Valued at a market cap of $24.1 billion, San Jose, California-based NetApp, Inc. (NTAP) provides enterprise storage, data management software, and cloud-based services to support modern data infrastructures. Its offerings include FAS and E-Series storage platforms, NVMe-based all-flash storage, and cloud solutions like Cloud Volumes ONTAP.

Companies valued at $10 billion or more are generally labeled as “large-cap” stocks, and NetApp fits this criterion perfectly. NetApp’s portfolio emphasizes storage efficiency, data protection, and hybrid cloud capabilities, serving the finance, healthcare, and telecommunications industries. The company operates globally across Hybrid Cloud and Public Cloud segments with a strong partner ecosystem.

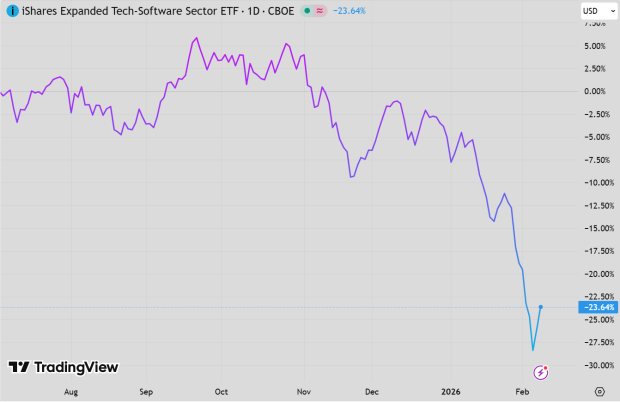

However, the data storage company is down 13.6% from its 52-week high of $135.45, achieved on Nov. 22. In addition, shares of NTAP have declined 2.7% over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 8.2% gains over the same time frame.

However, longer term, NTAP is up 32.6% on a YTD basis, outpacing NASX’s 29.8% gains. But, shares of NetApp have gained nearly 29% over the past 52 weeks, slightly lagging behind NASX’s 29.9% return over the same time frame.

NTAP has been trading above its 200-day moving average since last year and has mostly stayed above its 50-day moving average since during the period despite some fluctuations.

NetApp reported strong Q2 fiscal 2025 results on Nov. 21, with adjusted earnings of $1.87 per share, exceeding expectations and growing 18.4% year-over-year, while revenue rose 6% to $1.7 billion, driven by growth in all-flash storage and cloud services. The company raised its fiscal 2025 outlook, forecasting revenues of $6.5 billion – $6.7 billion and adjusted earnings of $7.20 per share – $7.40 per share. Management expects continued momentum across flash, AI, and cloud solutions, with Q3 guidance for revenue of $1.6 billion – $1.8 billion and earnings per share of $1.85 – $1.95. However, the stock fell 3.4% the next day, likely due to concerns over lower free cash flow, which dropped to $60 million from $97 million in the prior quarter, driven by upfront payments for strategic SSD purchases.

Nevertheless, in comparison, rival Western Digital Corporation (WDC) underperformed NTAP. Shares of Western Digital have gained 17.6% over the past 52 weeks and 14.4% on a YTD basis.

Despite NTAP’s strong price action in 2024, analysts remain cautiously optimistic about its prospects. Among the 20 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and it is currently trading below the mean price target of $140.50.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.