Super Micro Computer Set to Report Strong First-Quarter Earnings

Super Micro Computer, Inc. (SMCI) is scheduled to report its first-quarter fiscal 2025 results on November 5.

The company expects revenues to fall between $6 billion and $7 billion. The Zacks Consensus Estimate stands at $6.52 billion, reflecting a remarkable growth of 207.5% compared to the previous year’s quarter.

Stay current with all quarterly releases: Check Zacks Earnings Calendar.

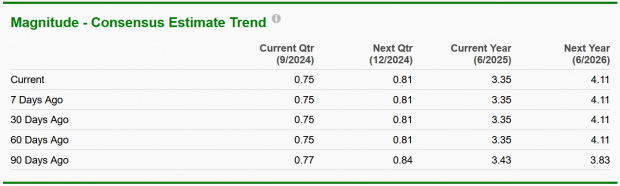

For non-GAAP earnings per share, Super Micro anticipates a range of 67 cents to 83 cents. Meanwhile, the Zacks Consensus Estimate for earnings is 75 cents per share, indicating a significant increase of 120.6% from the same quarter last year. This estimate has remained unchanged for 60 days.

Image Source: Zacks Investment Research

Super Micro has demonstrated a strong earnings surprise history, beating the Zacks Consensus Estimate three times in the last four quarters, with an average surprise of 0.6%.

Super Micro Computer, Inc. Price and EPS Surprise

Super Micro Computer, Inc. price-eps-surprise | Super Micro Computer, Inc. Quote

Current Expectations for Super Micro Computer Earnings

Analysis suggests uncertainty regarding an earnings beat for Super Micro this quarter. A combination of a positive Earnings ESP (Earnings Surprise Prediction) and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) generally increases the chance of exceeding earnings expectations. However, SMCI holds a Zacks Rank of #2 but currently has an Earnings ESP of -0.11%.

What’s Driving Super Micro Computer’s Performance This Quarter

Super Micro has been effectively leveraging the growing demand for AI technology by providing robust server and storage solutions. Increased orders from original equipment manufacturers (OEMs) have likely boosted the uptake of its AI servers, providing a positive impact for this quarter.

The company’s focus on developing high-quality Direct Liquid Cooling solutions for advanced applications is expected to enhance its performance during the fiscal first quarter. Additionally, Super Micro’s upgraded manufacturing capabilities support its growth in AI and enterprise rack-scale liquid-cooled solutions, responding to the demand for liquid-cooled data centers.

Impressive traction within top-tier data centers, cloud service providers, and edge computing customers has also contributed positively, thanks to its advanced next-generation AI and CPU platforms. Its effective building block architecture and automation systems allow for optimized rack-scale solutions with advantages in time-to-market and quality for its customers.

The performance of Super Micro Computer’s Server & Storage Systems segment is expected to show robust results, aided by its extensive infrastructure solutions for 5G and telecom workloads, bolstered by its ongoing partnership with NVIDIA Corporation (NVDA).

Moreover, strong demand for its H100-based systems and AI inferencing solutions is likely to positively impact the Subsystems & Accessories segment this quarter.

Year-to-date, Super Micro shares have risen 2.4%. However, this increase has not kept pace with the Zacks Computer – Storage Devices industry, the broader Computer & Technology sector, or the S&P 500, which have increased by 19.7%, 23.2%, and 20% respectively.

Compared to peers like Western Digital (WDC) and Pure Storage (PSTG), which have surged by 24.7% and 40.4%, respectively, SMCI’s performance has lagged.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Presently, Super Micro Computer appears undervalued with a forward 12-month price-to-earnings (P/E) ratio of 8.07, compared to the industry average of 13.11.

Image Source: Zacks Investment Research

Investment Outlook for SMCI Stock

Super Micro Computer is at the forefront of the burgeoning AI market, leveraging its technological and product edge in AI infrastructure, especially with generative AI and AI inferencing capabilities. Its diverse AI product portfolio and solid integrations into storage solutions enhance its attractiveness to investors.

Additionally, its varied business model encompasses Graphics Processing Units, core computing, storage, 5G, edge computing, and IoT solutions, which are all positive indicators for growth. Super Micro is ramping up production to fully harness AI opportunities and maintain momentum among cloud service providers, exemplified by the recent addition of three new manufacturing sites in Silicon Valley, aimed at furthering its AI and cooling solutions development.

Conclusion: Considering an Investment in SMCI Stock

With strong fundamentals, attractive valuation metrics, and promising long-term growth prospects within the AI infrastructure domain, investing in Super Micro Computer shares appears to be a sound decision. The company is strategically positioned to sustain robust growth as AI demand continues to escalate.

Expert Insights on Potential High-Growth Stocks

Our team has identified five stocks that exhibit a high likelihood of gaining 100% or more in the upcoming months. Among these, Director of Research Sheraz Mian emphasizes a standout stock primed for impressive growth.

This top choice is among the leading innovative financial companies, boasting a rapidly expanding customer base of over 50 million and offering diverse, cutting-edge solutions. While not all picks generate returns, this stock shows strong potential, akin to previous Zacks recommendations like Nano-X Imaging, which soared by +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Additional Picks

For the latest recommendations from Zacks Investment Research, you can download the report on 5 Stocks Set to Double today.

Western Digital Corporation (WDC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

Pure Storage, Inc. (PSTG): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.