Serve Robotics Sees Strong Growth Amid Last-Mile Delivery Demand

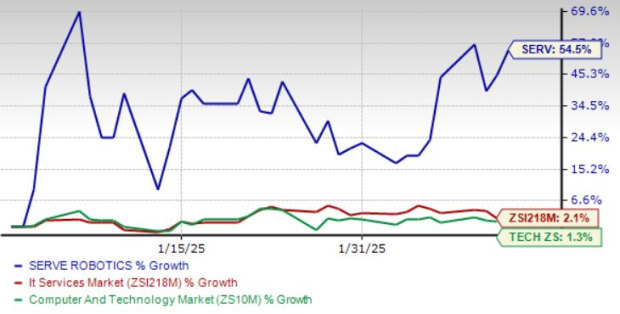

Serve Robotics (SERV) has experienced a remarkable increase of 54.5% in its stock price this year. This surpasses the Zacks Computer & Technology sector’s growth of 1.3% and the Zacks IT Services industry’s rise of 2.1%.

Prospects Driven by Strategic Partnerships

The company thrives on the rising demand for food and other Essentials via partner platforms like Uber Eats and 7-Eleven. A spin-off from Uber Technologies in 2021, Serve Robotics counts NVIDIA (NVDA), Uber, 7-Ventures, and Delivery Hero among its key investors.

With new partnerships with notable companies such as Shake Shack (SHAK), Ouster (OUST), Wing Aviation, and Magna, the company is well-positioned for growth. Its expanding robotics fleet aims to enhance its competitive stance against major delivery services like DoorDash and Amazon. Additionally, the acquisition of Vebu assets is set to boost SERV’s presence in the restaurant sector.

Growth in Robotics Operations

In the third quarter of 2024, SERV operated 59 active delivery robots, reflecting a 23% increase from the previous quarter and an impressive 97% surge year-over-year. These robots generated an average of 465 supply hours daily, marking a 21% rise from the prior quarter and a 108% increase from the previous year.

SERV Stock’s Performance

Image Source: Zacks Investment Research

Cost-Effective Delivery Solutions

Serve Robotics aims to lower the average delivery cost to under $1, making its services more affordable than traditional human courier delivery models. The company’s third-generation robots can handle larger quantities, allowing for increased delivery capacity.

The new technology includes an enhanced cargo bin that accommodates up to four large 16-inch pizzas—15% more volume than previous models. Equipments powered by NVIDIA’s Jetson Orin module, combined with Ouster’s REV7 lidar, significantly improve processing speed and operational efficiency, allowing these robots to travel further and operate longer on a single charge.

Serve Robotics has partnered with Magna International for the mass manufacturing of its third-generation robots and plans to deploy 2,000 units by 2025, aiming for an annual revenue of $60-$80 million upon full deployment.

In the first quarter of 2025, SERV anticipates deploying 250 robots in Los Angeles and is set to enter Dallas by the second quarter. Further expansions are also being considered in markets like San Diego and Vancouver.

SERV’s Earnings Outlook Improves

Recent earnings estimates for SERV show a narrowing loss prediction of 61 cents per share for 2025, slightly down from 64 cents just a month prior. The first-quarter 2025 loss estimates have also improved, now projected at 18 cents per share.

Serve Robotics Inc. Price and Consensus

Serve Robotics Inc. price-consensus-chart | Serve Robotics Inc. Quote

Strong Financial Position Supports Growth

Serve Robotics holds a strong cash position, which is expected to support its long-term objectives. The company raised $35.8 million from a public equity offering, followed by $15 million from a private placement. In August, an additional $20 million was secured through a private placement.

As of September 30, 2024, SERV reported cash and cash equivalents of $50.9 million. Following an $86 million raise in December, SERV’s total gross proceeds for 2024 reached $167 million, with about $220 million raised since its separation from Uber in 2021. An extra $80 million was raised in January 2025 via a registered direct offering of common stock.

Why Analysts Recommend SERV Stock

Current technical indicators are favorable for SERV, with shares trading above both the 50-day and 200-day moving averages. Despite a Value Score of F suggesting an overvaluation, SERV’s expanding fleet represents promising long-term potential for investors.

The stock holds a Zacks Rank #2 (Buy), indicating a favorable sentiment in the current market. Investors may find NOW an opportune time to consider adding this stock to their portfolio.

Zacks’ Top Stock to Watch

Experts at Zacks have identified five stocks with significant potential for substantial gains. Among them, the Director of Research, Sheraz Mian, points to one standout stock poised for impressive growth.

This top pick belongs to a highly innovative financial firm with a rapidly expanding customer base exceeding 50 million, indicating a readiness for significant financial success. Previous selections have yielded significant returns, and this stock could follow suit.

Free: See Our Top Stock And 4 Runners Up

Curious about Zacks Investment Research latest picks? Download our report on the 7 Best Stocks for the Next 30 Days for free.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Serve Robotics Inc. (SERV): Free Stock Analysis Report

Shake Shack, Inc. (SHAK): Free Stock Analysis Report

Ouster, Inc. (OUST): Free Stock Analysis Report

For the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.