Oracle’s Exadata X11M Platform: A Game Changer for 2025

Oracle has officially launched its Exadata X11M platform, promising significant advancements in technology that could boost its competitive edge as we approach 2025. Key features include 55% faster AI Vector searches, 2.2X faster analytics scan throughput, and 25% quicker transaction processing—all while keeping the same price as the previous model. This strategic move positions Oracle to potentially expand its market share in the rapidly growing fields of AI and data analytics.

Impressive Performance at Competitive Prices

Oracle’s focus on optimizing the Exadata X11M for AMD EPYC processors highlights its dedication to delivering top performance across various workloads. Enterprises seeking to upgrade their database systems may find the platform’s promise of 25% faster transaction processing and improved analytic query handling particularly appealing. By maintaining pricing similar to past versions while also enhancing performance, Oracle presents a strong value proposition for both current and prospective customers.

Boosting AI and Analytics

With its improved AI functionalities, including 55% faster persistent vector index searches and 43% quicker in-memory vector index queries, the Exadata X11M closely aligns with Oracle’s broader AI initiatives. The recent fiscal second-quarter results for 2025, showing a staggering 336% increase in GPU consumption, reflect the strong momentum Oracle is enjoying in AI-related tasks. The capabilities of the Exadata X11M could further enhance this positive trend.

Commitment to Energy Efficiency and Sustainability

The Exadata X11M also emphasizes energy efficiency through smart power management and workload consolidation, addressing the rising sustainability concerns among businesses. Customers can benefit from reduced energy usage and optimized data center space, making the platform an attractive solution for those aiming to meet environmental objectives while still excelling in performance.

Expanding Through a Multi-Cloud Strategy

Oracle announced that the Exadata X11M will be accessible on all major cloud platforms, including OCI, Amazon AMZN-owned AWS, Alphabet GOOGL-owned Google Cloud, and Microsoft MSFT Azure. These three companies controlled 68% of the global cloud services market in the third quarter of 2024, as reported by Synergy, with market shares of 31%, 20%, and 13%, respectively. This widespread availability, combined with full database compatibility across different cloud setups, could help Oracle reach a broader audience and encourage existing clients to adopt cloud solutions.

Financial Outlook and Growth Opportunities

As we look toward 2025, Oracle’s financial outlook is promising, bolstered by various growth drivers. The combination of enhanced performance while retaining previous pricing levels could lead to increased adoption and revenue gains. Efficiency improvements can also help preserve profits amid competitive pressures. The Exadata X11M’s advanced AI features and sustainability aspects enable ORCL to take advantage of emerging enterprise AI trends and rising ESG demands, paving the way for new revenue streams. Additionally, capabilities around workload consolidation can lead to better operational economics for clients.

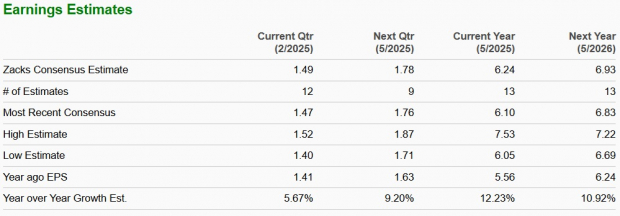

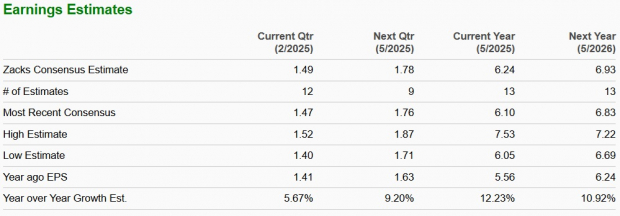

The Zacks Consensus Estimate anticipates ORCL’s fiscal 2025 revenues at $57.65 billion, representing an 8.85% increase from the previous year. Earnings expectations stand at $6.24 per share, reflecting a year-over-year growth of 12.23%, up by 1.3% over the last month.

Image Source: Zacks Investment Research

Discover earnings insights and surprises on the Zacks Earnings Calendar.

Investment Considerations

Investors may find Oracle’s strategic advances with the Exadata X11M platform particularly intriguing as we move into 2025. The ability to offer substantial performance gains while keeping costs steady showcases Oracle’s technological advantage and market insight. The platform’s readiness for various cloud service providers could expedite Oracle’s migration to the cloud and enhance its market prospects.

Furthermore, features that integrate advanced AI and energy efficiency address two vital enterprise concerns: AI integration and sustainability. Strong growth in cloud business and AI capabilities, as highlighted in the second-quarter fiscal results, suggest that the Exadata X11M could serve as a catalyst for ongoing growth.

While ORCL has performed exceptionally well, gaining 14.3% over the past six months, outpacing the Zacks Computer and Technology sector’s drop of 1% and the S&P 500’s growth of 6.3%, concerns arise regarding elevated valuations.

6-Month Price Performance

Image Source: Zacks Investment Research

Currently trading at a high EV/EBITDA ratio of 21.28X, compared to the Zacks Computer-Software industry’s 17.89X, ORCL’s stock may reflect overly optimistic growth projections, especially against the backdrop of increasing challenges in the cloud market.

ORCL’s Premium EV/EBITDA Valuation

Image Source: Zacks Investment Research

Market Outlook

Despite robust competition in the cloud and database arenas, Oracle’s Exadata X11M could place the company in a advantageous position for 2025. The platform’s ability to handle both traditional workloads and emerging AI applications, along with its multi-cloud support and sustainability features, creates multiple opportunities for growth.

Investors should keep an eye on Oracle’s effectiveness in turning its technological advantages into market share and revenue increases in 2025. Important indicators to track will include cloud revenue growth, AI workload uptake, and customer transitions across various deployment methods. The success of Oracle’s strategy involving the Exadata X11M could significantly impact its performance and market standing over the coming year. ORCL is currently rated Zacks Rank #3 (Hold).

Get Access to All Zacks’ Buys and Sells for Only $1

That’s right.

Previously, we surprised our members by allowing them 30 days of full access to all our picks for just $1. There is no obligation to spend more.

Thousands have taken advantage of this deal, while others were skeptical and didn’t believe there was no catch. The reason for this offer is to introduce you to our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which closed 228 positions with double- and triple-digit gains in 2023 alone.

Want the most recent recommendations from Zacks Investment Research? You can download the “7 Best Stocks for the Next 30 Days” report for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.