Microsoft Stock Stalls: Is it Time for a Turnaround?

Microsoft (NASDAQ: MSFT) stands as one of the world’s leading companies, boasting a market capitalization of roughly $3 trillion. However, the stock has recently lost momentum. Over the last six months, its share price has dipped by 3%, while year-to-date gains of 10% lag behind the S&P 500, which has surged by 20%.

The tech powerhouse has made significant strides with its investments in artificial intelligence (AI), enhancing its products with these new technologies. Despite this progress, the company’s performance may not be impressive enough to pique the interest of growth investors, particularly given the stock’s high valuation.

Is Microsoft’s stock at a high point, or is it primed for a resurgence?

Analysts Predict 20% Growth for Microsoft Stock

For those inclined to trust Wall Street analysts, there are reasons for optimism regarding Microsoft’s stock in the short term. Analysts typically provide price targets that estimate where the stock might head over the next 12 months. Currently, their average target is just under $494, suggesting a potential 20% increase from its current pricing.

However, these price targets vary widely, and analyst predictions can change. If the company’s upcoming quarterly results disappoint, analysts might lower their projections. Conversely, exceeding expectations would likely lead to upgrades. Thus, price targets for this stock are dynamic.

Potential Downgrades Ahead for Microsoft

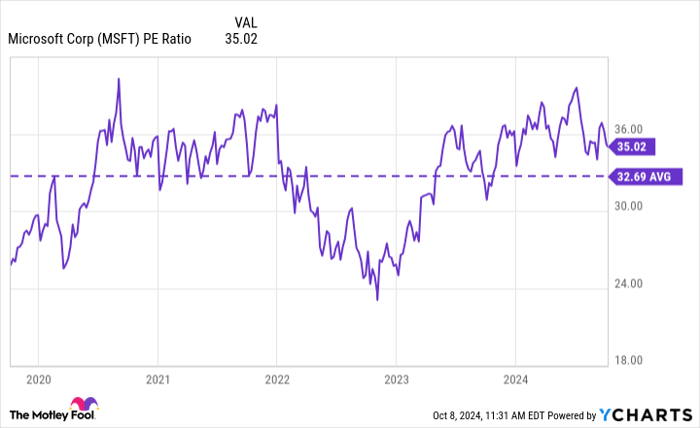

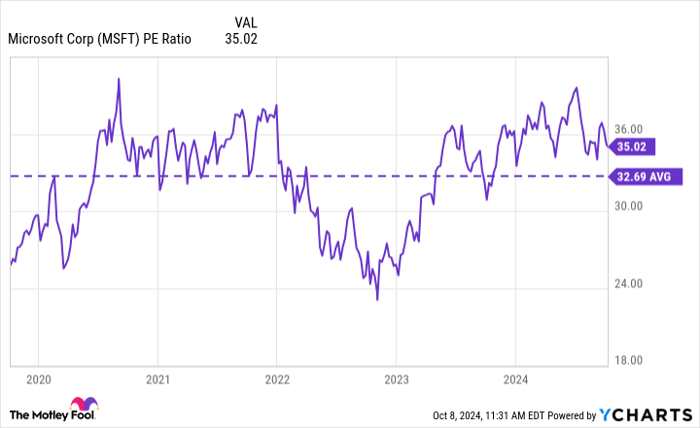

While Microsoft remains a strong long-term investment, the stock may be reflecting excessive optimism at this moment. The company is currently trading at a price-to-earnings ratio of 35, notably higher than its average over the past five years.

MSFT PE Ratio data by YCharts.

There are concerns regarding the effectiveness of Microsoft’s AI assistant, Copilot, in attracting users. The upcoming quarterly numbers should clarify how significantly AI is contributing to Microsoft’s performance.

In its last reported quarter ending July 30, Microsoft generated $64.7 billion in revenue, a 15% increase that outpaced last year’s 8% growth. Nevertheless, the key question remains whether this is sufficient to justify such a high earnings multiple.

Furthermore, the hefty investments in AI are impacting the company’s profits. In the last quarter, profits rose only 10% year over year, compared to a 20% increase a year prior. The gap between top-line growth and bottom-line performance raises eyebrows among investors.

If Microsoft fails to show solid top- and bottom-line growth in its upcoming fiscal Q1 results, scheduled for release later this month, bearish sentiment could rise, leading analysts to downgrade their ratings and lower price targets.

Is Now the Right Time to Buy Microsoft Stock?

Currently, it seems Microsoft has reached a peak in the short term. For the stock to climb significantly higher, investors may need to accept a price-to-earnings ratio approaching 40, which may not be justified by the current outlook.

For those planning to hold Microsoft stock for five years or more, now might be an opportune time to invest. Despite its premium pricing, it remains a solid long-term option. Still, given the high valuation, be prepared for potential corrections in the near future.

Should You Invest $1,000 in Microsoft Right Now?

Before making a purchase, consider the following:

The Motley Fool Stock Advisor team recently highlighted what they consider the 10 best stocks to invest in right now, none of which include Microsoft. These selected stocks could deliver significant returns in the coming years.

For instance, consider Nvidia, which made this list on April 15, 2005. If you had invested $1,000 when it was recommended, you would now have approximately $812,893!

Stock Advisor offers investors straightforward strategies for success, including portfolio-building tips and regular analyst updates, along with two featured stock picks each month. The Stock Advisor service has more than quadrupled the S&P 500’s return since 2002.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.