Netflix’s Stock Climbs: Is the Streaming Giant Just Getting Started?

Netflix (NFLX) has seen an impressive 79% stock surge in the last year, with shares currently valued at a premium. This raises a question: does Netflix have the potential for further growth, or is the momentum fading? Currently, the stock trades at 38 times analysts’ earnings estimates for December 2024, suggesting the rally could be losing steam. Nevertheless, Netflix is set to unveil a notable new in-house ad server this month, which could enhance its market position as it heads into 2025.

Growth in Ad-Supported Memberships

Netflix is enjoying substantial growth. The company, valued at $324.6 billion, reported a 15% increase in revenue year-over-year for the third quarter. Operating income rose by an impressive 52% to $2.9 billion, with an operating margin reaching 30%, up from 22% last year. Furthermore, Netflix’s ad-supported memberships grew 35% quarter-over-quarter, marking a significant shift in its business model.

The introduction of Netflix’s new ad server is expected to make the ad-supported tier even more profitable as it launches first in Canada this month and expands to other markets in 2025. Previously, Netflix relied on Microsoft’s (MSFT) ad server; the new system will leverage partnerships with Google Live and Trade Desk (TTD).

Understanding Ad Servers

What exactly is an ad server, and why is it crucial for Netflix? According to Amazon (AMZN) Web Services (AWS), ad servers are the technology that enables advertisers and publishers to manage and optimize advertisements across various platforms, including Netflix. This new ad server will enable Netflix to sell advertising slots to companies targeting its viewers.

Digital ads are prized by advertisers because they offer targeted engagement, catering to specific viewer preferences over traditional ads. Given Netflix’s close relationship with its users and access to detailed viewing data, its server can identify interests—like golf, for instance—and serve relevant ads, enhancing effectiveness.

Innovative “Episodic” Ads

Netflix is also exploring the concept of “episodic” ads—ads that tell a continuous story—which may help capture and retain viewer interest. Co-CEO and President Ted Sarandos emphasized the ad server as a “key server in unlocking value” within the ad-supported market, expressing confidence in Netflix’s growth in this area, similar to its past experiences with paid sharing initiatives.

Evaluating Netflix’s Valuation

As noted earlier, Netflix trades at a high valuation of 38.1 times earnings. However, analysts forecast an earnings per share increase to $23.79 for Fiscal 2025, suggesting a more attractive valuation of 31.8 times forward earnings. This is approaching the S&P 500’s (SPX) average valuation of 25 times earnings.

Assuming continued growth in the ad-supported sector, fueled by its new ad server, Netflix’s earnings are likely to rise, potentially making its current valuation more acceptable to investors.

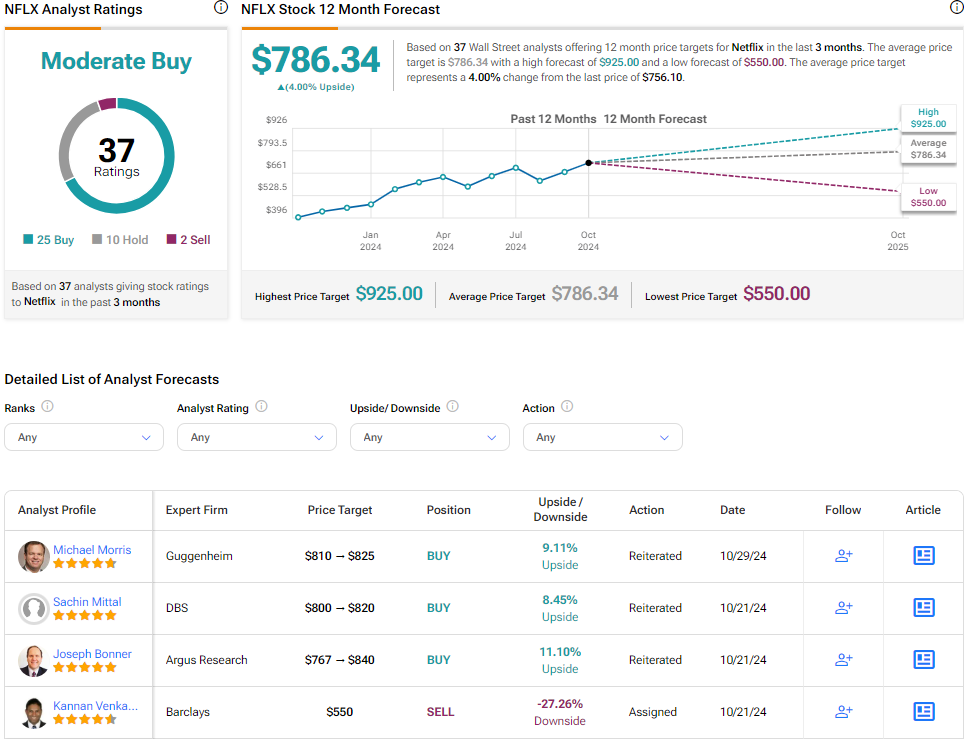

Analysts’ Ratings on NFLX Stock

According to Wall Street, NFLX holds a Moderate Buy consensus rating, based on 25 Buys, 10 Holds, and two Sells issued over the past three months. The average price target of $786.34 suggests a 4% upside from current trading levels.

Explore more NFLX analyst ratings

TipRanks Smart Score

While analysts maintain a Moderate Buy stance on Netflix, TipRanks’ proprietary Smart Score system indicates a more bullish outlook. Scoring between one to 10 based on eight critical market factors, Netflix boasts a Smart Score of 9 out of 10, equivalent to an Outperform rating.

Looking Forward

Netflix’s impressive growth story continues, reflected in its nearly 80% increase in stock value over the past year. The launch of its new ad server in Canada this month, followed by broader market rollouts in 2025, signals more growth potential ahead. Based on these developments, Netflix remains an attractive option for investors looking for opportunities in the evolving ad landscape.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.