Skyworks Solutions Struggles as Earnings Decline

Skyworks Solutions, Inc. (SWKS) has seen its stock fall 5.6% in the last three months. This decline comes as the broader Zacks Computer and Technology sector has increased by 9.7%, and its competitor Broadcom (AVGO) has skyrocketed by 44.3% during the same period.

Skyworks’ recent financial performance has fallen short. In the fourth quarter of fiscal 2024, the company’s revenues dropped 15.9% compared to the previous year, while non-GAAP earnings fell by 29.5%.

Several factors contributed to this underperformance: high inventory levels, inconsistent demand across different market segments, and weak global demand, particularly in automotive and industrial areas. Modest growth in broader market segments was offset by a downturn in infrastructure and automotive markets and increased competition from firms such as Qorvo (QRVO) and Cirrus Logic (CRUS).

Difficult Forecast Leads to Lowered Estimates

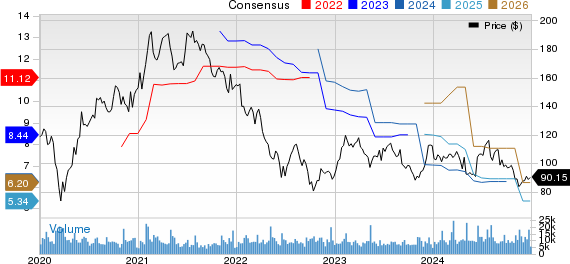

Skyworks Solutions Price and Consensus Chart

Skyworks Solutions price-consensus-chart

Looking ahead, the challenges in wireless and traditional data center markets are projected to persist. Competition from Broadcom, Qorvo, and Cirrus Logic is expected to continue putting pressure on prices and overall profit margins.

For the first quarter of fiscal 2025, Skyworks anticipates revenues of between $1.05 billion and $1.08 billion, expecting non-GAAP earnings to be around $1.57 per share. However, the Zacks Consensus Estimate for this quarter has dropped to roughly $1.07 billion, reflecting an 11.4% year-over-year decrease.

Moreover, the earnings estimate for fiscal 2025 has been reduced by 4 cents over the last two months to $5.34 per share, indicating a 14.8% decline from fiscal 2024’s earnings of $6.27 per share.

Potential for Recovery Amidst a Strong Portfolio

Despite recent setbacks, Skyworks holds a strong portfolio featuring amplifiers, antenna tuners, DC/DC converters, and other crucial components. This portfolio positions the company to benefit from the rising demand in wireless connectivity, IoT, automotive industries, and data centers, suggesting opportunities for growth and innovation.

Skyworks has noted improved demand driven by customer adoption of advanced Wi-Fi 6E and 7 systems. These systems, which are more complex and include additional bands, promise higher revenue potential. With Wi-Fi 7 shipments increasing, the industry is initiating a multi-year upgrade cycle.

The company remains optimistic about long-term market trends, counting on developments in edge IoT, automotive electrification, sophisticated security systems, and AI-driven workloads to foster growth.

Skyworks is also investing in partnerships with mobile clients to create efficient connectivity solutions. Recently, mobile revenues increased by 21% sequentially. The company expects continued growth in the quarter ending in December, fueled by normalized orders and seasonal product ramps.

Zacks Rank and Market Positioning

Skyworks has faced multiple challenges, including high inventory and uneven demand across markets. Nevertheless, the company’s commitment to 5G, IoT, and AI provides a solid foundation for future growth.

Currently, SWKS holds a Zacks Rank of #4 (Sell), indicating that investors may want to avoid buying the stock for now. Its Value Score of C highlights that its valuation may be high right now.

Be First to New Top 10 Stocks >>

Zacks Identifies Top 10 Stocks for 2025

Curious about the top 10 stocks set to shine in 2025? History shows their performance has the potential to be remarkable.

From 2012 until November 2024, the Zacks Top 10 Stocks portfolio yielded a gain of +2,112.6%, far exceeding the S&P 500’s +475.6%. Now, the team is carefully selecting the best 10 stocks to watch for 2025. Don’t miss your chance to invest before January 2.

Skyworks Solutions, Inc. (SWKS): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

Qorvo, Inc. (QRVO): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.