Market Response to Trump’s Treasury Appointment and GM Stock Dynamics

President-Elect Donald Trump’s choice of billionaire hedge fund manager Scott Bessent as the next Secretary of the Department of Treasury garnered a positive response from the markets yesterday, with the S&P 500 and Dow Jones indexes hitting new highs.

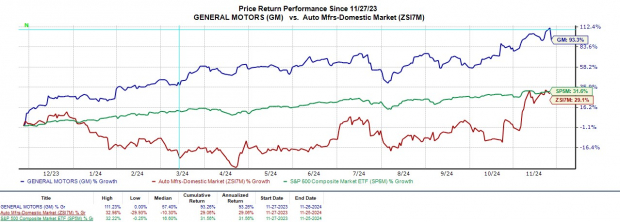

In contrast, auto stocks faced significant declines on Tuesday due to Trump’s plan for a 25% tariff on imported goods from Canada and Mexico. This move threatens to undermine the USMCA (United States-Mexico-Canada) free trade agreement, with General Motors GM expected to bear the largest impact.

General Motors operates extensively in North America, which led to an 8% drop in GM shares during today’s trading session. However, some investors may view this decline as a possible buying opportunity since GM reached a 52-week high of $61 a share this week and has maintained over 50% gains year-to-date.

Image Source: Zacks Investment Research

GM’s Robust Financial Outlook

General Motors’ recent stock high is largely attributed to the company’s strong financial performance. Total sales are projected to increase by 5% in fiscal 2024, setting a new record of $180.02 billion according to Zacks estimates. Even though GM’s top line is expected to decrease by 2% the following year, it will still be the largest U.S. automaker by revenue, surpassing Ford F and Tesla TSLA, which are forecasted at $174.28 billion and $99.65 billion respectively for FY24.

Moreover, GM is on track to achieve a record profit this year, with earnings expected to rise 34% in FY24 to $10.29 per share, compared to $7.68 last year. Earnings for FY25 are anticipated to grow an additional 2%.

Image Source: Zacks Investment Research

Valuation Perspectives on GM

A key factor for considering General Motors as a buy-the-dip option is its valuation. GM is currently trading at 5.8 times forward earnings, significantly lower than the S&P 500’s 25.3 times and the average for its Zacks Automotive-Domestic Industry at 13.1 times. In contrast, Ford trades at 6.2 times, while Tesla is considerably higher at 137.2 times.

Image Source: Zacks Investment Research

As the leading domestic automaker by revenue, GM trades at just 0.3 times sales, while the industry average stands at 1 times, and the S&P 500 at 5.4 times.

Image Source: Zacks Investment Research

GM’s Electric Vehicle Expansion

GM’s push into the electric vehicle sector has been particularly compelling for long-term investors. The company’s sales of electric vehicles, primarily driven by the Chevy Equinox EV, surged by 192% in Q3 2024, totaling 32,095 units sold compared to 11,006 units in the same period last year. Currently, GM has overtaken Ford in total EV sales in the U.S., following Tesla.

Image Source: GM.com

Conclusion

As General Motors heads towards a potential record year, the stock appears to be an appealing buy-the-dip opportunity, especially with a Zacks Rank of #2 (Buy). However, investors should closely monitor revisions in earnings estimates for FY25, as some analysts warn that proposed tariffs could impact GM’s profit margins by 2% or more.

Notably, this tariff proposal may be part of a larger negotiation strategy for Trump, given the long-standing free trade agreements in place since 1994 among the U.S., Canada, and Mexico.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.