Eli Lilly: A Potential Powerhouse in the Weight Loss Drug Market

Small-cap stocks often promise more returns because they come with higher risks. However, large-cap companies like Eli Lilly (NYSE: LLY), valued at $858 billion, are proving that they have growth potential too. With a strong foothold in the booming weight loss drug market, Eli Lilly could potentially transform investors’ fortunes. Let’s explore its prospects.

The Rise of Zepbound

Eli Lilly’s Zepbound is revolutionizing weight loss treatment. Launched just last year in November 2023, this drug is achieving remarkable sales growth and has quickly become a top product in a market where success usually takes years. What’s driving Zepbound’s success? The growing obesity crisis in the U.S. is a fundamental reason. The U.S. has one of the highest obesity rates globally, making it a prime market for effective therapies.

Moreover, the U.S. is the largest pharmaceutical market, accounting for about 44.4% of spending, which bodes well for solutions targeting obesity. This drug not only addresses the physical aspects of obesity but also links to reducing life-threatening conditions such as heart disease and diabetes. A study suggests that expanding access to weight loss drugs like Zepbound could save over 40,000 lives each year in the U.S.

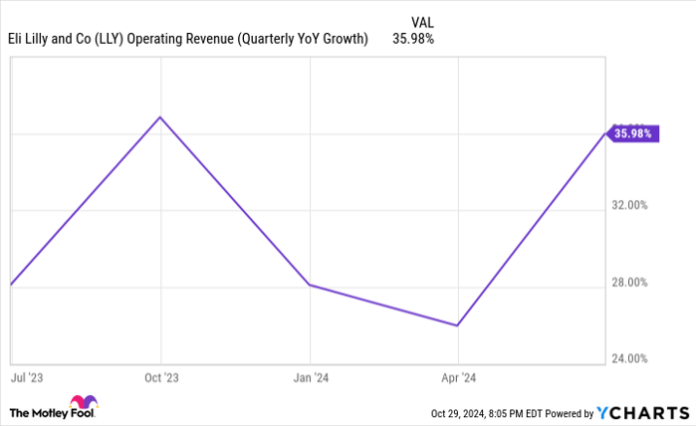

Eli Lilly’s financial outlook appears bright. Historically, a mid-teens revenue growth rate is a strong indicator of a pharmaceutical company’s health. After being slightly disrupted by the pandemic, Eli Lilly is now experiencing impressive revenue growth, spurred by Zepbound’s success.

LLY Operating Revenue (Quarterly YoY Growth) data by YCharts

While Eli Lilly faces competition—mainly from Novo Nordisk‘s Wegovy—the field remains relatively new. The pharmaceutical sector sees companies specializing in certain therapeutic areas, making it hard for newcomers to gain a foothold. Eli Lilly brings a hundred years of experience in diabetes treatments to the weight loss arena, which should provide advantageous insights.

The company is also exploring additional weight loss drugs, like retatrutide, which could outperform Zepbound. Unlike Zepbound, which targets two hormones, retatrutide works with three. Meanwhile, orforglipron, an oral option, might appeal to patients who prefer alternatives to injections. Eli Lilly’s innovations in this field show promise for solid growth for years to come.

Track Record of Success

Investors who bought $50,000 worth of Eli Lilly shares back in November 2012 would be millionaires today, assuming dividends were reinvested. Over this period, it achieved a compound annual growth rate of 29%, turning that initial investment into over $1 million.

LLY Total Return Level data by YCharts

Looking ahead, Eli Lilly seems poised for continued success—not only due to weight loss products but also because of its innovative efforts in other areas, such as a recent breakthrough in Alzheimer’s treatment. The company’s projected earnings-per-share growth of about 72% over the next five years supports a forward price-to-earnings rate of 67.26. Eli Lilly’s solid fundamentals will likely ensure regular dividend increases. Thus, investing in the near $1 trillion company appears promising.

Should You Consider Investing in Eli Lilly?

Before deciding to purchase Eli Lilly shares, take this into account:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy right now—and Eli Lilly is not among them. The selected stocks are predicted to yield significant returns in the coming years.

For instance, think about Nvidia, which made this list on April 15, 2005… if you invested $1,000 at that time, you’d have $829,746!*

Stock Advisor offers investors a straightforward plan for success, including tips on portfolio building, regular updates from analysts, and two new stock picks each month. Since 2002, the service has more than quadrupled the returns compared to the S&P 500.*

View the 10 stocks »

*Stock Advisor returns as of October 28, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

The views expressed here are the author’s opinions and do not necessarily reflect those of Nasdaq, Inc.