NVIDIA (NVDA) Stock: A Hidden Gem for Investors

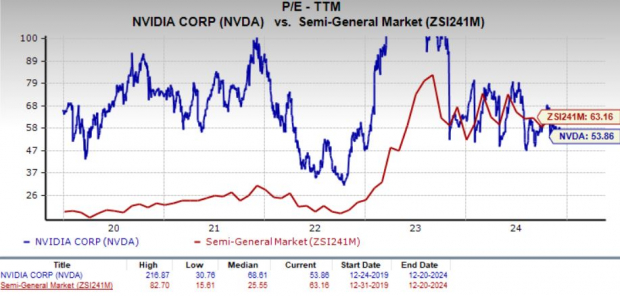

NVIDIA NVDA may currently be undervalued. Its trailing 12-month price-to-earnings (P/E) ratio is 53.86, notably below the industry average of 63.16. This discrepancy could underscore either market hesitance regarding NVDA’s growth potential or a mispricing of a company expected to lead in AI computing through 2025.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Given this valuation, investors must determine how to approach NVDA. Careful evaluation of the company’s key strengths and weaknesses, especially as a leading AI chip designer, will be essential in making informed decisions.

Introducing Blackwell Architecture: NVIDIA’s Next Leap in AI

NVIDIA has unveiled its new generation of chips, featuring the Blackwell architecture. These chips offer significant speed enhancements, allowing AI-reliant companies to process data more efficiently. For instance, a chatbot like ChatGPT benefits from this speed, delivering smarter, quicker responses.

Amazon.com Inc AMZN, Microsoft Corporation MSFT, and Alphabet Inc GOOGL are leading cloud service providers that are quickly integrating NVIDIA’s Blackwell GPUs into their platforms. These enhancements are particularly crucial for AI and high-performance computing applications.

NVIDIA: Building the AI Factories of the Future

Imagine factories designed not for manufacturing products but for generating intelligence. These “AI factories” harness powerful NVIDIA hardware and software to continuously develop and refine AI systems, operating around the clock like traditional factories.

Training AI and deploying it for practical tasks rely on a combination of specialized NVIDIA GPUs and innovative software. NVIDIA stands as the driving force behind these revolutionizing factories, allowing them to produce advanced AI models with impressive efficiency.

NVIDIA’s reach extends beyond larger tech firms; many small startups focused on AI also utilize its tools to create innovative solutions. From automated legal assistants to generative art platforms, these startups heavily depend on NVIDIA technology.

As generative AI rapidly becomes a multi-billion-dollar industry, the demand for NVIDIA products grows. Both small and large companies are eager to enter this transformative market.

NVIDIA’s Global Influence: AI Development Beyond Borders

NVIDIA’s impact is truly global. Many countries aspire to develop advanced AI systems tailored to local needs, such as addressing specific challenges in healthcare and education, or providing support in regional languages.

NVIDIA supports these ambitions by supplying powerful GPUs and software technology, collaborating with governments and companies to establish robust AI infrastructure.

In India, NVIDIA is aiding the creation of AI “factories” where numerous GPUs work collaboratively to develop and execute advanced AI models.

Similarly, in Japan, NVIDIA technology powers some of the country’s most formidable AI supercomputers, handling tasks ranging from analyzing complex scientific data to predicting weather patterns and advancing manufacturing robotics.

NVIDIA’s Future: Strong Prospects for 2025?

NVIDIA’s impressive performance shines through its one-year stock chart, with shares soaring 175.9%, substantially outperforming the industry’s 124% gain. Despite this upward trajectory, the stock appears undervalued, as its current P/E ratio is below its five-year median of 68.61. This may suggest significant potential for growth heading into 2025.

One-Year Price Chart

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Looking ahead, analysts generally predict robust gross margins for NVIDIA, despite existing supply challenges. Projections indicate stability and enhancement as the Blackwell architecture gains momentum. Additionally, the company has committed to returning $11.2 billion to shareholders in the third quarter of fiscal 2025 through share repurchases and dividends, signaling a strong dedication to shareholder value.

For investors seeking to benefit from potential gains resulting from the AI revolution next year, acquiring NVDA shares seems prudent. The stock currently holds a Zacks Rank #2 (Buy). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s average price target for NVDA indicates a potential 30.3% increase from its recent closing price of $134.70, with the highest target reaching $220—representing a 63.3% possible gain. This suggests that long-term shareholders could witness considerable short-term benefits should the stock perform as anticipated.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Insights from Research Chief: “Best Pick for Doubling Your Investment”

Amid a vast selection of stocks, five Zacks experts have each identified their top pick expected to surge by +100% or more in the coming months. Director of Research Sheraz Mian has singled out one as having exceptional upside potential.

This company targets millennials and Gen Z, generating nearly $1 billion in revenue last quarter. Current pullbacks present an ideal opportunity for investment. While not every recommended stock is guaranteed success, this particular one may outperform previous Zacks ’Stocks Set to Double’, like Nano-X Imaging, which surged by +129.6% within nine months.

Free: Explore Our Top Stock and Additional Recommendations

Interested in the latest picks from Zacks Investment Research? Download 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.