Is IonQ the Next Big Name in Quantum Computing?

Recent advancements in quantum computing, particularly by Google, have sparked new interest from investors. Google’s Willow quantum computing chip has achieved a remarkable feat, completing a benchmark test that would have taken the world’s fastest supercomputer an astounding 10 septillion years to finish.

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is not solely a quantum computing company; it is a larger tech giant with diverse investments including quantum technology. In contrast, IonQ (NYSE: IONQ) focuses exclusively on quantum computing. With interest in this field on the rise, the question many investors are asking is whether IonQ is a smart investment option.

Stay Informed! Get daily market news with our Breakfast News newsletter. Sign Up For Free »

Understanding the Difference: Quantum vs. Traditional Computing

To grasp the potential of quantum computing, it’s important to understand how it differs from traditional computing. Conventional computers use bits to store information, which represent a simple binary choice: 1s and 0s. Quantum computers operate on qubits, allowing for a range of values between 0 and 1, which provides them with greater processing power and flexibility. However, quantum computing also faces challenges, particularly with estimation errors as it does not firmly deliver values of 1 or 0, an issue that has challenged many in the field. Google’s Willow chip has effectively tackled this issue, showcasing a novel arrangement of qubits.

This breakthrough, while not directly benefiting IonQ, has significantly elevated interest in the quantum space and underscored some of IonQ’s strengths. The company is also addressing the error challenge. In November, IonQ announced its anticipation of achieving 99.9% qubit gate fidelity by 2024, aiming to consistently improve thereafter. This positions IonQ impressive close to the capabilities demonstrated by the Willow chip, albeit with less market visibility given its size.

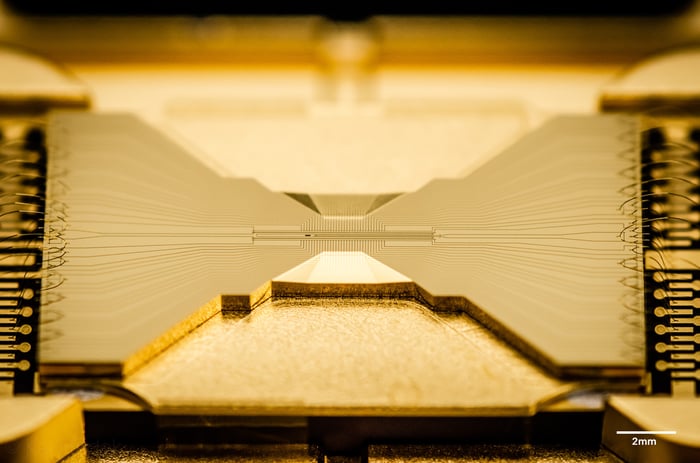

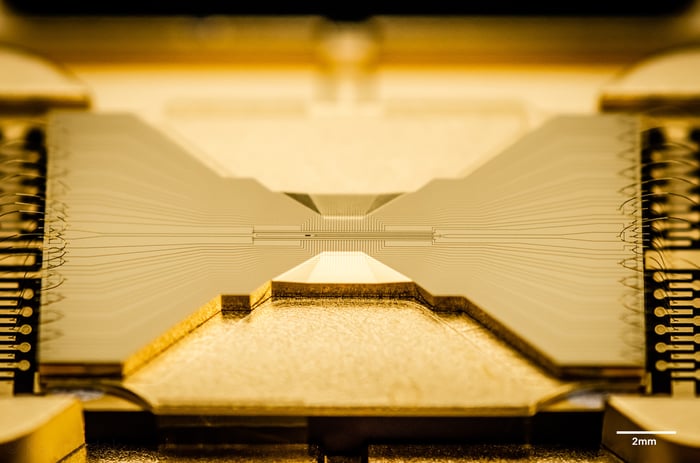

Image source: IonQ.

IonQ has also secured significant contracts, including a $54.5 million agreement with the U.S. Air Force Research Lab—the largest known quantum computing contract awarded in 2024. Additionally, the company partners with drug research firms and engineering simulation businesses. These contracts are crucial for IonQ as it is not yet profitable, relying on external funding for research and development efforts.

It is crucial to acknowledge that much about quantum computing remains uncertain. Investors still lack clarity on which company will emerge as the frontrunner or how quantum technology will impact various industries. Nevertheless, if IonQ succeeds, substantial financial returns could follow.

Speculative Nature of IonQ’s Future

IonQ projects a total addressable market for quantum computing as $65 billion by 2030 and $850 billion by 2040. These ambitious forecasts should be approached cautiously, particularly since they stem from the company itself, which stands to gain from the excitement surrounding the technology. However, if IonQ can capitalize on opportunities in this booming field, revenues could increase significantly from its current market cap of $9.6 billion.

Still, investing in IonQ carries risks. It should be considered a venture capital-like investment, as outcomes could vary widely, including the potential for complete losses should IonQ fall behind competitors. For those considering a stake in IonQ, it is advisable to limit the investment to no more than 1% of one’s total portfolio.

Additionally, the recent surge in interest regarding quantum computing has propelled IonQ’s stock price up by around 450% since early October. Given the volatility in this sector, waiting for the excitement to settle may be prudent before making a larger investment.

Alternatively, investors might consider a diversified approach by acquiring shares from several companies in the quantum computing space, including IonQ and Alphabet, to spread risk effectively.

Quantum computing may represent a groundbreaking shift in technology over the next decade. However, identifying which company will succeed and the timing of that success remains highly unpredictable, resulting in a higher investment risk compared to conventional stocks.

Explore a Potentially Lucrative Investment Opportunity

Have you ever felt like you missed out on investing in major stocks? Now is your chance to pay attention.

Occasionally, our expert analysts release a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you are concerned about missing your investment opportunity, now may be the time to get in before it’s too late. The numbers are compelling:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,640!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,181!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,206!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and opportunities like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.