Palo Alto Networks, Inc. (PANW) has achieved remarkable success in its first quarter of fiscal 2025, exceeding market projections and reinforcing its status as a leader in cybersecurity. With strong earnings, strategic growth, and a promising outlook, PANW stands out as an attractive investment opportunity. Here’s an overview of why now is a good time to consider purchasing Palo Alto Networks stock.

Palo Alto Networks Posts Strong Q1 Earnings

Palo Alto Networks announced non-GAAP earnings of $1.56 per share for the first quarter, surpassing the Zacks Consensus Estimate by 5.4% and reflecting a 13% increase from the previous year. Revenue totaled $2.14 billion, which is a 14% rise year over year, predominantly fueled by growth in subscription and support services.

Subscription and Support revenues accounted for 83.5% of total revenue, jumping 16% to $1.79 billion, indicating a rising demand for its Next-Generation Security (NGS) offerings. Meanwhile, product revenues increased by 3.7% compared to last year, reaching $353.8 million, thanks to the growing adoption of firewall appliances.

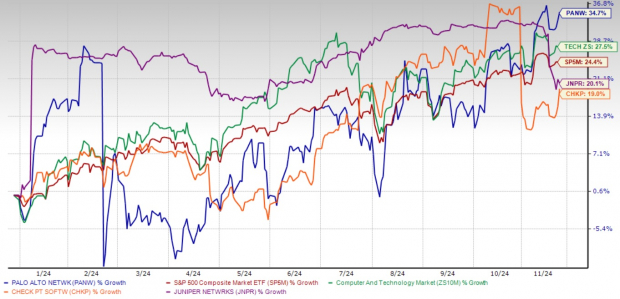

Palo Alto Networks has consistently surpassed expectations for the past four quarters, with an average earnings surprise of 7.6%. In 2024, the company’s stock has surged nearly 35%, outpacing broader indices like the S&P 500, which has grown by 24.4%, and the Zacks Computer & Technology sector, which climbed 27.5%.

In comparison to its cybersecurity peers, Juniper Networks, Inc. (JNPR) and Check Point Software Technologies Ltd. (CHKP), Palo Alto Networks is performing well. Year-to-date, Juniper Networks has risen 20.1% and Check Point 19%.

Year-to-Date Stock Performance

Image Source: Zacks Investment Research

Strong Performance in Next-Generation Security Fuels Growth

Palo Alto Networks reported an impressive Next-Generation Security Annualized Recurring Revenue (NGS ARR) of $4.52 billion, reflecting a 40% increase year over year. This growth highlights the company’s successful strategy in providing diverse cybersecurity solutions through platforms like Cortex, Prisma Cloud, and XSIAM.

Image Source: Palo Alto Networks, Inc.

The hybrid cloud pipeline has exceeded $1 billion, emphasizing Palo Alto’s growing influence in the cloud-native security market. The company achieved a 6.6% sequential growth in NGS ARR, showcasing its resilience in a transforming cybersecurity environment.

Long-Term Growth Drivers for Palo Alto Networks

Palo Alto Networks is well-positioned to capitalize on the increasing need for cybersecurity solutions as digital threats become more prevalent and complex. Businesses find themselves increasingly reliant on advanced security technologies, and Palo Alto Networks is leading this charge.

According to Fortune Business Insights, the global cybersecurity market is projected to grow from $172.2 billion in 2023 to an astonishing $424.97 billion by 2030. With its innovative products, Palo Alto Networks is set to capture a substantial share of this expanding market.

The company has also significantly invested in emerging fields such as cloud security, artificial intelligence (AI), and automation, reinforcing its market dominance. A notable partnership with NVIDIA Corporation (NVDA) to create private 5G security solutions exemplifies its commitment to advancing AI-driven threat detection in crucial industries like telecommunications.

Palo Alto Networks’ platform strategy, which combines a range of cybersecurity tools into a single solution, has proven transformative. By focusing on Annual Recurring Revenue (ARR) instead of one-time sales, the company has established a more stable revenue model attractive to investors, gaining traction with enterprises committed to longer-term engagements.

Projections for fiscal years 2025 and 2026 indicate steady double-digit growth in both revenue and earnings, suggesting that Palo Alto Networks is poised for a sustained upward trend driven by strong demands for its cybersecurity offerings.

Image Source: Zacks Investment Research

PANW Stock: A Strategic Investment for Growth

With solid fundamentals and a promising future, Palo Alto Networks is well-positioned in the industry. The company’s strong first-quarter results, innovative products, and emphasis on AI-driven cybersecurity reinforce its leadership status. Sustained growth in ARR and collaborative ventures enhance its appeal as a long-term investment.

Although the cybersecurity industry is competitive, Palo Alto Networks’ extensive portfolio, increasing market share, and solid financial performance make it an attractive option for growth-focused investors. This may be an opportune moment to invest in PANW and take part in its ongoing success. Currently, Palo Alto Networks has a Zacks Rank of #2 (Buy). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Five Stocks with Doubling Potential

Each stock in this analysis has been selected by a Zacks expert as a top candidate for gaining +100% or more in 2024. Past recommendations have seen impressive returns, including +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently under the radar, presenting a prime opportunity for investors to get in early.

Today, Discover These Five Promising Stocks >>

Interested in the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free today.

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

Check Point Software Technologies Ltd. (CHKP): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.