Pitney Bowes Shows Growth Potential Amid Market Transformation

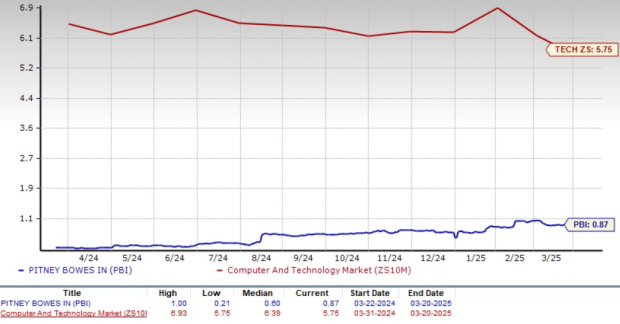

Pitney Bowes (PBI) is trading at a notably low price-to-earnings (P/E) ratio, significantly below that of the broader tech sector and the S&P 500. Currently, PBI’s forward 12-month P/E ratio stands at 0.87X, which contrasts sharply with the Zacks Computer and Technology sector’s average of 5.75 and the S&P 500’s average of 4.89.

Current Valuation of Pitney Bowes

Image Source: Zacks Investment Research

Over the past year, Pitney Bowes shares have surged by 122.1%, outperforming the Zacks Computer and Technology sector and the S&P 500, which recorded returns of 5.1% and 8.8%, respectively. This remarkable performance raises the question: is PBI still a viable investment opportunity?

Performance Comparison Over One Year

Image Source: Zacks Investment Research

Robust Partnerships Fuel Pitney Bowes’ Growth

Pitney Bowes boasts a wide-ranging customer base that includes over 90% of Fortune 500 companies, solidifying its market presence. Collaborations with industry leaders like Amazon (AMZN), eBay (EBAY), Shopify, and Salesforce (CRM) enhance its capabilities in global logistics and technology.

For example, PBI provides cross-border e-commerce logistics services to eBay in the U.S. and U.K. Additionally, its longstanding partnership with Amazon Web Services (AWS) integrates advanced technologies into its offerings.

Through the Shipping API Partner Program with Salesforce, these partnerships not only diversify revenue sources but also position PBI for sustained growth.

Strategic Divestiture of GEC Segment to Support Future Growth

Pitney Bowes has faced challenges from the underperformance of its Global Ecommerce (GEC) segment. Despite significant investments, including the acquisitions of Borderfree in 2015 and Newgistics in 2017, profitability has declined post-pandemic due to decreasing package volumes and competitor price cuts.

By divesting the GEC segment, PBI anticipates incurring one-time exit costs of $165 million, with $120 million already paid in 2024. This strategic move allows the company to concentrate on more profitable areas while streamlining its operations.

Pitney Bowes Aims for Financial Stability

Pitney Bowes is making strides in tackling its significant long-term debt and enhancing liquidity. The repatriation of $117 million from international operations has resulted in over $100 million in extra cash, facilitating debt reduction efforts and improving financial flexibility.

On the fourth-quarter earnings call, PBI revealed it used internally generated cash to pay off $275 million in Oaktree notes, while also trimming offshore cash holdings by $90 million, thus enhancing cash availability.

The company’s financial performance shows promising recovery, with a reported 33% year-over-year growth in adjusted operating profit for the fourth quarter of 2024, reaching $114 million and an operating margin increase of 580 basis points to 22.2%.

Analysts appear optimistic about Pitney Bowes’ earnings growth potential. The Zacks Consensus Estimate for 2025 earnings increased by 13 cents to $1.21 over the past 60 days, indicating an expected year-over-year growth of 47.6%. Notably, PBI has exceeded the Zacks Consensus Estimate in the past four quarters, with an average surprise of 96.64%.

Pitney Bowes Inc. Price, Consensus, and EPS Surprise

Pitney Bowes Inc. price-consensus-eps-surprise-chart | Pitney Bowes Inc. Quote

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Conclusion: Consider Investing in PBI Stock

Pitney Bowes is driving its transformation through realignment and cost-cutting strategies. With the divestiture of the GEC segment and a focus on financial discipline and strategic partnerships, the company is well-positioned for future profitability.

Given its financial recovery, undervalued stock price, and optimistic growth outlook, PBI presents a strong investment opportunity. Investors looking to leverage this transformation might consider adding this Zacks Rank #1 (Strong Buy) Stock to their portfolios at this time.

Unlock Zacks’ Insights for Just $1

We’re not kidding.

In a previous offer, we granted members 30-day access to all our picks for just $1, with no obligation to spend more.

Though thousands seized this opportunity, others hesitated, believing there had to be a catch. Our motivation is straightforward: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which saw 256 positions close with double- and triple-digit gains in 2024 alone.

Want the latest recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days. Click for the free report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.