BlackBerry Stock Surges: Analyzing Recent Gains and Future Prospects

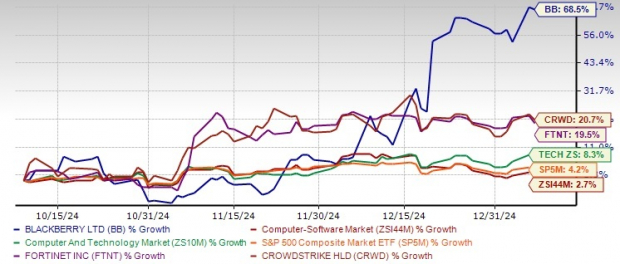

BlackBerry Limited’s BB shares have soared 68.5% over the past three months, marking a significant difference compared to the industry’s 2.7% and the S&P 500’s 4.2% growth during the same period.

Performance Overview

Image Source: Zacks Investment Research

BlackBerry has also outperformed the broader Zacks Computer & Technology sector, which saw an 8.3% increase, as well as cybersecurity peers like Fortinet, Inc. (FTNT) and CrowdStrike Holdings, Inc. (CRWD), which gained 19.5% and 20.7%, respectively. This impressive stock performance is attributed to recent positive developments.

Several key announcements contributed to the surge. Most notably, BB’s QNX unit recently disclosed partnerships, including a significant collaboration with tech leader Microsoft Corporation (MSFT). Earlier, the company had rebranded its IoT division as “QNX,” responding to feedback from key stakeholders.

Additionally, the announcement of BB’s sale of its Cylance business to Arctic Wolf, a decision made in December 2024, alongside strong third-quarter fiscal 2025 results—highlighting solid adjusted EBITDA and positive free cash flow—also acted as catalysts for growth.

BB stock closed its last trading session at $4.06, after reaching a new 52-week high of $4.35. Investors are now curious about potential further gains in 2025.

Does QNX Rebranding Indicate Future Growth?

The rebranding effort seeks to boost recognition and affirm BlackBerry’s leadership in the automotive and embedded software markets. This initiative aims to enhance the development of next-generation software-defined vehicles (SDVs) and mission-critical applications. The new QNX brand identity features a fresh logo, improved website, and a focus on delivering performance-driven, forward-thinking solutions.

To support its strategy, BlackBerry introduced the QNX Cabin, a cutting-edge tool that allows original equipment manufacturers to virtually develop digital cockpit solutions in the cloud. The company is also ramping up developer support to foster innovation in embedded software across various industries.

A collaboration with Microsoft aims to assist automakers in building, validating, and refining software in the cloud for SDVs. This partnership will integrate the QNX Software Development Platform 8.0 with Microsoft Azure, providing a robust cloud environment for automakers to innovate efficiently and minimize developmental risks. Furthermore, QNX and Microsoft plan to broaden their cooperation to include the QNX Hypervisor and QNX Cabin.

In addition to this, QNX is engaging in a long-term partnership with Vector and TTTech Auto to create a foundational software platform for vehicles, aiming to simplify software integration processes and reduce costs.

Positive Outlook After Cylance Sale

Investor sentiment improved markedly following BlackBerry’s announcement of its plan to sell the underperforming Cylance cybersecurity division, leading to a 15% stock increase on that day.

This $160 million deal involves upfront cash, shares of Arctic Wolf, and additional compensation. Following adjustments, BB expects to receive nearly $80 million at closing and another $40 million a year later. Arctic Wolf will also provide about 5.5 million common shares as part of the agreement, which is expected to finalize in the fourth quarter of fiscal 2025, pending regulatory approvals.

Even as BlackBerry divests from Cylance, it remains focused on its Secure Communications business, which includes products like BlackBerry UEM, BlackBerry AtHoc, and BlackBerry SecuSUITE, vital to its ongoing strategy.

As a result of the Cylance sale, BlackBerry has revoked its previous guidance related to cybersecurity and is now focusing solely on the Secure Communications segment. Revenue expectations for this division are projected between $267 and $271 million for the upcoming quarter.

Positive Analyst Revisions for BlackBerry

Analysts are optimistic about BlackBerry’s future, as shown by upward adjustments to earnings per share (EPS) forecasts. EPS estimates for the current fiscal year have shifted to 1 cent, a recovery from a previous estimate of a 2 cent loss. For the following fiscal year, estimates have improved from 2 cents to 7 cents.

Image Source: Zacks Investment Research

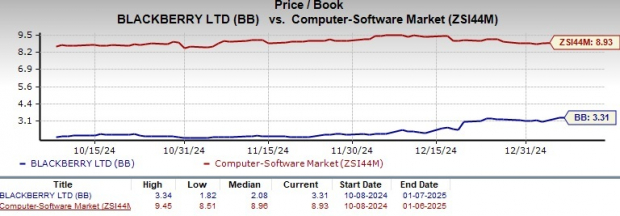

Strong Technical Indicators and Valuation

BB stock currently trades at a trailing 12-month price/book ratio of 3.31, notably lower than the industry average of 8.93, suggesting it may be undervalued.

Image Source: Zacks Investment Research

Additionally, technical indicators favor a favorable outlook. The stock is trading above both its 50-day and 100-day moving averages, indicating positive momentum and stability, reflective of favorable market sentiment and growth potential.

Image Source: Zacks Investment Research

Is It the Right Time to Invest in BB Stock?

With improving financial results, strategic partnerships, and a focus on high-potential sectors like IoT and cybersecurity, BlackBerry is positioned for long-term growth.

BB currently holds a Zacks Rank #1 (Strong Buy) and has a Momentum Score of B. Based on Zacks’ criteria, stocks that are ranked #1 or #2 (Buy) and possess a Momentum Score of A or B are considered solid investment opportunities. You can find the complete list of today’s Zacks #1 Rank stocks here.

Explore Top Picks for the Coming Month

Recently released: Experts have chosen 7 outstanding stocks from a pool of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

Since 1988, this collection has consistently outperformed the market, boasting an average annual gain of +24.1%. Be sure to consider these 7 selections as you plan your investment strategy.

For the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click to access this free resource.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

BlackBerry Limited (BB): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.