Nvidia’s Earnings Report Sparks Investor Anticipation

Nvidia NVDA is in the spotlight as it prepares to publish its third-quarter earnings on Wednesday, November 20. Investors are eager, hoping for robust results that could drive a broader market rally.

Recently, Nvidia surpassed Apple AAPL to become the largest company by market capitalization, exceeding $3 billion.

Image Source: Zacks Investment Research

What to Expect from Nvidia’s Q3 Performance

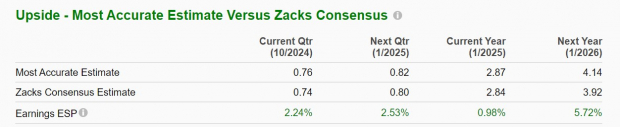

Nvidia’s Q3 sales are projected to rise by 82% to $33.1 billion compared to $18.12 billion in the same quarter last year. Analysts expect the company’s earnings per share (EPS) to jump 85% to $0.74, up from $0.40 per share a year prior.

The Zacks Expected Surprise Prediction (ESP) suggests Nvidia might again exceed earnings forecasts, with the Most Accurate Estimate for Q3 EPS at $0.76, 2% above the Zacks Consensus.

Image Source: Zacks Investment Research

Nvidia outperformed earnings expectations by 6% in August, reporting Q2 EPS at $0.68 against forecasts of $0.64. The company has established itself as a leader in chips for artificial intelligence, beating earnings estimates for seven consecutive quarters, with an average EPS surprise of 12.7% in its last four reports.

Additionally, Nvidia has beaten top-line estimates for 22 quarters in a row, averaging an 8.36% sales surprise in the last four quarters.

Image Source: Zacks Investment Research

Examining NVDA’s Current Trends

Stock Performance

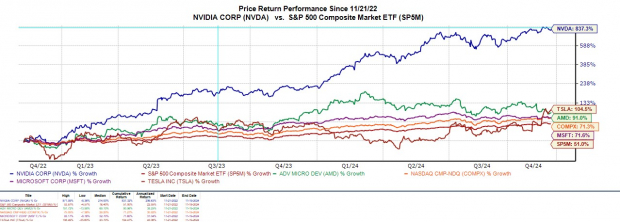

This year, Nvidia’s stock has surged nearly 200%, greatly outpacing its tech peers like Meta Platforms META and Tesla TSLA, which are up 57% and 38%, respectively. In contrast, AMD AMD has seen its stock decline by 6% this year.

Image Source: Zacks Investment Research

Comparative Valuation (P/E)

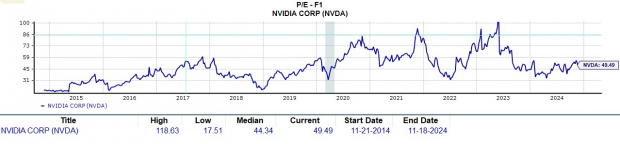

Currently, shares of NVDA trade around $144, reflecting a price-to-earnings (P/E) ratio of 49.4 times forward earnings. This is significantly above the S&P 500’s 24.9 times and AMD’s 42 times. Yet, NVDA is nearing its 10-year median P/E of 44.3 and remains well below its peak of 118.6 times.

Image Source: Zacks Investment Research

Earnings Estimates for NVDA

A crucial factor in deciding whether to invest in NVDA is the trend in earnings estimate revisions. Over the past 90 days, EPS estimates for Nvidia have increased, with recent upward adjustments for fiscal years 2025 and 2026.

According to Zacks estimates, Nvidia’s annual earnings are expected to rise by 118% in FY25 to $2.84 per share, up from $1.30 in FY24. Furthermore, FY26 EPS is projected to climb an additional 38% to $3.92.

Image Source: Zacks Investment Research

Conclusion

If Nvidia meets or exceeds expectations this quarter, its stock may continue to rise. Currently, NVDA holds a Zacks Rank #1 (Strong Buy), supported by positive earnings revisions and the Zacks ESP indicating strong earnings potential.

7 Promising Stocks for the Upcoming Month

Experts have identified seven standout stocks from a list of 220 Zacks Rank #1 Strong Buys, considered to be “Most Likely for Early Price Pops.”

Since 1988, this collection has consistently outperformed the market, achieving an average yearly gain of +23.7%. These selected stocks warrant immediate consideration.

See them now >>

Want up-to-date recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.