Broadcom’s Stock Surges Following Strong Q4 Results and AI Demand

Broadcom AVGO shares have surged more than 30% since the semiconductor leader released impressive fiscal fourth-quarter results last Thursday. The momentum stems from strong demand for its custom artificial intelligence (AI) chips, which have become vital for AI data centers.

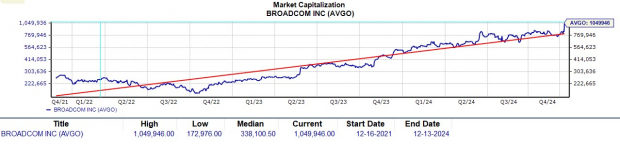

Recently achieving a market capitalization of $1 trillion for the first time, investors are eager to see if this rally will persist.

Image Source: Zacks Investment Research

Key Highlights from Broadcom’s Q4

Driven by its AI initiatives, Broadcom reported a 51% year-over-year sales increase in Q4, reaching $14.05 billion, slightly below Zacks’ estimate of $14.06 billion. Adjusted net income for Q4 stood at $6.96 billion, translating to $1.42 per share, surpassing the Zacks EPS consensus of $1.39 and rising 28% from $1.11 per share compared to the same quarter last year.

Overall, Broadcom recorded a 44% revenue increase for fiscal 2024, reaching a record $51.57 billion, with AI revenue more than tripling to $12.2 billion. Annual earnings per share ballooned 26% to $4.87, up from $3.86 in FY23.

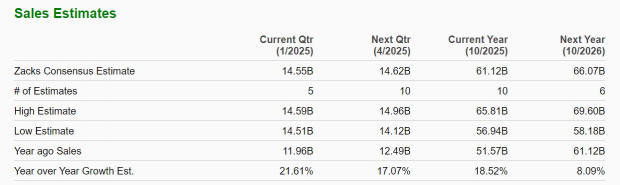

Image Source: Zacks Investment Research

Positive Projections and Market Outlook

As a significant chip supplier for Apple AAPL, Broadcom CEO Hock Tan revealed the addition of two major hyperscale data center clients. Consequently, Broadcom anticipates a 22% increase in first-quarter revenue to $14.6 billion, with Zacks’ current consensus at $14.55 billion.

Additionally, AI revenue is projected to rise 65% in Q1 to $3.8 billion. Zacks forecasts total sales growth of 18% in FY25 and an additional 8% in FY26, potentially reaching $66.07 billion. Broadcom estimates its AI segment could generate between $60 billion and $90 billion in annual sales by 2027.

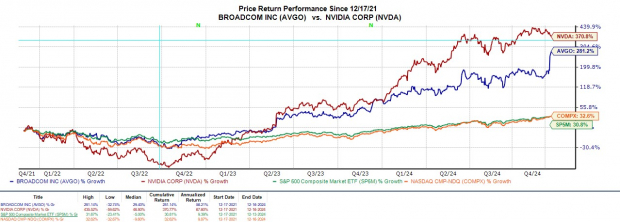

Image Source: Zacks Investment Research

Financial Performance and Valuation

Broadcom is increasingly competing with Nvidia NVDA for market leadership. The stock has more than doubled this year, significantly outperforming major market indexes.

Image Source: Zacks Investment Research

Trading at around $241 per share, AVGO has a forward earnings multiple of 36.7X. This is higher than the S&P 500’s 25.7X but lower than Nvidia’s 45.6X, aligning closely with the Zacks Electronics-Semiconductors Industry average.

Despite being reasonably priced relative to its earnings, Broadcom trades at a premium based on various valuation metrics, much like many of its major tech peers.

Image Source: Zacks Investment Research

Conclusion

After a strong performance, Broadcom holds a Zacks Rank #3 (Hold). The rising demand for its AI products enhances its marketing outlook, attracting long-term investors. However, further gains may depend on positive revisions to earnings estimates in the upcoming weeks.

7 Best Stocks for the Next 30 Days

Recently released: Experts highlight 7 top stocks from a list of 220 Zacks Rank #1 Strong Buys. These selections are labeled as “Most Likely for Early Price Pops.”

Since 1988, the complete list has outperformed the market more than twice over, averaging a +24.1% yearly gain. Be sure to consider these top picks.

Apple Inc. (AAPL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.