Palantir Technologies: A Stellar Performer Amidst the AI Revolution

Palantir Technologies PLTR has emerged as one of the top-performing stocks in 2024, recognized for developing software that supports vital organizational tasks, including counter-terrorism for government agencies.

With an impressive increase of over +300% year-to-date, questions are arising about whether PLTR deserves a place in investors’ portfolios as we approach the new year. Encouragingly, the stock has surged by more than 600% since its public debut in 2020.

Image Source: Zacks Investment Research

Positive Market Sentiment for PLTR

A key driver of investor interest is the company’s involvement in artificial intelligence (AI). Palantir provides a range of AI solutions that enable organizations to better utilize their data.

Palantir Foundry, its primary platform, leverages AI and machine learning to streamline data integration and deliver actionable insights. The Palantir Artificial Intelligence Platform (AIP) aims to enhance productivity and cut costs, while the Edge AI platform supports training and managing AI models for real-time decision-making.

Strategic Partnerships Enhance PLTR’s Profile

Palantir’s collaboration with the U.S. government amplifies its attractiveness to investors. In December, the company extended its contract to support the U.S. Army Data Platform (ADP).

The ADP is integral to managing the Army’s readiness and logistics, utilizing AI to analyze and visualize key data. This contract, valued at $400.7 million over four years, has the potential to reach up to $620 million.

Robust Financial Performance

Financial results also contribute to the positive momentum behind PLTR. The company has consistently met or exceeded the Zacks EPS Consensus for eight consecutive quarters.

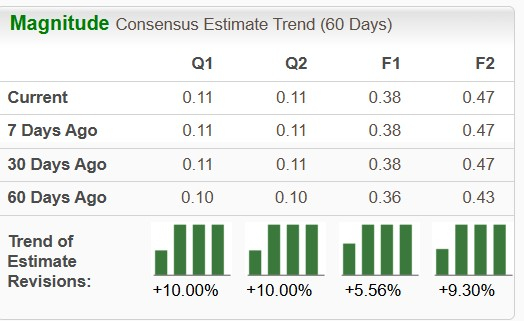

As per Zacks estimates, Palantir’s total revenue is projected to grow by 26% in fiscal 2024 and another 24% in fiscal 2025, reaching $3.5 billion. Earnings per share (EPS) are anticipated to increase 52% this year to $0.38, a rise from $0.25 in 2023, with further growth to $0.47 expected in FY25.

Recent upward revisions in EPS estimates for FY24 and FY25 suggest that Palantir stock may still have room for more growth.

Image Source: Zacks Investment Research

Conclusion

Currently, Palantir stock holds a Zacks Rank #2 (Buy), indicating a favorable outlook from recent earnings estimate trends. Given its status as a notable IPO and ongoing growth potential, PLTR remains a strong candidate for investors seeking portfolio diversification.

Zacks Recommends a Leading Semiconductor Stock

Despite being only 1/9,000th the size of NVIDIA, which has seen over +800% growth since our recommendation, our newly highlighted chip stock has even greater room to thrive.

With significant earnings growth and a broadening customer base, this company is poised to capitalize on the substantial demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to escalate from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

Get Your Free Stock Analysis of Palantir Technologies Inc. (PLTR)

Click here to read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.