Wall Street Analysts Weigh In: Insights on Meta Platforms (META)

Before deciding to Buy, Sell, or Hold a stock, investors often look to the ratings provided by Wall Street analysts. These ratings can impact a stock’s price, but how reliable are they?

Let’s delve into what these analysts are saying about Meta Platforms (META) and how to interpret their advice.

Current Recommendations for Meta Platforms

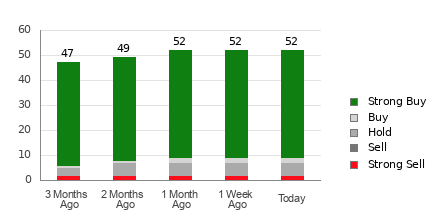

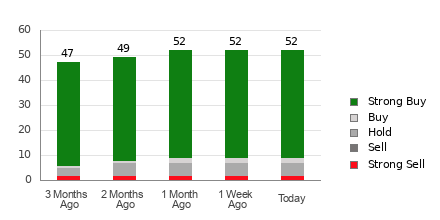

As of now, Meta Platforms has an average brokerage recommendation (ABR) of 1.38 on a scale of 1 to 5, where 1 represents Strong Buy and 5 signifies Strong Sell. This ABR is computed from the recommendations of 52 brokerage firms, with 43 issuing Strong Buy ratings and 2 providing Buy ratings. Together, these ratings amount to 82.7% for Strong Buy and 3.9% for Buy.

Understanding Brokerage Recommendation Trends

While a Buy recommendation emerges from the ABR, caution is advised. Research indicates that brokerage recommendations do not always effectively guide investors to the best potential stocks.

Why is this the case? Brokerage firms often have vested interests in stocks they follow, leading to a bias in their analysts’ ratings. Our findings show that for each “Strong Sell,” there are typically five “Strong Buy” recommendations, suggesting that these ratings may not reflect actual stock performance accurately.

Evaluating Recommendations with Zacks Rank

To get a clearer picture, investors might consider Zacks Rank, a proprietary tool that categorizes stocks from #1 (Strong Buy) to #5 (Strong Sell). This system effectively predicts stock price performance based on earnings estimate revisions, offering a more stable approach than the ABR.

Unlike the ABR, which reflects solely brokerage ratings and can include decimals (e.g., 1.28), Zacks Rank is driven by earnings data and is displayed in whole numbers. Analysts at brokerage firms tend to be overly optimistic, while the Zacks Rank relies on actual earnings estimate revisions, making it more reliable for short-term predictions.

Is Now a Good Time to Invest in META?

The Zacks Consensus Estimate for Meta Platforms has been stable at $22.68 for the current year. This unchanged estimate suggests that analysts are consistent in their assessment of the company’s earning potential. Consequently, Meta may perform in line with the overall market soon.

Dating this analysis is the fact that the consensus estimate change, along with several other earnings factors, has resulted in a Zacks Rank of #2 (Buy) for Meta Platforms. You can explore a full list of today’s Zacks Rank #1 (Strong Buy) stocks.

In conclusion, while the average brokerage recommendation indicates a positive stance towards Meta Platforms, combining this with Zacks Rank can further guide investment decisions.

Get Ahead: Zacks Top 10 Stocks for 2025

Want to discover our top stock picks for 2025 ahead of the crowd?

Historically, these selections have seen impressive performance. From 2012 through November 2024, the Zacks Top 10 Stocks portfolio gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. As 2025 approaches, our Director of Research, Sheraz Mian, is studying 4,400 companies to identify the top 10 stocks to buy and hold. Mark your calendar for January 2 to catch these recommendations.

Interested in the latest insights from Zacks Investment Research? You can download our report on 5 Stocks Set to Double. Click to access this free report.

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.