What Does the 2024 Election Mean for TSMC Investors?

Investors may be anxious about how the results of the 2024 election will influence Taiwan Semiconductor Manufacturing (TSMC) (NYSE: TSM). As the world’s leading semiconductor producer, TSMC holds a vital role in the global tech industry.

Political Ramifications for TSMC

TSMC faces significant geopolitical pressures. China has long aimed for a takeover of Taiwan, the company’s base of operations. This ongoing political struggle predates the semiconductor sector’s rise and currently affects global economies since roughly two-thirds of chip production occurs in Taiwan.

According to a report by the Semiconductor Industry Association (SIA), the U.S.’s share of chip manufacturing fell to about 12% in 2020, down from around 40% in 1990. To combat this alarming decline, the Biden administration allocated nearly $53 billion in subsidies for chip manufacturing via the CHIPS Act.

While TSMC is set to open a new facility in Arizona, it will only account for nearly 4% of its overall production capacity. This limited domestic output may not meet the expectations of a government keen on revitalizing U.S. manufacturing.

TSMC’s Continued Importance

Despite these political dynamics, American companies might still rely on TSMC for a compelling reason: they have few alternatives. Taiwan reportedly holds around 92% of the global wafer production for the most advanced chips, as noted by the SIA. These chips are crucial for cutting-edge technologies, including artificial intelligence (AI) applications. A failure to source chips from TSMC risks putting the U.S. at a technological disadvantage.

While competitors like Samsung and Intel are establishing factories in the U.S., they too face uncertainty. Like TSMC, they depend on advanced machines from ASML to manufacture chips. However, TSMC has maintained its competitive edge even in comparison to firms utilizing the same technology, which may compel companies and governments to keep working with TSMC.

Furthermore, scaling production capacity is not a rapid process. For example, Samsung does not anticipate starting production at its Texas facility until 2026, and Intel’s Ohio plant is unlikely to begin operations until 2027 or 2028. Consequently, the Trump administration will probably have to make do with the current industry’s realities for a while.

Investors may find TSMC stock attractive despite the associated risks. In the first nine months of 2024, TSMC’s revenue reached $63 billion, marking a 32% increase compared to the same period in 2023. The company also effectively managed its operating expenses relative to revenue, resulting in a net income of $25 billion for shareholders—up 33% from the previous year.

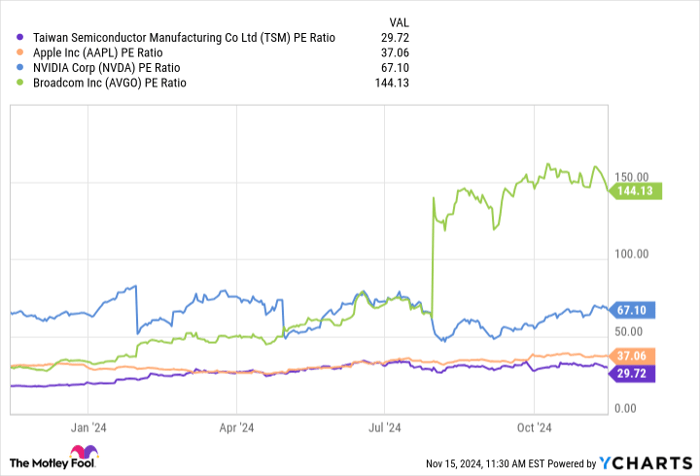

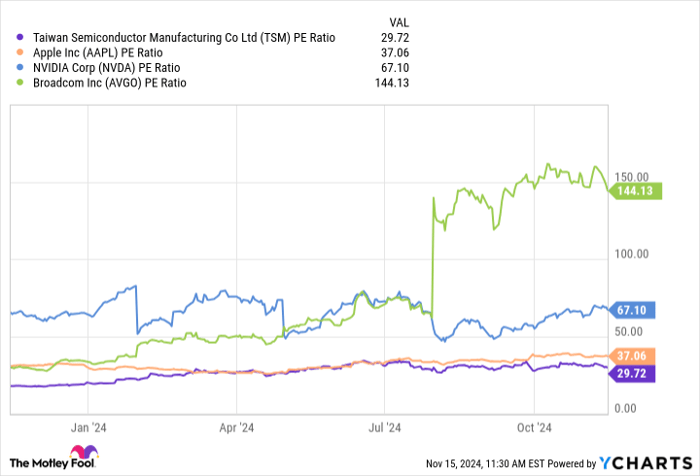

Despite an earnings multiple of 30, TSMC’s price-to-earnings (P/E) ratio is lower than its three largest customers, Apple, Nvidia, and Broadcom. This could present an appealing opportunity for investors, even amid uncertainties.

TSM P/E Ratio data by YCharts

Is TSMC Stock a Smart Buy Before Jan. 20?

In the end, TSMC stock appears to be a favorable purchase before Jan. 20.

A Trump administration may prioritize domestic manufacturing, which might seem challenging for TSMC.

However, TSMC’s significance to the tech industry—and, by extension, the global economy—suggests that political factors are likely to keep the company in the game. Even if a competitor were to emerge, replicating TSMC’s business will take years of investment in new factories.

Additionally, TSMC’s stock is trading at a discount compared to its biggest clients. For these reasons, many believe TSMC stock could offer good returns for investors regardless of any upcoming political shifts.

Should You Invest $1,000 in Taiwan Semiconductor Manufacturing Right Now?

Before making any investment in Taiwan Semiconductor Manufacturing, consider the following:

The Motley Fool Stock Advisor team recently highlighted what they view as the 10 best stocks for investors today—and TSMC did not make that list. The selected stocks are projected to yield significant returns in the foreseeable future.

Take, for instance, when Nvidia featured on this list on April 15, 2005… if you invested $1,000 then, it would be worth $870,068!*

Stock Advisor equips investors with strategies for achieving success, featuring guidance on portfolio building, consistent analyst updates, and two new stock picks monthly. The Stock Advisor service has more than quadrupled the S&P 500’s returns since 2002*.

Explore the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Will Healy has positions in Intel. The Motley Fool has positions in and recommends ASML, Apple, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and has the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.