“`html

ARM Holdings Set to Report Q2 Results Amidst Mixed Expectations

Arm Holdings plc (ARM) will announce its second-quarter fiscal 2025 results on Nov. 6, after the market closes.

Profit Projections Show Decline

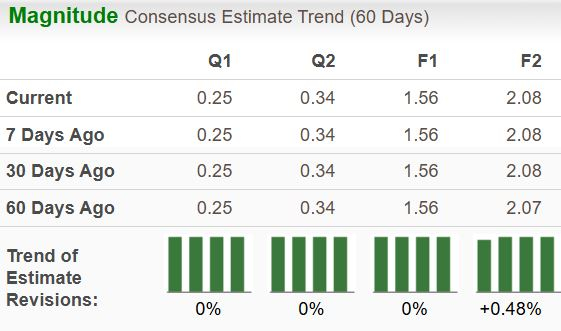

The Zacks Consensus Estimate for earnings this quarter is set at 25 cents, reflecting a 30.6% decrease from the same quarter last year. Revenue expectations stand at $808.9 million, which indicates a modest year-over-year increase. Recently, analyst estimates have remained unchanged.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Stay informed on all quarterly releases: See Zacks Earnings Calendar.

Strong Earnings Surprise History

ARM has posted impressive results in the past, consistently exceeding the Zacks Consensus Estimate for the last four quarters, with an average earnings surprise of 22.2%.

Analysis Model Signals Caution

Our model does not indicate a definitive earnings beat for this quarter. A positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically suggests a higher chance of an earnings beat, but that is not applicable here. ARM currently shows an Earnings ESP of 0.00% and holds a Zacks Rank of #3.

You can access the complete list of today’s Zacks #1 Rank stocks here.

Key Factors Influencing Results

ARM is known for its innovative chip designs and software tools, which are essential for smartphones, cars, and data centers. Industry giants like Apple (AAPL), Nvidia (NVDA), and Qualcomm (QCOM) depend on ARM’s technology. For the upcoming quarter, we anticipate solid revenue performance, driven by both royalty and licensing revenues. However, growth is expected to be gradual year over year due to the timing of revenue recognition related to licensing.

ARM previously projected approximately 20% year-over-year growth in royalty revenues, expecting increased adoption of Armv9 technology, which commands higher royalty rates compared to Armv8. Revitalization in the smartphone market and gains in non-mobile sectors have also contributed to royalty revenue growth.

Stock Performance Overview

This year, ARM’s stock price has surged by 88.2%, with a 28.1% increase over the past three months. This significant rally has resulted in a high valuation, with ARM shares currently trading at a forward 12-month Price/Earnings ratio of 75.65X, substantially surpassing the industry’s 38.13X average.

Image Source: Zacks Investment Research

Investment Outlook and Considerations

While ARM’s revenue growth has been modest in recent years, the current climate of AI-driven technology could boost sales for the company. As a relatively new public equity, ARM faces initial pressure on its margins, despite impressive gross margins. Increased investment in research and development could drive future growth and innovation.

Advice for Investors

With the stock price having risen substantially over the past year, investors should be cautious about potential corrections. ARM’s foundation remains solid, but waiting for a more favorable entry point could yield better investment returns. The company’s strong position in the AI hardware sector and advancements in chip design indicate promising long-term growth, but timing remains crucial for optimal investment outcomes.

Expert Picks for Potential Gains

From thousands of stocks analyzed, five Zacks experts have selected their favorites poised to potentially double in value within months. One, chosen by Director of Research Sheraz Mian, focuses on appeal to millennial and Gen Z audiences and generated nearly $1 billion in revenue last quarter. A recent pullback makes now a favorable time to invest. While not every pick succeeds, this one could outperform earlier selections, like Nano-X Imaging, which rose by over 129% in roughly nine months.

Free: See Our Top Stock And 4 Runners Up

Get the latest recommendations from Zacks Investment Research. Today, download 5 Stocks Set to Double. Click to access your free report.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and may not reflect the opinions of Nasdaq, Inc.

“`