“`html

Pitney Bowes: An Intriguing Opportunity Amid Low Valuations

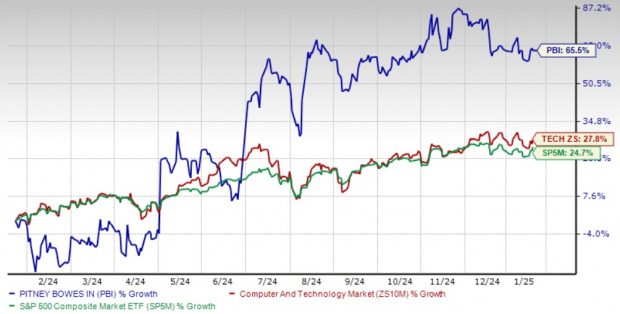

Pitney Bowes (PBI) is trading at a notably low price-to-earnings (P/E) ratio, significantly under the averages of the tech sector and S&P 500. Currently, Pitney Bowes boasts a forward 12-month P/E ratio of 6.67X, which is much lower than the Zacks Computer and Technology sector average of 27.01X, as well as the S&P 500 average of 22.33X.

Additionally, Pitney Bowes has a low price-to-sales (P/S) ratio, prompting investors to consider whether PBI represents a value buy.

Pitney Bowes P/E (F12M) Overview

Image Source: Zacks Investment Research

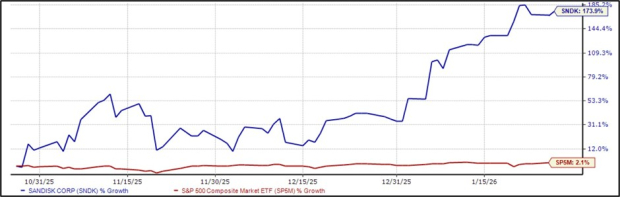

Despite its low valuation, Pitney Bowes shares have increased by 65.5% over the past year. This performance exceeds both the Zacks Computer and Technology sector’s gain of 27.8% and the broader S&P 500’s rise of 24.7%. Given the company’s solid fundamentals and growth prospects, many investors view the surge in PBI’s stock price as a potential opportunity.

Pitney Bowes Price Performance Overview

Image Source: Zacks Investment Research

Strong Partnerships Bolster Pitney Bowes’ Future

A customer base that includes over 90% of Fortune 500 companies reflects Pitney Bowes’ strong market presence. Its collaborations with major firms like Amazon (AMZN), eBay (EBAY), Shopify, and Salesforce (CRM) further enhance its standing in global logistics and technology.

For instance, Pitney Bowes provides cross-border e-commerce logistics for eBay in both the U.S. and U.K. Additionally, its long-standing partnership with Amazon Web Services (AWS), along with being a member of the AWS Solution Provider Network, showcases its ability to incorporate the latest technologies.

Furthermore, the Shipping API Partner Program connects PBI and Salesforce. These alliances not only diversify revenue but also set the stage for future growth.

PBI Sells GEC Business to Enhance Focus on Core Strengths

Pitney Bowes has faced challenges with its Global Ecommerce (GEC) segment. Despite substantial investments, including the acquisitions of Borderfree in 2015 and Newgistics in 2017, the GEC segment struggled post-pandemic as package volumes fell, and competitors employed aggressive discounting.

Acknowledging GEC as a hindrance, Pitney Bowes plans to divest this segment, aiming to improve its financial outlook. The anticipated sale to Hilco Global, expected to finalize in early 2025, could add $136 million to annual earnings. This strategic move allows PBI to sharpen its focus on higher-margin ventures, potentially enhancing profitability.

Solid Financial Progress for PBI

Pitney Bowes has made strides in addressing its long-term debt and enhancing liquidity. The company successfully repatriated $117 million from overseas, leaving it with over $100 million in excess cash to aid debt reduction and bolster financial agility.

Moreover, significant cost-saving measures are underway. Between the start of 2024 and the third quarter, PBI realized $90 million in annualized savings from its SendTech and Presort operations. Management anticipates total cost savings for the year to fall between $150 million and $170 million, underscoring its drive for improved efficiency.

The company is also witnessing strong improvements in non-GAAP operating profit and margin through all three quarters of 2024. By the third quarter, adjusted operating profit saw a year-over-year rise of 22.6%, reaching $103 million. The margin expanded by 490 basis points to 22.2%. For 2024, PBI expects earnings before interest and tax to reach between $355 million and $360 million—a promising sign of rising profitability.

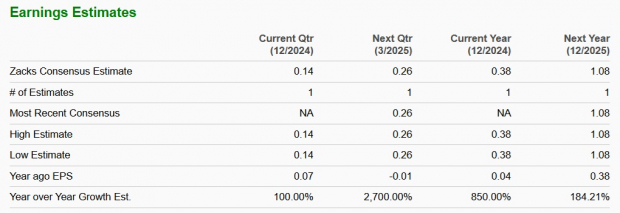

Analysts are projecting a bright earnings growth outlook for Pitney Bowes. The Zacks Consensus Estimate for 2025 has recently increased by 3 cents to $1.08, indicating an impressive 184% growth year-over-year. PBI has exceeded these analysts’ estimates in each of the last four quarters, averaging a surprise of 105%.

Image Source: Zacks Investment Research

For the latest EPS estimates and surprises, visit the Zacks Earnings Calendar.

Conclusion: Consider Investing in PBI Stock

Pitney Bowes stands at a crucial juncture, with strategic restructuring and cost-management efforts paving the way for future growth. The divestment of the GEC segment, combined with strong financial management and valuable partnerships, positions PBI for long-term success.

Given its encouraging financial recovery, undervalued stock, and optimistic growth potential, PBI appears to be a worthy investment opportunity. Investors looking to benefit from this change may want to consider adding PBI to their portfolios. Currently, PBI holds a Zacks Rank #1 (Strong Buy). Explore the complete list of today’s Zacks #1 Rank stocks.

Top 7 Stocks to Watch Over the Next 30 Days

Recently released: Experts have identified 7 top stocks from a select list of Zacks Rank #1 Strong Buys, branding them as “Most Likely for Early Price Pops.”

Since 1988, the comprehensive list has outperformed the market more than twice, averaging a gain of +24.1% per year. Make sure these 7 stocks receive your priority right now.

See them now >>

Looking for the latest recommendations from Zacks Investment Research? Today, you can download the report on the 7 Best Stocks for the Next 30 Days.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Salesforce Inc. (CRM): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Pitney Bowes Inc. (PBI): Free Stock Analysis Report

For the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`