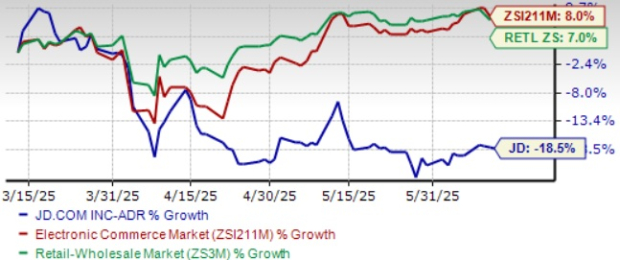

JD.com stock fell by 18.5% over the past three months, significantly underperforming the Zacks Internet – Commerce industry, which rose by 8%, and the Zacks Retail-Wholesale sector, which gained 7%. In the first quarter of 2025, JD’s revenue grew by 16% year over year, but margins eroded, with a non-GAAP operating margin of 3.9% due to rising costs and competition.

Fulfillment costs increased by 17.4% year over year to RMB 19.7 billion, impacting profitability. JD’s aggressive expansion into food delivery and AI requires significant upfront investments, yet returns remain uncertain. The company’s earnings estimate for 2025 has been revised downward by 16.9% to $3.81 per share, indicating potential challenges ahead.

In a highly competitive market dominated by Alibaba with an 80% market share, JD.com struggles against rivals like PDD Holdings and Meituan, which utilize aggressive pricing strategies. Given these challenges, analysts suggest caution for investors considering JD.com.