Warren Buffett’s Recent Moves: A Cautionary Tale for Investors

Warren Buffett has shown time and again his knack for making smart investment choices through both good times and bad. Leading Berkshire Hathaway, he has achieved a compounded annual gain of nearly 20% over 58 years, far exceeding the S&P 500‘s 10% return during the same period. Consequently, many investors closely follow Buffett’s investments and insights.

Recently, however, Buffett’s actions may carry more weight than his words. Known as the Oracle of Omaha, he made a significant move that investors ought to recognize. Some might interpret this decision as a warning. Is it possible that Buffett has insights that Wall Street lacks? Let’s explore this further.

Image source: The Motley Fool.

Market Optimism: What’s Fueling It?

First, let’s examine the broader market landscape for this year. All three major indexes are poised for substantial gains driven by a drop in interest rates and heightened interest in artificial intelligence (AI) stocks. The Federal Reserve reduced interest rates twice this fall, with the belief that lower rates will help consumers spend and allow companies to borrow more easily for growth.

AI technology is also rising in importance, with the potential to transform numerous business sectors and enhance daily living. This could lead to heightened efficiency and reduced costs for various companies, alongside innovative products that could boost revenues. Analysts predict that the current $200 billion AI market could reach $1 trillion by the end of the decade. Consequently, many investors have flocked to leading AI companies, which has propelled the indexes upward. This year, the S&P 500, Nasdaq, and Dow Jones Industrial Average are showing impressive increases of 25%, 26%, and 18%, respectively.

Buffett’s Sobering Decision

Amid this excitement, Buffett recently took a more cautious approach. In the third quarter, he reduced his holdings in two of his favored stocks, Apple (NASDAQ: AAPL) and Bank of America (NYSE: BAC), by 25% and 23%, respectively. Earlier in the year, he had already cut his Apple position by almost 50%. Although Apple remains Buffett’s top holding, Bank of America has dropped from second largest to third place behind American Express.

Market Behaviors: Caution from Buffett

In his 2023 shareholder letter, Buffett highlighted the “casino-like behavior” he perceives in the current stock market, indicating his growing caution. This resonates with his sentiments from 2000, where he remarked that after experiencing “effortless money,” investors might be tempted to stay too long in a rising market, akin to Cinderella at the ball.

Does Buffett’s caution imply he knows a downturn is coming? Not necessarily. Earlier this year, he expressed a desire to realize gains at the current capital gains tax rate. Thus, his decisions regarding Apple and Bank of America do not necessarily reflect a loss of faith in those companies.

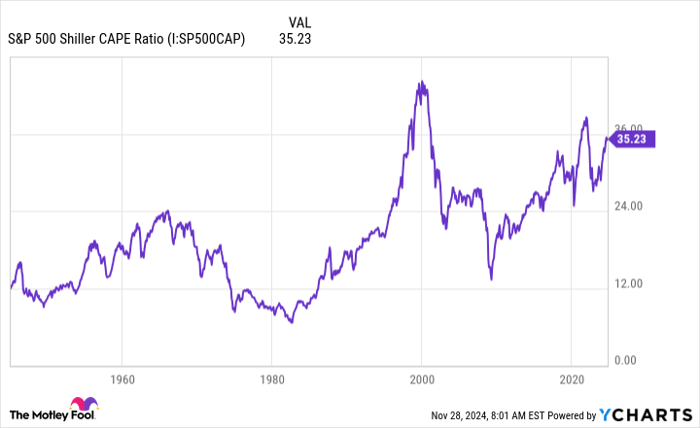

Valuation Caution: A Historical Lens

Buffett’s moves, combined with his historical perspective, should encourage investors to closely assess today’s market valuations. A useful tool for this is the S&P 500 Shiller CAPE ratio, which is currently above 35. This valuation measure, accounting for inflation, compares companies’ earnings over a decade against their prices. This level has only been matched or exceeded twice since the S&P 500’s formation as a 500-company index in the late 1950s, clearly placing the current market among its priciest moments.

S&P 500 Shiller CAPE Ratio data by YCharts.

This situation urges investors, like Buffett, to navigate the market carefully. It’s wise to scrutinize each stock’s valuation rather than jumping into popular stocks that may have already seen significant price increases. This doesn’t advocate for halting investments or fearing an impending market decline. History shows that the market will face downturns, but the silver lining is this: if you invest in quality stocks at reasonable prices and maintain your holdings long-term, short-term market fluctuations are less likely to derail your returns.

Thus, Buffett’s recent caution isn’t a signal to cease investing. It serves as a reminder to be selective with stock choices and keep a long-term focus — a strategy that could lead to substantial investment success.

Is Now the Right Time to Invest in Apple?

Before diving into Apple stock, here’s a point to consider:

The Motley Fool Stock Advisor analyst team has pinpointed what they believe are the 10 best stocks for investors today, and surprisingly, Apple isn’t included. Those top stocks could generate significant returns in the years ahead.

Reflecting on past success: When Nvidia made the cut on April 15, 2005, a $1,000 investment would now be worth $847,211!

Stock Advisor delivers an accessible roadmap for investors seeking success, including advice on portfolio building, regular analyst updates, and two fresh stock picks each month. The Stock Advisor service has notably more than quadrupled the returns of the S&P 500 since 2002*.

Check out the 10 stocks now »

*Stock Advisor returns as of November 25, 2024

American Express is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. Adria Cimino has positions in American Express. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.