Investors Grapple with Tesla’s Volatile Performance Amidst Market Changes

Investors continued to show a strong interest in artificial intelligence (AI) stocks last year, with notable options among the “Magnificent Seven” standing out in Wall Street’s portfolio. However, one tech giant, Tesla (NASDAQ: TSLA), missed the excitement for most of 2024.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider now. See the 10 stocks »

This article will review Tesla’s price fluctuations last year and investigate the reasons behind its current decline. Is this a chance to “buy the dip,” or are investors better off steering clear?

Examining Tesla’s Ups and Downs in 2024

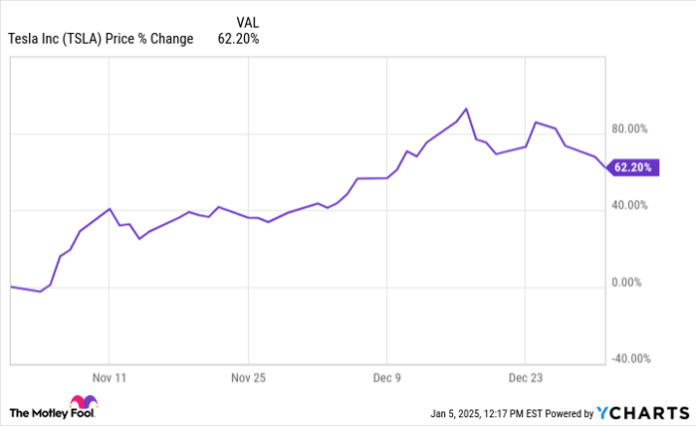

From January to October 2024, Tesla stock saw significant fluctuations, but its price fluctuated to a standstill overall for those months.

Interestingly, from November to December, Tesla shares surged over 60%, reaching record highs.

TSLA data by YCharts.

What caused this rapid ascent? While the conclusion of the U.S. presidential election, with Donald Trump emerging as the victor, played a role, the more intricate reason lies in CEO Elon Musk’s relationship with Trump.

Dan Ives, an analyst at Wedbush Securities, speculates that Musk’s connection might signal positive prospects for Tesla, with potential regulatory advantages for the company’s ambitious plans, including autonomous taxi fleets.

However, following this surge, Tesla’s shares have been on a steady decline since mid-December. Let’s delve into the factors leading to this downturn and determine if cautiousness is warranted.

Image source: Getty Images.

The Factors Behind Tesla’s Recent Decline

Looking at the broader market, 2024 was a successful year for stocks, with the S&P 500 climbing 23% and the Nasdaq Composite increasing by 29%.

December, however, did not align with this trend. The Nasdaq remained mostly unchanged while the S&P 500 saw a drop of approximately 2.5%.

These market movements are common, particularly as investors often choose to realize gains before the year’s end, leading to strategic decisions like tax loss harvesting.

Tesla’s sharp rise in the last two months of 2024 made a pullback almost expected. Disappointing fourth-quarter delivery and production numbers for electric vehicles further fueled concerns.

When companies fail to meet expectations, it typically raises red flags. In Tesla’s case, such shortcomings may hint at weaker demand for its vehicles or suggest a slowing economy, creating uncertainty for the future.

Keeping Long-Term Goals in Perspective

Despite the disappointing numbers, there were still highlights in Tesla’s Q4 results. The company delivered 495,570 vehicles, a record figure. Additionally, indicators suggest strong performance in the Chinese market, which is encouraging given the country’s uncertain economic outlook.

While challenges remain, Tesla’s results hint at resilience. Musk’s connection with the incoming administration might also prove beneficial in expediting regulations critical to Tesla’s self-driving initiatives.

This sell-off could provide a buying opportunity for long-term investors considering Tesla stock.

Where to Invest $1,000 Now

Our analyst team has valuable insights to share. Stock Advisor’s average return is an impressive 914%, compared to the S&P 500’s 174%.*

They’ve revealed what they believe are the 10 best stocks available today, including Tesla, and nine other potential picks.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Adam Spatacco has positions in Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.