“`html

SoundHound AI: A Booming Stock Amidst Market Volatility

SoundHound AI (NASDAQ: SOUN) has become one of the standout performers in 2024, seeing impressive gains of nearly 140% to date. However, the stock has also faced significant ups and downs throughout the year.

The surge in the company’s share price occurred during the first quarter, sparked by news that semiconductor giant Nvidia had invested in SoundHound. The stock hit its peak in March, but has since fallen 51% from that high.

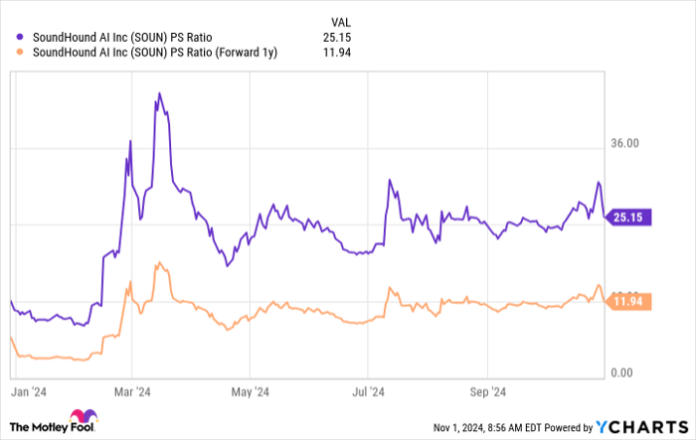

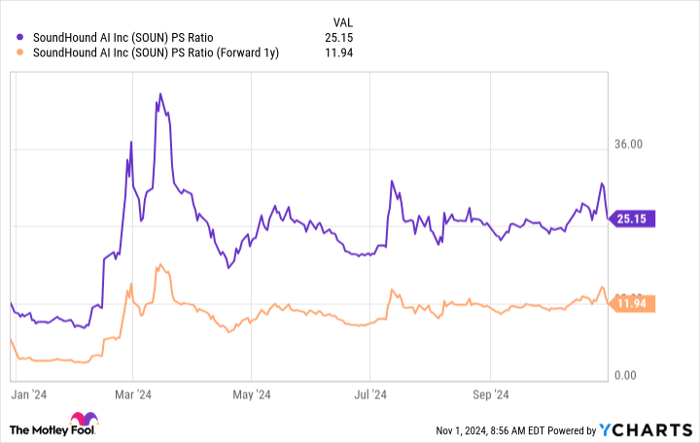

This volatility explains why SoundHound AI still trades at a high valuation despite not yet being profitable. Currently, its price-to-sales ratio stands at 25, significantly more than the U.S. technology sector’s average of 8.

Despite the high price, many argue that SoundHound’s rapid growth justifies its valuation. The company operates in a market that may support robust growth for the foreseeable future.

Anticipating Strong Results for the Upcoming Quarter

Demand for SoundHound’s voice AI solutions has surged, resulting in strong growth in their revenue. The company’s revenue for the first half of the year increased by 62% year over year, totaling $25.1 million.

Analysts project a revenue of $23.0 million for the third quarter, nearly equaling its revenue from the first half of the year. This may seem overly optimistic, but SoundHound’s full-year guidance supports a brighter outlook.

Management is targeting at least $80 million in revenue for the year, anticipating a total of $54.9 million for the second half. If the $23.0 million Q3 forecast holds true, the company’s revenue would show an impressive 73% increase compared to the previous year, marking a significant acceleration from last quarter and last year.

Two key factors support SoundHound AI’s potential for this kind of revenue growth. First, the company reports a solid revenue pipeline with a cumulative backlog of subscriptions and bookings amounting to $723 million, which it claims has nearly doubled year-over-year in the second quarter.

This cumulative booking figure represents the value of contracts signed with customers, while cumulative subscriptions indicate potential revenue from current customers over the next five years. Although this metric has an element of uncertainty, its growth rate suggests a positive future for SoundHound.

The second factor driving expected growth is the acquisition of Amelia, a provider of enterprise AI software for customer service. Following this acquisition, SoundHound updated its revenue guidance for 2024 to at least $80 million, up from an earlier forecast of $71 million.

Achieving the $80 million goal would equate to a 74% increase from 2023, with management forecasting at least $150 million in revenue for 2025. Additionally, SoundHound has identified a total addressable market (TAM) of $140 billion, suggesting it is at the beginning of a significant growth trajectory.

Is This Stock Worth Buying Right Now?

SoundHound’s rapid growth is clear, indicating the potential for continued expansion. Nevertheless, its high valuation could deter some investors from making a purchase.

Meanwhile, other AI-software-focused companies like Palantir Technologies carry even steeper valuation ratios—Palantir’s sales multiple stands at 40, despite its slower growth rate compared to SoundHound.

While Palantir is a well-established leader in the AI software market with larger revenues and a path to profitability, SoundHound’s growing backlog suggests it may soon play a pivotal role in the voice AI sector. The company has secured a solid customer base that includes Stellantis, several electric vehicle manufacturers, and numerous quick-service restaurants, in addition to other promising markets like AI customer service.

This context makes SoundHound’s forward sales multiple appear relatively attractive:

Data by YCharts.

Investors willing to accept some risk may find SoundHound an appealing growth asset to consider adding to their portfolios. When the company announces its quarterly results on Nov. 12, positive news could further boost interest in this AI stock.

Should You Invest $1,000 in SoundHound AI Today?

Before deciding to purchase SoundHound AI shares, keep this in mind:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy right now…and SoundHound AI isn’t one of them. The selected stocks have the potential for significant returns in the coming years.

Consider this: when Nvidia was selected for the list on April 15, 2005, an investment of $1,000 then would be worth $829,746 today!

Stock Advisor offers an easy-to-follow strategy for investors, including guidance for building portfolios, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has produced returns that have more than quadrupled that of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`