As investors, we often rely on the sage advice of brokerage-firm-employed analysts to inform our stock decisions. But are their recommendations truly worth their weight in gold? Let’s first take a peek at what the Wall Street elite think about Meta Platforms (META) before delving into the reliability of their thoughts.

Brokerage Recommendations for META: The Inside Scoop

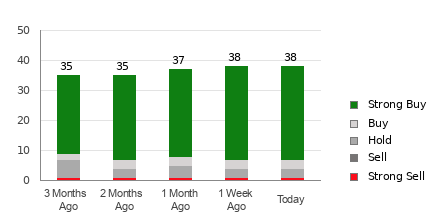

Meta Platforms currently boasts an average brokerage recommendation (ABR) of 1.26, representing a Strong Buy to Buy rating scale, based on the collective opinions of 42 brokerage firms. 37 out of 42 recommendations stand at Strong Buy, with one at Buy, comprising 88.1% and 2.4% of all recommendations, respectively.

Derisory Dependence on Brokerage Recommendations

While the ABR may hint at a buy for Meta Platforms, leaning solely on this data for investment decisions might be a trifle imprudent. Studies indicate that these recommendations yield little success in steering investors toward stocks poised for significant price appreciation. The embedded bias of analysts in favor of stocks they cover often skews their ratings positively. For every “Strong Sell” advisory, brokerage firms proffer five “Strong Buy” recommendations. It’s evident — these institutions’ interests don’t always converge with those of retail investors, rendering them unreliable guides for gauging price trajectories.

Unearthing the Zacks Rank: A Profound Gauge

Enter the Zacks Rank, a robust stock rating tool with an externally audited track record. This distinctive mechanism categorizes stocks into five cadres, offering a dependable indicator of near-term stock performance. Pairing the ABR with the Zacks Rank can pave the path for wiser investment choices.

ABR vs. Zacks Rank: Deciphering the Dichotomy

Though both the ABR and Zacks Rank flaunt a 1-5 gamut, their composition and underpinning vary. The ABR pivots purely on brokerage evaluations, whereas the Zacks Rank hinges on quantitative models and earnings estimate revisions, showcasing a telltale correlation between estimate trends and near-term stock dynamics.

The ABR vs. Zacks Rank Verdict

Brace yourself for the earnings estimate revelations: the Zacks Consensus Estimate for Meta Platforms stands at $14.34 for the current year, billing a 0.3% uptick over the past month. The alignment of analysts’ buoyant stance on EPS revisions has notched up a Zacks Rank #2 (Buy) for Meta Platforms, further underpinning a potential surge in the stock’s value.

Panning for Gold in META

Punctuated by a fortifying consensus estimate and a compelling Zacks Rank, Meta Platforms may navigate a profitable trajectory in the near term. The Buy-equivalent ABR for Meta Platforms could manifest as a commendable compass for investors.

Zacks Investment Research