Palantir Technologies Inc. Rides the AI Wave with Stellar Stock Performance

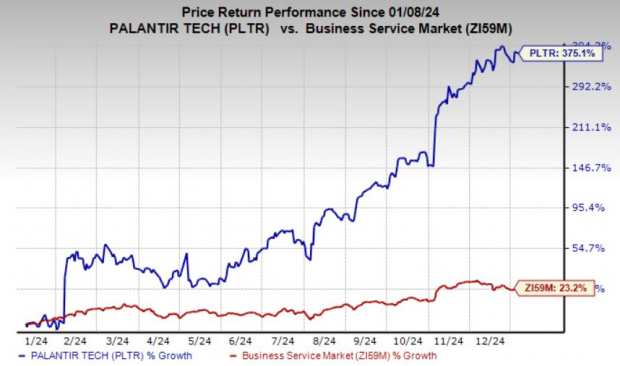

In 2024, Palantir Technologies Inc. (PLTR) achieved remarkable growth, becoming the best-performing stock on the S&P 500 with an astounding 340% return. Its inclusion in the S&P 500 enhanced share demand, particularly from index funds and ETFs, significantly expanding its visibility and investor base.

As of now, the shares have soared a striking 375% over the past year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The rise in PLTR stock reflects growing investor enthusiasm for the rapidly expanding artificial intelligence (AI) market. This interest is evident in the sector’s overall performance, with NVIDIA (NVDA) up 177%, International Business Machines (IBM) gaining 43%, and Oracle (ORCL) rising 61% in the past year.

Let’s explore whether PLTR still presents a buying opportunity after such a significant rally.

Expanding Customer Base and Revenue Models

Palantir serves businesses looking for customized AI and machine learning (ML) services, particularly large government and corporate clients ready to invest in its systems. The company’s client roster includes some of the world’s leading organizations, demonstrating the strength of its technology. This focus on high-profile clients enables Palantir to generate premium revenues, which could lead to stable growth in the future.

Recognizing the need for diversification, Palantir has developed a modular sales approach. This strategy allows customers to purchase specific components instead of committing to the entire platform initially. Furthermore, it includes a usage-based pricing model that reduces barriers for new clients. By starting on a smaller scale, clients can gradually increase their spending as they expand their use of Palantir’s solutions, contributing to significant growth in its U.S. commercial customer base.

We foresee that as AI adoption grows in the private sector, commercial revenues may eventually surpass government revenues.

Palantir’s AI Strategy Sparks Industry Growth

Palantir’s AI strategy is robust, integrating its proprietary Foundry and Gotham platforms while promoting AI usage in government and commercial sectors. The AI Platform (AIP) is central to these efforts, enabling organizations to analyze large datasets for real-time insights. This capability is crucial in sectors like defense, healthcare, finance, and intelligence, where quick decision-making and operational efficiency are essential.

In the government sector, Palantir aligns its AI strategy with U.S. defense objectives. Notable projects, including its work on the Department of Defense’s Open DAGIR project, emphasize its commitment to modernizing military operations through AI. Such initiatives enhance data interoperability and support timely decision-making, further establishing Palantir as a key player in defense.

In the commercial arena, Palantir’s AIP boot camps have successfully engaged over 1,000 companies, providing hands-on experience and showcasing the platform’s versatility across industries such as logistics and supply chain management.

In the third quarter of 2024, Palantir reported a 40% year-over-year growth in U.S. government revenues, driven by strong demand for its AI products. The U.S. commercial segment saw a remarkable 54% surge, driven by AIP successes. Additionally, operating income skyrocketed by 183% year-over-year, while the adjusted operating margin improved by 900 basis points, indicating effective cost management and enhanced revenue from government contracts.

Solid Financial Position

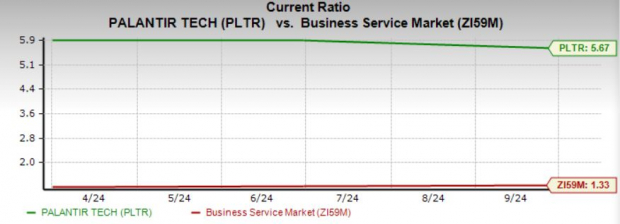

Palantir has a robust financial foundation, with cash and equivalents totaling $4.6 billion as of September 30, 2024, and no outstanding debt. This provides ample liquidity for growth investments. The current ratio stands at 5.67, far exceeding the industry average of 1.33, reinforcing that the company can comfortably meet short-term obligations.

Image Source: Zacks Investment Research

Promising Earnings Outlook for PLTR

The Zacks Consensus Estimate for PLTR’s fourth-quarter 2024 earnings stands at 11 cents, indicating a 37.5% increase from the previous year. Expected earnings for 2024 and 2025 are projected to grow by 52% and 25%, respectively. Sales are anticipated to rise by 28% year over year in the fourth quarter of 2024, with estimated increases of 26.7% and 24.3% in 2024 and 2025.

Recent upward revisions in earnings estimates reflect strong analyst confidence in PLTR. In the past 60 days, four estimates for fourth-quarter earnings have been revised upward, with no reductions, leading to a 10% increase in the Zacks Consensus Estimate. For both 2024 and 2025, six estimates also moved upward, with no downward adjustments, increasing the earnings estimate by 6% for 2024 and 9% for 2025.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Consider PLTR Stock for AI-Focused Investment

With its leadership in the AI sector, strong financial performance, solid cash reserves, and positive earnings forecast, PLTR stock represents an attractive investment opportunity. Although it has experienced significant gains, the continued demand for AI solutions and government contracts suggest that the stock could have further upside potential. Investors looking for growth in the AI sector may find adding Palantir to their portfolios beneficial.

PLTR currently holds a Zacks Rank #2 (Buy), indicating a favorable outlook. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Top Stock Picks with High Growth Potential

From a pool of thousands of stocks, five Zacks experts have selected their top picks, each expected to gain +100% or more in the coming months. Among them, Director of Research Sheraz Mian highlights one stock with the most explosive growth potential.

This particular company focuses on millennial and Gen Z markets, generating nearly $1 billion in revenue last quarter. A recent pullback has created an ideal entry point. While not all selected stocks succeed, this one could significantly outperform previous recommendations from Zacks, such as Nano-X Imaging, which surged by +129.6% in just over nine months.

Get our Top Stock and four additional recommendations for free.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

International Business Machines Corporation (IBM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.