Sterling Infrastructure Surges: A Deep Dive into Recent Performance

In the midst of a wider post-election stock rally, Sterling Infrastructure STRL stands out with remarkable progress.

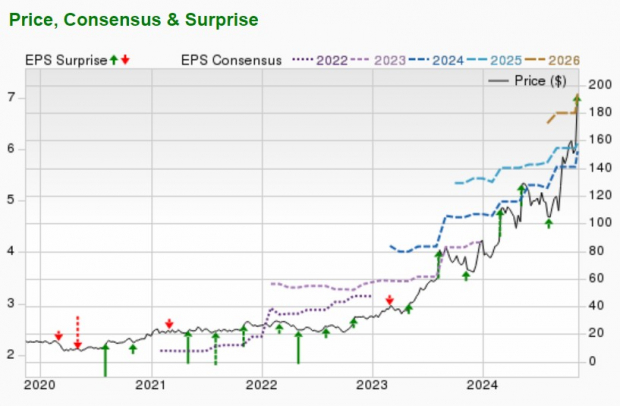

With shares rising over 120% year-to-date, STRL reached a new peak of $201 during Monday’s trading. Investors now wonder if this upward trend will continue.

Image Source: Zacks Investment Research

Strong Growth Following Stellar Q3 Results

Sterling’s growth has been fueled by mission-critical projects, including those in the data center sector. The company reported significant Q3 results last Wednesday, achieving a 89% increase in operating income within its E-Infrastructure solutions segment. Additionally, net income rose 56% to $61.3 million, equaling $1.97 per share, up from $1.26 in the same period last year.

Sterling surpassed Q3 EPS estimates of $1.68, marking the seventh consecutive quarter of exceeding earnings expectations. The average EPS surprise over the last four quarters stands at 21.5%. Though the company’s Q3 sales reached $593.74 million, they missed expectations of $599.9 million; however, this figure represents a 6% increase from $560.35 million the previous year.

Image Source: Zacks Investment Research

Key Financial Highlights

Other notable Q3 achievements include a 42% increase in EBITDA, totaling $100.8 million, along with record gross margins of 21.9%, compared to 16.4% from a year prior. Sterling’s cash and equivalents also jumped by 42% to $648.12 million, up from $409.39 million at the end of Q3 2023.

Image Source: Zacks Investment Research

Evaluating Sterling’s Valuation

Sterling’s impressive growth has helped distinguish it from competitors. Currently, STRL trades at 32.4 times its forward earnings. This valuation is not excessively high compared to the industry average of 25.8 times.

Image Source: Zacks Investment Research

Revised Earnings Projections

Earnings estimates for fiscal 2024 and 2025 have recently been revised upward by 5% and 1%, respectively. According to Zacks estimates, Sterling is on track to achieve 33% EPS growth this year, with an additional projected growth of 2% in fiscal 2025, bringing EPS to $6.11.

Image Source: Zacks Investment Research

Conclusion

With a positive trend in earnings revisions, Sterling Infrastructure is currently rated with a Zacks Rank #1 (Strong Buy).

As one of the standout stocks of recent years, it is reasonable to expect STRL may continue its upward trajectory. Furthermore, Sterling boasts a robust backlog exceeding $2 billion and is actively pursuing significant multi-phase infrastructure projects.

Explore Top Clean Energy Stocks with Big Potential

Energy plays a vital role in our economy and encompasses a multi-trillion dollar industry, giving rise to some of the most successful companies in the world.

Advancements in technology are enabling clean energy sources to increasingly replace traditional fossil fuels. Substantial investments are already flowing into clean energy initiatives, from solar power to hydrogen fuel cells.

Identifying emerging leaders in this sector could yield some of the most promising stocks for your portfolio.

Download “Nuclear to Solar: 5 Stocks Powering the Future” to discover Zacks’ top picks at no cost.

Looking for the latest recommendations from Zacks Investment Research? Download “5 Stocks Set to Double” today for free.

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

To view the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.