NVIDIA Eyes Impressive Growth as Q3 Earnings Approach

NVIDIA Corporation NVDA is gearing up to release its third-quarter fiscal 2025 earnings on November 20.

Strong Revenue Projections Highlight NVIDIA’s Growth

For the fiscal third quarter, NVIDIA anticipates revenues between $32.5 billion (+/-2%). The Zacks Consensus Estimate stands at $32.81 billion, reflecting a remarkable 81% increase compared to the same quarter last year.

Stay informed with Zacks Earnings Calendar for all quarterly releases.

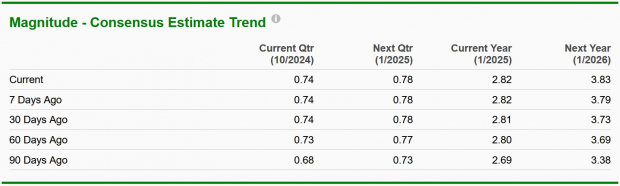

The Zacks Consensus Estimate for NVIDIA’s quarterly earnings has seen a minor upward revision to 74 cents per share in the last 60 days. This represents an impressive year-over-year growth of 85%, up from the 40 cents per share reported in the previous year.

Image Source: Zacks Investment Research

NVIDIA has consistently exceeded the Zacks Consensus Estimate in each of the past four quarters, achieving an average surprise of 12.7%.

NVIDIA’s Earnings and Price Surprise History

NVIDIA Corporation price-eps-surprise | NVIDIA Corporation Quote

Anticipating an Earnings Beat

Our analysis indicates that NVIDIA is likely to report earnings above expectations this season. A positive Earnings ESP, combined with a Zacks Rank of #1 (Strong Buy), enhances the likelihood of an earnings beat, which unfortunately does not apply here. You can explore today’s complete list of Zacks #1 Rank stocks here.

Earnings ESP: The Earnings ESP shows a difference of +2.30%, with the Most Accurate Estimate at 76 cents per share compared to the Zacks Consensus Estimate of 74 cents per share. Use our Earnings ESP Filter to discover stocks worth buying or selling ahead of their reports.

Zacks Rank: NVDA holds a Zacks Rank of #2.

Key Factors Influencing NVIDIA’s Performance

NVIDIA’s Datacenter segment continues to thrive, driven by increased demand for cloud-based solutions resulting from hybrid work trends. The upward trend in hyperscale demands and inference market adoption are likely supportive of this quarter’s revenue growth.

The Datacenter end market is expected to benefit from the growing need for generative AI and large language models powered by NVIDIA’s Hopper and Ampere GPU architectures. With major cloud service and consumer internet companies increasing their orders, we estimate Datacenter revenues for the third quarter could reach $28.48 billion, reflecting a substantial year-over-year growth of 96%.

Additionally, NVIDIA’s performance in the Gaming and Professional Visualization segments shows signs of recovery. After a year-long back-and-forth in inventory levels, the Gaming market registrations reflected a solid demand, with second-quarter revenues increasing 16% to $2.88 billion year-over-year. Our estimate for the Gaming end market in Q3 is $3.11 billion, indicating a 9% rise from the prior year.

NVIDIA’s Professional Visualization earnings have also stabilized, with increases recorded for four consecutive quarters; we project third-quarter revenues at $557 million, marking a 34% increase from last year.

The company’s Automotive segment has seen positive growth trends in eight of the last nine quarters. This upward momentum is likely to continue due to rising investments in self-driving technology and AI cockpit solutions. We estimate third-quarter revenues for the Automotive segment at $340 million, indicating a year-over-year growth of 30%.

NVIDIA’s Stock Performance and Valuation Overview

Year to date (YTD), NVDA has surged 196.2%, significantly outperforming the Zacks Semiconductor – General industry’s growth rate of 139.5%. NVIDIA has outshined other major chip manufacturers such as Micron MU, Marvell Technology MRVL, and Advanced Micro Devices AMD, where Micron and Marvell increased by 16% and 50.4% respectively, while AMD faced a decline of 5.8% YTD.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

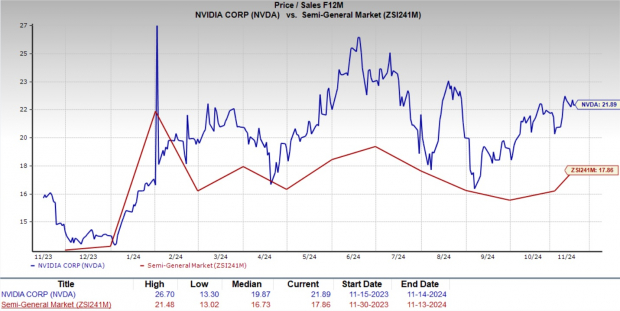

Considering NVIDIA’s current valuation, the stock trades at a premium, with a forward 12-month P/S ratio of 21.89X compared to the industry average of 17.86X, signaling a potentially stretched valuation.

Image Source: Zacks Investment Research

Implications for Investors Considering NVDA

NVIDIA’s revenue growth over the past year has largely stemmed from the heightened demand for chips essential for developing generative AI models. The company’s dominance in this market, which spans various sectors including marketing, education, and healthcare, positions it well for the future.

With the global generative AI market projected to reach $967.6 billion by 2032, growing at a CAGR of 39.6% from 2024 to 2032, NVIDIA stands to benefit significantly. However, this growth will require enterprises to upgrade their network infrastructures extensively to support advanced AI applications effectively. NVIDIA’s cutting-edge chips, including the A100, H100, and B100, are viewed as top picks for these tasks, establishing NVIDIA’s leadership in this evolving sector. As the demand for generative AI surges, NVIDIA’s innovative products are likely to drive substantial growth in revenues and market presence.

NVIDIA: A Quick Summary

As a standout in the semiconductor industry, NVIDIA’s success has been fueled by its stronghold in GPUs and initiatives in AI, data centers, and autonomous vehicle technology. Its impressive product lineup, leadership in AI, and commitment to innovation make it an appealing investment choice.

Despite the stock’s premium valuation, supported by consistent financial performance and robust growth opportunities across sectors like automotive and healthcare, NVIDIA remains well-regarded in market circles. Investors should consider taking advantage of NVDA’s potential for sustainable long-term growth.

Important: Solar Stocks Ready for a Surge

The solar industry is poised for renewal as technology firms pivot from fossil fuels towards renewables to support the AI boom.

Trillions of dollars are expected to flow into clean energy over the next few years, with analysts suggesting solar will make up 80% of this renewable energy expansion. This presents an exceptional opportunity for savvy investors to profit in the near term and beyond—but choosing the right stocks is crucial.

Discover Zacks’ exclusive solar stock recommendation free of charge.

Interested in the latest suggestions from Zacks Investment Research? Download the report on 5 Stocks Set to Double today at no cost.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.