeframe.

JPM Total Return Level data by YCharts.

The bank’s success stems from effective balance-sheet management and strategic decision-making amid high inflation and rising rates. However, this performance comes with a catch: JPMorgan’s stock is currently valued quite highly.

CEO Jamie Dimon indicated earlier this year, “We’re not going to buy back a lot of stock at these prices.” This raises a question: should investors be wary of JPMorgan’s current valuation?

Successful Adaptation to Rising Interest Rates

JPMorgan Chase has clearly outperformed its peers, achieving remarkable earnings results while maintaining a steady grip on key performance metrics. The bank’s strategy of patience and careful capital management during the interest rate changes has been key to its success.

During 2020 and 2021, the Federal Reserve drastically lowered interest rates, bringing the federal funds rate close to zero. Many banks seized this opportunity, loading up on lower-interest-earning assets. JPMorgan, however, took a cautious route. Dimon cautioned investors about looming inflation risks, advocating for the retention of substantial cash and liquid securities.

As interest rates began to rise in 2022 and 2023, JPMorgan effectively utilized its cash reserves to invest in higher-interest-earning assets, significantly increasing its net interest income (NII). The bank reported a staggering $89.3 billion in NII last year, a 71% increase compared to 2021.

JPMorgan’s careful capital management led to outstanding operating results in the recent quarters. This strong financial foundation also enabled the bank to successfully acquire deposits and assets from First Republic when it collapsed in May 2023.

Is Jamie Dimon’s Message a Warning?

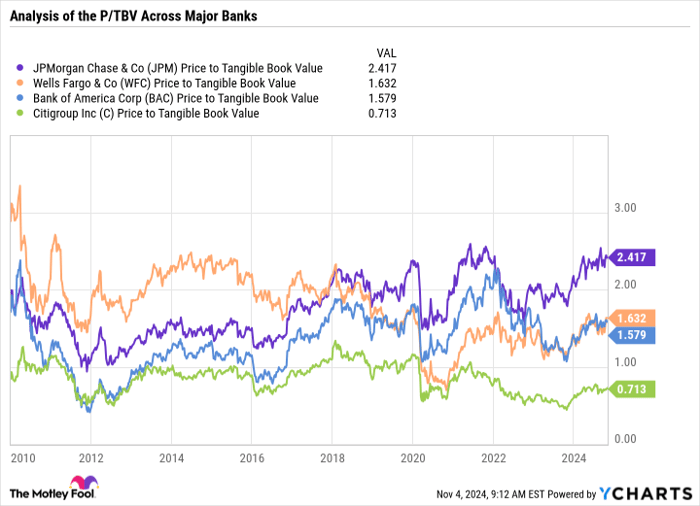

Despite its impressive performance, investors are flocking to JPMorgan’s stock, which is now priced at a significant premium compared to both its peers and historical figures.

Currently, JPMorgan Chase trades at 2.41 times its tangible book value. For context, competitors like Wells Fargo and Bank of America trade at 1.63 and 1.58 times their tangible book value respectively. Historically, JPMorgan’s average has been 1.76 times its tangible book value since 2010.

This high valuation even prompted Dimon’s remarks at the annual investor meeting in May, stating, “Buying back stock of a financial company greatly in excess of two times tangible book is a mistake. We aren’t going to do it.”

JPM Price to Tangible Book Value data by YCharts.

This caution regarding stock valuations resembles sentiments expressed by Berkshire Hathaway CEO Warren Buffett. Berkshire opted not to repurchase shares during the third quarter, emphasizing that such decisions depend on proper price evaluation.

Looking Ahead for JPMorgan Chase

In the third quarter, JPMorgan Chase showcased another strong quarter, achieving a return on tangible common equity of 19% and an NII increase of $23.5 billion. The bank anticipates net charge-offs to stabilize around 3.4% for the year, indicating resilience among consumers.

However, projections indicate that NII (excluding markets) could drop to below $87 billion next year, down from an expected $92.5 billion for 2024. Additionally, JPMorgan plans to invest significantly in technology and artificial intelligence (AI), which may lead to higher-than-expected expenses in the coming year.

Although JPMorgan Chase remains a well-managed bank well-suited for future success due to its diversified banking operations and solid capital management, investors should note its high market valuation compared to its competitors and historical averages. Waiting for a more favorable price before investing in this bank stock could be a wise move.

Is Now a Good Time to Invest $1,000 in JPMorgan Chase?

Before investing in JPMorgan Chase, it’s important to consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks to buy now—and JPMorgan Chase is not on that list. These selected stocks could yield substantial returns in the years ahead.

For instance, when Nvidia was included on this list on April 15, 2005, a $1,000 investment then would be worth approximately $912,352 today!*

Stock Advisor offers investors a straightforward roadmap for success, including portfolio-building strategies, analyst updates, and two new stock picks each month. The Stock Advisor service has outperformed S&P 500 returns by over four times since 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Wells Fargo, Bank of America, and JPMorgan Chase are advertising partners of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, and JPMorgan Chase. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.