Warren Buffett’s Berkshire Hathaway has made headlines once again with its recent 13-F filing to the Securities and Exchange Commission (SEC). Although Buffett’s team has been selling off stocks in recent quarters, the investment in Domino’s Pizza(NYSE: DPZ) caught many analysts off guard.

The news prompted a brief increase in both the average share volume and stock price of Domino’s. However, investors often have differing reasons for purchasing individual stocks, and not every selection from a billionaire is a good fit for the average investor. Therefore, it’s essential to delve deeper into Domino’s before deciding whether it warrants your investment.

Understanding Domino’s Pizza

Domino’s stands as the largest pizza company globally, boasting nearly 21,000 locations across over 90 countries and serving around 1 million customers daily. Approximately 99% of these outlets are franchise-owned.

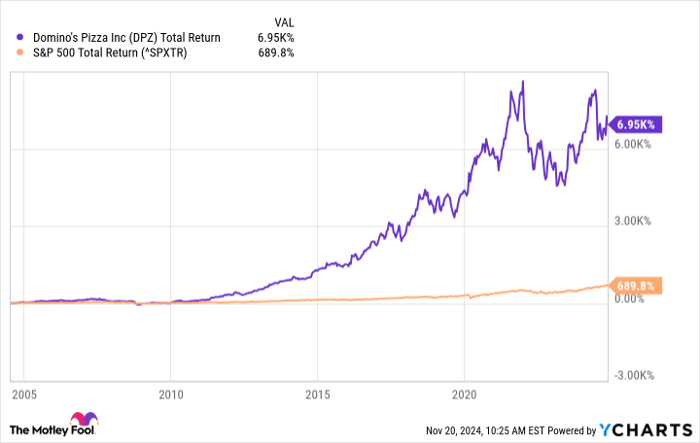

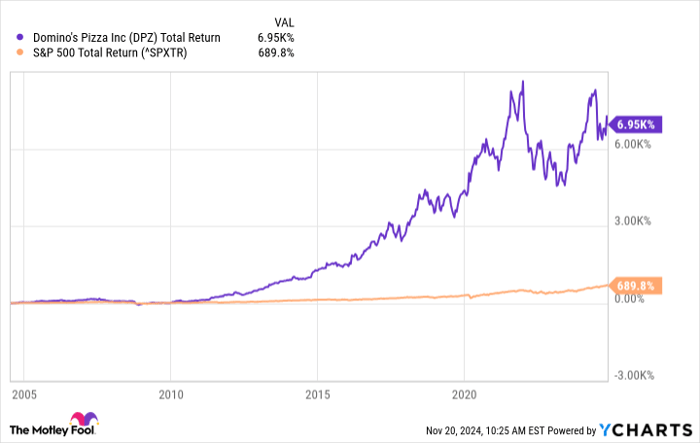

Founded in Ypsilanti, Michigan, in 1960, Domino’s has actively pursued expansion. Although it steadily grew to roughly 7,500 global locations, it didn’t launch its initial public offering (IPO) until July 2004. Since then, the company has delivered a staggering total return of nearly 7,000%, significantly outperforming the S&P 500.

DPZ Total Return Level data by YCharts.

While Domino’s hasn’t specified a concrete growth target in its reports, the company maintains it can continue adding thousands of new locations globally. It has indicated aspirations for around 1,100 net new stores yearly, which includes approximately 175 in the United States.

Berkshire’s Stake in Domino’s Pizza

Under SEC regulations, Berkshire Hathaway is required to submit a 13-F filing detailing its stock holdings each quarter. However, the firm is not mandated to clarify its investment decisions, leaving little insight into why Buffett’s team chose to invest in Domino’s.

One plausible reason could be that Berkshire purchased the stock after Domino’s second-quarter earnings report for fiscal 2024 (ending June 16), which was published on July 18. Following that earnings release, Domino’s stock dropped 14% in the subsequent trading session as the company reduced its forecasts for global store growth. The stock experienced minimal gains afterward before beginning a recovery in September.

In addition, the company only opened 72 new stores in fiscal Q3 (ending September 8), signaling a slowdown in growth. Furthermore, in fiscal Q2, Domino’s suspended its guidance for 1,100 net new stores globally, which likely unsettled some investors.

The declining stock price has brought the price-to-earnings (P/E) ratio down to 27. Nevertheless, many investors might still find this multiple costly. In the first three quarters of fiscal 2024, Domino’s reported revenue of almost $3.3 billion, marking a 6% year-over-year increase, which may not inspire investors to pay a premium.

Domino’s also recorded a net income of $415 million, reflecting a 15% rise from the previous year, buoyed by boosts in other income and interest earnings. However, analysts project only a 6% profit increase next year, suggesting a slowdown from current growth rates.

Shareholders receive $6.04 per share per year in dividends. Yet, with a dividend yield of 1.4%, it barely surpasses the 1.25% average for the S&P 500, leaving little incentive for investors to consider this stock appealing.

Should You Follow Buffett into Domino’s Pizza Stock?

After reviewing Domino’s and its financial status, most investors should likely think twice before investing in its stock.

There’s a good chance Domino’s will provide positive returns for its shareholders over time. However, it’s vital for average investors to recognize that they do not have the same resources or insights as Buffett and his team.

Berkshire’s significant size often limits its ability to discover stocks with returns that beat the market. Additionally, since Berkshire holds $288 billion in Treasury bills, investing in Domino’s may solely be an effort to preserve wealth and collect modest dividends.

Domino’s is expected to continue its slow, steady expansion. However, average investors are likely to find more promising returns in alternative stocks.

Is Now the Right Time to Invest $1,000 in Domino’s Pizza?

Before purchasing shares in Domino’s Pizza, you might want to consider this:

The Motley Fool Stock Advisor analyst team has identified what it considers the 10 best stocks for investors right now… and Domino’s Pizza isn’t among them. These top picks could generate significant returns in the coming years.

For instance, when Nvidia was recommended on April 15, 2005, a $1,000 investment would be worth $869,885!*

Stock Advisor offers investors a straightforward roadmap to success, providing guidance on portfolio building, regular analyst updates, and two new stock picks each month. Since its inception, the Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

Explore the 10 stock picks »

*Stock Advisor returns as of November 18, 2024

Will Healy has positions in Berkshire Hathaway. The Motley Fool also has positions in and recommends Berkshire Hathaway and Domino’s Pizza. The Motley Fool operates under a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.