Rivian Automotive: The Downfall of an EV Visionary

The largest initial public offering (IPO) of 2021 has come back down to earth. Electric vehicle (EV) upstart Rivian Automotive (NASDAQ: RIVN) went public with a $100 billion market cap, raising over $10 billion in the process. Today, its stock is down 94% from all-time highs as production stalls and the company burns enormous levels of cash every quarter. Its market cap is only $10.5 billion today.

Management will be updating investors with third-quarter earnings results on Nov. 7. Optimistic investors may say the company is in hypergrowth mode and set to stabilize due to a deal with Volkswagen. Bears may say the company will run out of cash within a year or two. It’s time to see whether you should buy the dip on Rivian stock before its Q3 earnings are released.

Production Woes and Intense Competition

Rivian portrays itself as a premium EV brand. It boasts the R1T truck, which has received strong reviews and seems to have satisfied customers. However, the price of its vehicles often exceeds $100,000, making them accessible only to wealthier buyers. The company began production and deliveries in 2022, experiencing rapid growth initially as it addressed a significant customer backlog.

Unfortunately, Rivian’s growth in production and delivery has stalled in recent quarters. In Q3, the company delivered merely 10,000 vehicles—a decrease that marks its lowest output since March 2023. Notably, this decline is not indicative of a broader slowdown in the EV market. Competitors like Tesla continue to deliver around 500,000 vehicles per quarter, highlighting strong demand in the sector.

Furthermore, Rivian lacks a budget-friendly vehicle, which limits its appeal to a larger customer base. This situation worsens with the Federal Reserve’s interest rate hikes aimed at controlling inflation, making Rivian’s EVs even less affordable for many potential buyers. While the company’s vehicles may offer exceptional quality, creating a successful automotive business requires selling more than 10,000 cars per quarter, unless one is positioned as an ultra-luxury brand.

Can Volkswagen Rescue Rivian?

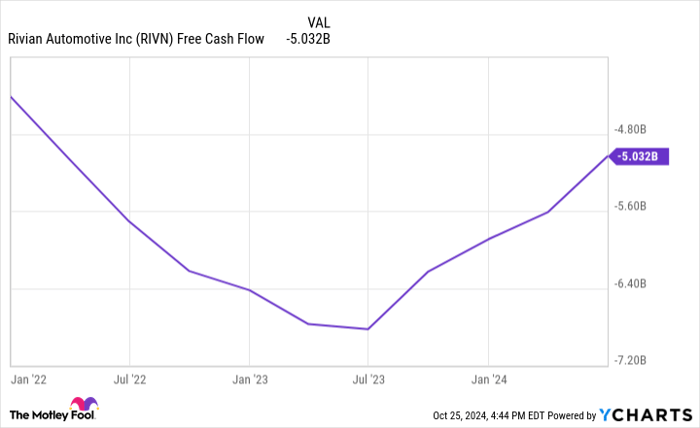

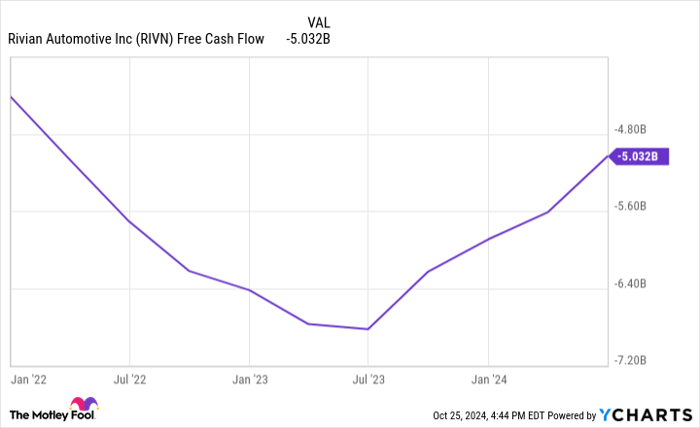

Given the slowdown in vehicle sales, Rivian is facing significant financial losses. In the last quarter, revenue barely rose to $1.16 billion, while its operating loss widened to $1.375 billion within just three months. The company is experiencing a negative gross margin, indicating it loses money on each car sold even before accounting for overhead costs. Over the past year, free cash flow was a staggering negative $5 billion, a trend expected to continue in Q3 due to low delivery figures.

Desperate for funds, Rivian announced a partnership in which Volkswagen will invest $5 billion into its business. In exchange, Volkswagen intends to utilize Rivian’s technology in its forthcoming EV lineup set for release in the next decade, potentially including new Scout vehicles revealed recently.

This investment provides Rivian with a necessary lifeline of $5 billion, buying it additional time to manage its cash flow challenges.

RIVN Free Cash Flow data by YCharts

Is Buying Rivian Stock a Good Idea?

Buying Rivian stock is not advisable at this time.

The evidence suggests that Rivian operates with poor unit economics. It continues to stagnate and is burning through $5 billion in free cash flow annually. Even with the forthcoming Volkswagen investment, Rivian could run out of cash in two to three years. Currently, its cash reserves (before the Volkswagen deal) barely surpass $5 billion.

Despite its stock being down over 90% from its peak, Rivian’s initial valuation was exorbitant. Market cap fluctuations will not matter if the company fails to demonstrate profitability, which is essential for providing long-term shareholder value. Unless management executes a remarkable turnaround to achieve positive cash flow, Rivian stock should be avoided.

Should You Invest $1,000 in Rivian Automotive Now?

Before purchasing stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive isn’t one of them. These selected stocks have the potential for significant returns in the coming years.

For example, when Nvidia made this list on April 15, 2005, if you invested $1,000 at that time, you’d have $865,595!!

Stock Advisor provides a reliable framework for investors, including portfolio building guidance, regular analyst updates, and two new stock recommendations each month. Over since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla and Volkswagen. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.