Cognizant Technology Solutions Shows Strong Growth Amid Expanding Client Base

Cognizant Technology Solutions (CTSH) has seen its shares rise by 6.1% over the past month, surpassing the Zacks Business – Software Services industry’s increase of 3.2% and the broader Zacks Computer & Technology sector’s gain of 0.7%.

Cognizant’s success can be attributed to a growing client roster and a strong network of partners. The company has built a robust pipeline that includes both renewing existing contracts and creating new opportunities.

The company’s upward trend is evident in its recent financial results for the third quarter of 2024. Cognizant reported revenues of $5 billion, which marks a sequential growth of 3.5% in constant currency and a year-over-year increase of 2.7%. This growth stems from strong demand in sectors like health sciences and financial services.

Specifically, the Health Science division saw an impressive 7.6% growth year-over-year in constant currency, bolstered by significant demand across payer, provider, and life sciences sectors.

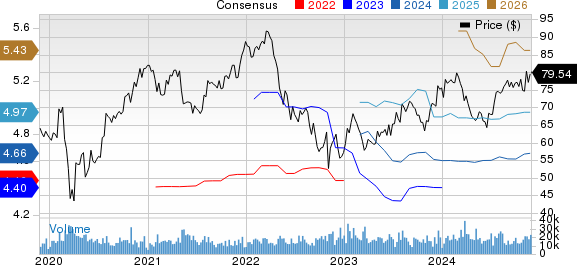

Cognizant’s Pricing Trends and Consensus Expectations

Cognizant Technology Solutions Corporation price-consensus-chart | Cognizant Technology Solutions Corporation Quote

Meanwhile, the Financial Services sector has returned to growth, recording a slight increase of 0.5% in constant currency and 0.7% year-over-year, driven by rising discretionary spending and solid demand.

Cognizant’s Partnerships: A Key to Future Growth?

Cognizant’s collaboration with leading tech companies like NVIDIA (NVDA), ServiceNow (NOW), and Palo Alto Networks (PANW) has been a highlight of its strategy.

In the third quarter of 2024, Cognizant signed six contracts worth over $100 million each, demonstrating its capability to secure significant business. Overall, the company has inked 19 significant deals this year, surpassing last year’s total of 17.

Additionally, Cognizant has established a new partnership with NVIDIA aimed at enhancing its data modernization capabilities. This collaboration seeks to combine the Cognizant Data and Intelligence Toolkit with the NVIDIA RAPIDS library to improve cloud infrastructure efficiency and prepare for AI advancements.

Moreover, Cognizant has expanded its relationship with ServiceNow, positioning itself as the first partner to launch the new Workflow Data Fabric, which merges business and technology data for real-time access by AI agents.

Teaming up with Palo Alto Networks has also enabled Cognizant to provide AI-driven cybersecurity solutions, simplifying technology for enterprises while strengthening security.

CTSH’s Investment in AI and Growth Prospects

Cognizant is heavily investing in artificial intelligence, allocating $1 billion towards enhancing its platforms and capabilities, reflecting a commitment to leading in the fast-changing digital landscape.

The third quarter of 2024 saw advancements in AI and automation through Cognizant’s Neuro IT Ops, Flowsource, and AI-driven platforms, all designed to enhance productivity and reduce costs for clients, particularly in sectors like software development and IT operations.

In a significant move, Cognizant launched Cognizant Neuro Cybersecurity in October, aiming to bolster cybersecurity resilience through the integration of various solutions, thereby improving threat management and decision-making processes as cyber threats become increasingly prevalent.

Acquisitions have also significantly contributed to Cognizant’s growth. The integration of Belcan, for instance, added approximately 150 basis points to revenue growth in the third quarter of 2024. This acquisition has not only strengthened Cognizant’s position in the aerospace and defense markets but has also broadened its access to the engineering and research services sector, which is expected to grow faster than traditional IT services.

2024 Guidance: Growth Ahead

For the fourth quarter of 2024, Cognizant anticipates revenues between $5 billion and $5.1 billion, which translates to a growth rate of 5.1% to 7.1% (or an increase of 4.8% to 6.8% in constant currency).

The Zacks Consensus Estimate for fourth-quarter revenues stands at $5.07 billion, suggesting a year-over-year growth of 6.60%. Meanwhile, the consensus estimate for earnings is set at $1.13 per share, reflecting a slight decline of 4.2% over the previous month, and a year-over-year decrease of 4.24%.

Looking ahead to 2024, revenues are projected between $19.7 billion and $19.8 billion, indicating an increase of 1.6% to 2.1% reported (or a growth of 1.4% to 1.9% in constant currency). Notably, acquisitions are expected to add 200 basis points to revenue growth.

The Zacks Consensus Estimate for 2024 revenues is at $19.72 billion, denoting a year-over-year increase of 1.88%. Adjusted earnings per share for 2024 are expected to be between $4.63 and $4.67, with the consensus mark for earnings at $4.66, reflecting an increase of 0.86% in the past 30 days and an overall increase of 2.42% year-over-year.

In Conclusion

Currently, Cognizant shares have a Value Score of B, suggesting they are reasonably priced in the market.

The forward 12-month Price/Sales ratio for CTSH stands at 2.03, which is notably lower than the industry average of 12.16.

Cognizant operates under a Zacks Rank #2 (Buy), indicating investor confidence. For those interested, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Research Chief Identifies “Stock Set to Double”

Our expert team has identified five stocks with the highest potential for growth, with Director of Research Sheraz Mian highlighting one stock that is most likely to see significant gains.

This top pick belongs to a leading financial firm, which has rapidly expanded its customer base to over 50 million, supported by a diverse range of innovative solutions. While not every stock recommendation succeeds, this one has the potential to outpace previous Zacks success stories like Nano-X Imaging, which soared by +129.6% in less than nine months.

Get our Top Stock and Four Additional Picks for Free

Stay updated with the latest recommendations from Zacks Investment Research by downloading ‘5 Stocks Set to Double’ for free.

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

ServiceNow, Inc. (NOW): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.