Visa Faces DOJ Lawsuit Over Allegations of Monopoly in Debit Card Market

The U.S. Department of Justice (DOJ) is taking action against Visa (NYSE: V), claiming the company has monopolized the debit card market to maintain its 60% share in the U.S. As a result, Visa’s stock saw a brief decline but has since bounced back.

Lawsuits can create uncertainty for investors, but Visa has weathered similar storms in the past. The question now is whether this situation presents a buying opportunity for this leading payment stock.

Examining the Allegations Against Visa

The DOJ’s lawsuit against Visa centers on two key claims. First, it suggests that Visa engages in exclusionary agreements with merchants (like your local coffee shop) that penalize those who accept other debit card networks. This practice is said to protect Visa’s substantial market share.

Second, the lawsuit accuses Visa of forming partnerships with tech companies, such as Apple, to block potential competitors from introducing their own payment solutions.

While these allegations hold some weight, it’s uncertain if a resolution would significantly impact Visa’s market dominance. The company benefits from a strong competitive advantage—sometimes referred to as a competitive moat—beyond merely seeking exclusion through contracts.

Visa has established relationships with billions of consumers and millions of merchants worldwide. The likelihood of a competitor convincing all these parties to make a sudden switch seems slim.

Moreover, Visa does not impose excessively high fees. The DOJ’s complaint mentioned a significant $7 billion figure, but the overall U.S. debit card payment volume is about $5 trillion annually. Holding a 60% market share, Visa processes around $3 trillion of that volume.

Notably, Visa’s take rate for U.S. debit card transactions stands at just 0.23%. This rate supports rapid processing and fraud protection, which does not appear to be an excessive charge.

Resilience Despite Global Scrutiny

Visa has faced similar challenges before, which may ease investor worries regarding this lawsuit. In 2010, Visa complied with the Durbin Amendment, which limited transaction fees for merchants. Although this constraint affected its pricing, the company continued to perform well.

Globally, nations have introduced their own domestic competition aimed at reducing fees associated with companies like Visa. Examples include India’s RuPay and UPI and Brazil’s Pix. Despite these efforts, Visa’s growth remains steady.

In the last quarter, Visa reported a 7% year-over-year increase in payment volume, with debit cards in circulation rising from 3 billion to 3.2 billion. This surge indicates that the company is thriving, even amid governmental attempts to create competition.

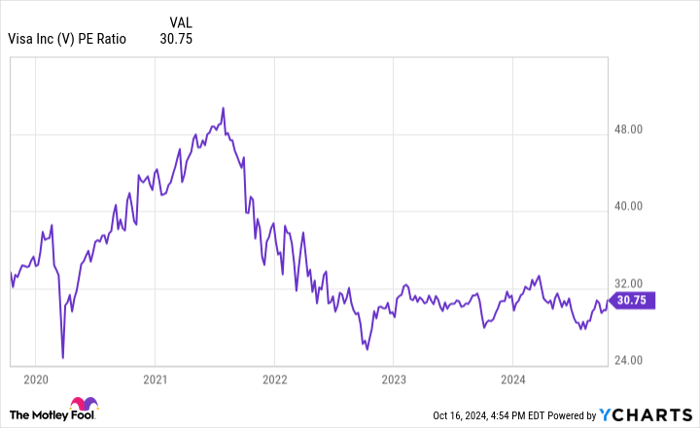

V Price-to-Earnings Ratio data by YCharts.

Evaluating Visa’s Stock Value

I believe Visa’s revenue and profits are on track for continued growth, aligned with the global economy and increasing consumer spending.

If consumers accumulate more wealth and disposable income, payment volume for Visa will rise, subsequently boosting revenue and earnings. This relationship is straightforward.

However, Visa stock doesn’t appear particularly cheap for such a large, established company. With a current market cap of $565 billion, Visa has a price-to-earnings ratio (P/E) of around 31.

While Visa is a strong business, its growth rate isn’t expected to be hyper-accelerated over the next decade. Investors should remain calm in the wake of the DOJ lawsuit, but it’s worth noting that Visa stock might not be a bargain right now.

Opportunities for Investors

If you often feel like you’ve missed out on purchasing successful stocks, there’s still a chance here.

Our expert analysts occasionally issue a “Double Down” stock recommendation for companies they believe are primed for growth. If you worry about missing your chance, now may be the time to act before opportunities slip away. The data is compelling:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this may be a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Visa. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.