Teva Pharmaceutical Industries Limited has seen its TEVA stock drop by 10% in the past month, despite the company reporting strong third-quarter results. They exceeded expectations for both earnings and sales, and offered a modest increase in their earnings and sales outlook. The decline in stock price may be due to investors feeling lukewarm about the slight adjustment in guidance. Despite this reaction, some analysts suggest that the market’s response was overly harsh.

As the world’s largest generic drug manufacturer, measured by both total and new prescriptions, Teva also produces several branded medications. It is vital to evaluate the company’s strengths and weaknesses to determine if the current stock dip represents an opportunity for long-term investors.

Driving Growth with New Branded Drugs

Teva continues to expand its market share with its newest drugs, Austedo and Ajovy. Although Ajovy is experiencing slower growth in the U.S., Teva anticipates that overall sales will benefit from patient growth and future launches in Europe and other international markets. Looking ahead to 2024, Ajovy is projected to generate around $500 million in sales.

Austedo is expected to achieve over $2.5 billion in annual revenues by 2027. The launch of Austedo XR, a new daily formulation, is expected to enhance these sales. Teva anticipates launching Austedo in Europe in 2026, with projected sales in 2024 reaching approximately $1.6 billion.

In May 2023, Teva launched Uzedy (risperidone) extended-release injectable suspension for treating schizophrenia. During the third-quarter conference call, the company raised Uzedy’s revenue guidance from $80 million to $100 million due to increasing demand.

Teva also has progress to report on its branded drug pipeline, which includes olanzapine, a late-stage injectable treatment for schizophrenia, and TEV-48574, an anti-TL1A therapy in mid-stage development for inflammatory bowel diseases. To leverage this asset, Teva partnered with Sanofi SNY to share global development costs. Top-line data from a phase IIb trial of TEV-48574 is anticipated by the end of this year.

Strengthening Generics and Biosimilars Pipeline

Teva actively pursues first-to-file (FTF) and first-to-market opportunities along with approvals for complex generics, which encounter less competition. Despite limited new complex generic approvals from 2021 to 2023, Teva has launched several products in 2024 and plans to introduce more in 2025, reinforcing its position in the global generics market.

In the biosimilars arena, Teva has a robust pipeline, including collaborations with Alvotech. They received approval for Simlandi, a biosimilar to AbbVie’s ABBV Humira, in February 2024 and launched it in May. Selarsdi, a biosimilar to J&J’s JNJ Stelara, was approved in April 2024 and is set to launch in February 2025 due to a settlement with J&J. In October 2024, Teva introduced the first generic version of Novartis’ Sandostatin LAR. Teva is also developing biosimilars for Amgen’s Prolia, with multiple others in late-stage development, aiming for six biosimilar launches by 2027.

The U.S. generics and biosimilars business shows signs of stability, a notable change from recent years. Teva expects steady growth in the U.S. generics segment in 2025, driven by upcoming complex generic products and the introduction of specific biosimilars.

Resolution of Opioid Litigation

Facing numerous lawsuits related to its opioid products, Teva has been under pressure for its role in the opioid epidemic. In June 2023, the company announced a comprehensive settlement agreement to resolve claims from all 50 U.S. states and nearly all litigating subdivisions, committing up to $4.25 billion over 13 years. This amount includes the distribution of its generic Narcan valued at approximately $1.2 billion. Additionally, in September 2024, Teva settled opioid claims with Baltimore for $80 million, surpassing initial settlement projections of $2.6 billion.

Price Performance, Valuation, and Earnings Outlook

In 2023, Teva’s stock increased by 58.7%, significantly outperforming the industry, which rose by 10.7%. The stock has consistently performed better than both the sector and the S&P 500, particularly after years of subdued performance.

TEVA Stock Outperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

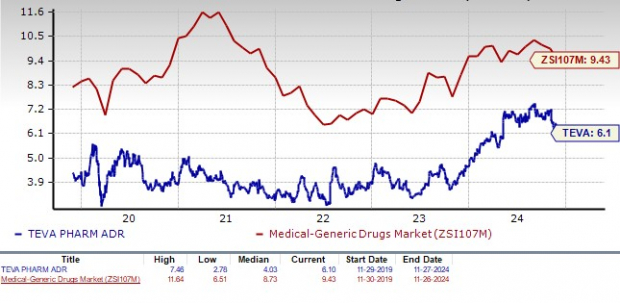

Currently, TEVA’s stock holds an attractive price-to-earnings (P/E) ratio of 6.10, undercutting the industry average of 9.43.

TEVA Stock Valuation

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Teva’s earnings remains unchanged at $2.44 per share for 2024, while estimates for 2025 have slightly decreased from $2.76 to $2.75 per share in the past month.

TEVA’s Estimate Movement

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Potential to Invest in Teva

Teva’s revenues have been under significant pressure since losing exclusivity for its top multiple sclerosis drug, Copaxone, in 2015. Despite these challenges, the company is gradually recovering.

Teva Pharmaceutical Industries Ltd. (TEVA) is currently facing intense competition for some of its top-selling drugs. Additionally, the company is managing a significant debt burden and dealing with price-fixing allegations. Despite these hurdles, Teva’s newer medications—Austedo, Uzedy, and Ajovy—alongside a stable generics business, are helping to foster revenue growth.

Turning the Tide with New Strategies

The resolution of costly opioid litigations through a nationwide settlement, combined with fresh product launches and a solid generics segment bolstered by biosimilars, is clarifying Teva’s long-term growth trajectory. The company is not only cutting costs but also enhancing profit margins by optimizing its operations and reducing its debt levels.

Investment Outlook for Teva Stock

Teva’s reasonable market valuation, coupled with an improving product pipeline and anticipated sales and profit increases, presents a compelling case for investors. Currently holding a Zacks Rank #3 (Hold), this stock could be a worthwhile addition for long-term investors, especially after its recent price drop.

Infrastructure Spending: A Growing Market

As America gears up for unprecedented infrastructure initiatives with trillions in federal funding aimed at revamping roads, bridges, and AI data centers, investors can capitalize on the emerging opportunities.

Discover five unexpected stocks that stand to benefit from this burgeoning spending spree, which is just beginning to unfold in this sector.

Download your free guide on profiting from the trillion-dollar infrastructure boom today.

Sanofi (SNY): Get a free stock analysis report.

Johnson & Johnson (JNJ): Access a free stock analysis report.

Teva Pharmaceutical Industries Ltd. (TEVA): Get your free stock analysis report.

AbbVie Inc. (ABBV): Access a free stock analysis report.

For more insights, read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.