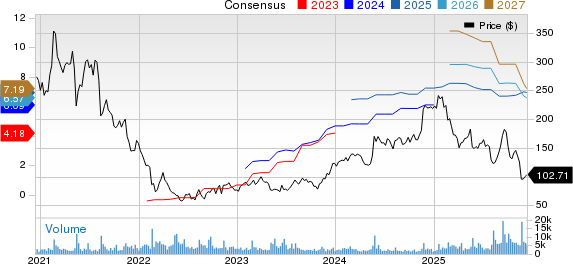

SoundHound AI (NASDAQ: SOUN) saw its stock price surge from $2 to $24 in 2024, marking a twelvefold increase. As of early 2025, the stock has decreased by approximately 55% from its 52-week high of $25. Currently, the stock is trading at $11, and management projects revenue for 2025 to be between $157 million and $177 million, indicating a potential 100% year-over-year growth.

Revenue for SoundHound doubled in the past year, from $51 million to $102 million, with a quarterly revenue milestone reaching $29 million, a 151.2% year-over-year increase. The company attributes its growth to expanded partnerships, particularly in the automotive sector, including collaborations with Mercedes-Benz and Hyundai, and its recent acquisition of Amelia, which brings contracts in various sectors, including healthcare and finance.

To double its stock value, SoundHound needs to maintain over 25% revenue growth and achieve profitability, despite ongoing operational challenges and significant market competition. The company’s price-to-sales (P/S) ratio currently stands at 40x, but analysts suggest it could be moderated to 30x if revenue grows to approximately $250 million by 2027, potentially pushing the stock price to around $20.