Target’s Fourth Quarter Results Prompt Investor Reflection on Future Strategy

Target Corporation (TGT) released its fourth-quarter fiscal 2024 results last Tuesday before the market opened, igniting new discussions among investors about the stock‘s future direction. As a well-entrenched entity in the retail landscape, Target is recognized for its ability to adjust to changing consumer behaviors and economic conditions.

With the latest earnings available, investors are now faced with a pivotal decision: Should they increase their holdings, maintain current positions, or sell the stock?

Insights from Target’s Q4 Performance

Target’s fourth-quarter performance exceeded expectations, showcasing moderate comparable sales growth and robust digital momentum. However, the company continues to face challenges from margin pressures, escalating costs, and intensifying competition. (Read: Target Beats on Q4 earnings, Issues Cautious View on Tariff Concerns)

The retailer reported net sales of $30,915 million, reflecting a 3.1% decrease year-over-year attributed to one less week of sales compared to 2023. Nonetheless, comparable sales increased by 1.5% in the fourth quarter, rebounding from a 0.3% increase in the previous quarter. This figure indicates a 0.5% decline in comparable store sales but an impressive rise of 8.7% in comparable digital sales.

Despite stable sales, pressure on margins persists. The gross margin contracted by 40 basis points to 26.2%, driven by increased digital fulfillment and supply chain costs, alongside elevated promotional and clearance markdown rates. Mitigating these challenges were some benefits from other merchandising activities. The operating margin fell to 4.7%, down from 5.8% during the same quarter last year.

While Target has successfully saved over $2 billion in costs over the past two years, further efforts are needed to bolster margins.

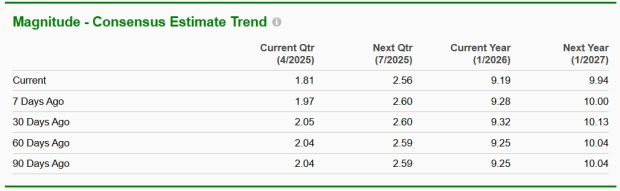

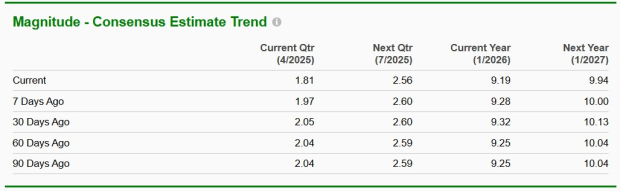

Consensus Estimates Following Target’s Q4 Earnings

Following its earnings report, Target provided a cautious outlook for the first quarter of fiscal 2025. The Minneapolis-based retailer expects considerable year-over-year profit pressures in the first quarter, influenced by ongoing consumer uncertainty, a slight drop in February net sales, tariff concerns, and the anticipated timing of certain expenses throughout the fiscal year.

Although Target recorded record sales for Valentine’s Day in February, overall monthly performance proved to be lackluster. Unseasonably cold weather across the U.S. adversely affected apparel sales, while a drop in consumer confidence contributed to diminished demand for discretionary items.

For fiscal 2025, Target projects net sales growth of around 1% with flat comparable sales. A modest improvement in operating margin is also anticipated. The company forecasts adjusted earnings between $8.80 and $9.80 per share, compared to $8.86 for 2024.

The Zacks Consensus Estimate for earnings per share has been adjusted downward. Analysts have reduced their forecasts by 9 cents to $9.19 for the current fiscal year and by 6 cents to $9.94 for the next fiscal year over the past week.

See the Zacks earnings Calendar to stay updated on market-moving news.

Image Source: Zacks Investment Research

Can Target’s Strategy Ensure a Strong Future for Investors?

Target is utilizing its strong brand identity, diverse product offerings, and growing e-commerce capabilities to strengthen its market position and pursue sustainable growth. By emphasizing innovation and integrating advanced technology, the company aims to secure its long-term prospects. Target has laid out an ambitious strategy to achieve more than $15 billion in revenue growth by fiscal 2030.

By seamlessly combining physical locations with a robust digital presence, Target has improved the shopping experience. The retailer plans to open 20 new stores and remodel several existing locations in fiscal 2025. Enhanced options for same-day delivery and curbside pickup, along with personalized online services, have helped Target maintain a competitive advantage against industry giants like Amazon (AMZN), Walmart (WMT), and Dollar General (DG). During the last quarter of fiscal 2024, same-day services grew by over 25%, and Target Circle membership increased by 13 million members in 2024.

Target’s assortment of owned and popular national brands reinforces its position as a one-stop shopping destination. The retailer has adeptly adapted to evolving consumer trends by expanding its range across discretionary and essential products. Innovations in high-demand categories demonstrate TGT’s proactive approach to customer needs, while a balanced product mix continues to draw a diverse customer base. The company’s $31 billion private label portfolio provides a significant competitive edge.

Target’s third-party marketplace, Target Plus, surpassed $1 billion in gross merchandise volume (GMV) in fiscal 2024, with expectations to achieve $5 billion in GMV over the next five years, significantly enhancing its product range. Additionally, Target’s advertising segment, Roundel, generated nearly $2 billion in fiscal 2024 and is projected to double in size within five years.

To enhance efficiency, Target is modernizing its inventory management with technology solutions that optimize stock availability and delivery times. The company is also unveiling new package delivery methods leveraging its supply chain assets and Shipt service, ensuring faster and more reliable order fulfillment. Target remains dedicated to innovation and enhancing customer satisfaction, striving to offer unique shopping experiences while maintaining good value. A commitment of $4 billion to $5 billion for store remodels, supply chain enhancements, and digital advancements is planned for fiscal 2025.

Target Stock Valuation Post Q4 Earnings

Currently, Target is trading at a forward 12-month price-to-earnings (P/E) multiple of 12.16X, which is significantly lower than the industry average of 30.04X. Furthermore, the stock is trading below its median P/E of 14.93 observed over the past year. This suggests that TGT could present a value opportunity for investors looking to future performance.

Target’s Stock Shows Valuation Appeal Amid Recent Declines

Stock is priced attractively relative to its peers and historical levels, positioning it as a potential bargain.

Understanding TGT’s Valuation

Image Source: Zacks Investment Research

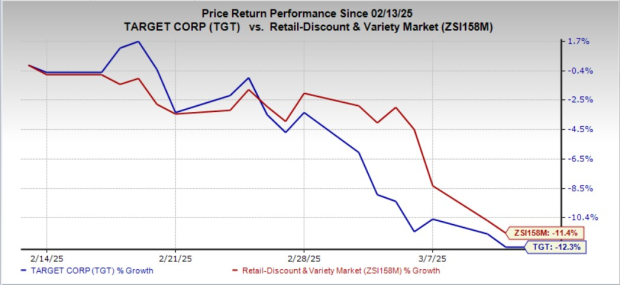

Recently, Target’s stock has faced a sharp 12.3% decline over the past month. This drop suggests broader market challenges as well as specific issues impacting the company’s performance. As a result, the stock currently trades at a discount, potentially appealing to value investors.

Recent Performance Overview of TGT Stock

Image Source: Zacks Investment Research

Investment Strategy for TGT Stock

Given Target’s cautious outlook for the fourth quarter, investors may find it wise to hold their current positions in TGT stock. While the company confronts immediate hurdles, its strong brand recognition, diverse product range, and efficient e-commerce strategy form a robust base for potential growth. Currently, TGT holds a Zacks Rank of #3 (Hold), indicating a stable position in the market.

Promising Stocks with Growth Potential

Five stocks have been carefully chosen by Zacks experts as top contenders to potentially double in value by 2024. Past recommendations have achieved impressive growth, recording rises of +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks highlighted in this report are currently under the radar of Wall Street, presenting a compelling opportunity for early investment. Today, learn more about these five potential home runs >>

Interested in the latest recommendations from Zacks Investment Research? You can now download the 7 Best Stocks for the Next 30 Days. Click here to access this free report.

Stock Analysis Reports:

- Amazon.com, Inc. (AMZN): Free Stock Analysis Report

- Target Corporation (TGT): Free Stock Analysis Report

- Walmart Inc. (WMT): Free Stock Analysis Report

- Dollar General Corporation (DG): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.