Investors Eye Nvidia and Alphabet as Bargain Stocks Amid Market Sell-off

As the markets experience a slight downturn, investors ought to identify dominant stocks presenting good value. The current sell-off largely stems from fears of a potential trade war linked to President Donald Trump’s tariffs.

Two stocks stand out as resilient: Nvidia (NASDAQ: NVDA) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Both appear to be strong buys at this stage, and any further market weakness could enhance purchasing opportunities.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia’s Dominance in AI Sector

Nvidia, known for its graphics processing units (GPUs), plays a significant role in the artificial intelligence (AI) sector. The demand for GPUs has surged as major tech companies invest heavily in AI infrastructure. Predictions for 2025 signal another record year for Nvidia due to capital expansion from its largest clients, which primarily focuses on AI tech.

Interestingly, Nvidia’s stock recently dipped, attributed to concerns over a possible trade war. However, this argument seems unwarranted, as the momentum in AI development shows no signs of halting. Major clients have substantial cash reserves, which means a slight economic downturn is unlikely to derail their spending on NVIDIA products. Capturing early market share in this burgeoning industry is crucial, thus making Nvidia an appealing stock to acquire, especially with its shares down roughly 25% from their peak.

Despite potential tariff impacts, Nvidia reported its Q4 results with a forecast of 65% revenue growth for Q1. Wall Street analysts are optimistic, maintaining their projections for FY 2026 (ending January 2026) at 56% revenue growth and earnings per share (EPS) of $4.50. This valuation places Nvidia’s stock at 24.5 times forward earnings, which remains favorable compared to the broader S&P 500 trading at 21.6 times.

Nvidia presents a strong buying opportunity in this current market climate. Investors would benefit from taking advantage of this unwarranted market fluctuation.

Alphabet: A Steady Performer

When considering value, Alphabet appears even more attractively priced. Although it doesn’t exhibit the same rapid growth as Nvidia, with analysts estimating 11% revenue growth for 2025, Alphabet has a stable revenue stream from its advertising business on Google. This foundation supports consistent growth alongside Alphabet’s investments in other sectors, including autonomous vehicles via Waymo and cloud computing through Google Cloud.

Alphabet also actively engages in share repurchases, enhancing EPS growth. For instance, in Q4, Alphabet reported a 12% increase in revenue year-over-year, while EPS surged by 31%, driven by operational efficiencies and buybacks. Such performance suggests Alphabet can exceed the broader market’s long-term return threshold of 10%.

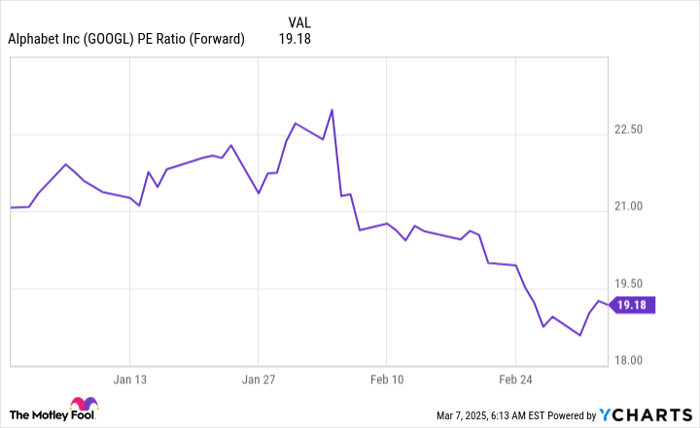

Despite these advantages, Alphabet is traded at a mere 19.2 times forward earnings, presenting an approximate 11% discount compared to the market, making it an appealing stock for long-term investment.

GOOGL PE Ratio (Forward) data by YCharts.

This favorable pricing suggests Alphabet is a strong stock to consider for buying now. Its valuation should eventually align closer to market averages, thus providing investors with worthwhile returns.

In summary, Nvidia and Alphabet emerge as solid purchases at present, provided investors are prepared to hold for the medium to long term. Over the next three to five years, current economic worries are likely to diminish, while robust growth trajectories of these companies will drive results.

Considerations for Investing in Nvidia

Before committing to buying Nvidia stock, it’s crucial to note the following:

The Motley Fool Stock Advisor recently recommended what it believes are the 10 best stocks to buy now… and Nvidia was not one of them. The selected stocks have strong potential for substantial returns in the forthcoming years.

For context, if you invested $1,000 in Nvidia following this recommendation on April 15, 2005, your investment would have grown to $690,624!*

Stock Advisor offers investors straightforward guidance for portfolio building, regular updates from analysts, and two new Stock picks each month. Since inception, Stock Advisor has more than quadrupled the returns of the S&P 500 since 2002*. Join to access the latest top 10 stocks list.

see the 10 stocks »

*Stock Advisor returns as of March 10, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.