The Vanguard S&P Mid-Cap 400 ETF Shows Potential: Analysts Predict Gains Ahead

As part of our analysis at ETF Channel, we examined the underlying assets of various ETFs and compared their current trading prices with the average 12-month target prices set by analysts. For the Vanguard S&P Mid-Cap 400 ETF (Symbol: IVOO), the weighted average implied target price stands at $116.63 per unit.

Current Trading Price vs. Analyst Targets

IVOO is currently trading at approximately $106.24 per unit, suggesting an upside potential of 9.78% based on analysts’ expectations for its underlying holdings. Significant upside potential is seen among three of IVOO’s constituent stocks: Old National Bancorp (Symbol: ONB), Medpace Holdings Inc (Symbol: MEDP), and Toro Company (Symbol: TTC). For instance, although ONB’s recent price is $18.87 per share, analysts anticipate a 20.23% increase to an average target of $22.69. Medpace, with a current price of $326.54, is expected to rise by 19.94% toward a target of $391.67, while TTC, trading at $81.62, has an anticipated target of $97.40 per share, reflecting a 19.33% upside.

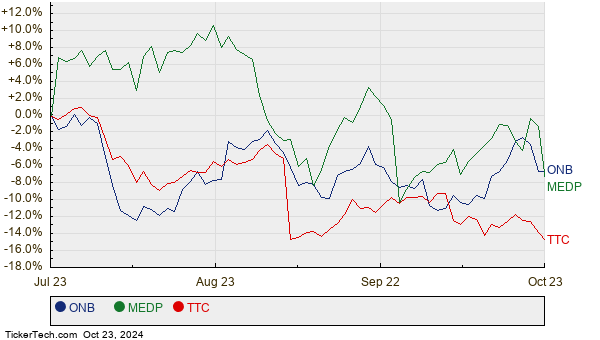

Price History of Select Stocks

Below is a 12-month price history chart that compares the performance of ONB, MEDP, and TTC:

Summary of Analyst Target Prices

The table below summarizes the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Mid-Cap 400 ETF | IVOO | $106.24 | $116.63 | 9.78% |

| Old National Bancorp | ONB | $18.87 | $22.69 | 20.23% |

| Medpace Holdings Inc | MEDP | $326.54 | $391.67 | 19.94% |

| Toro Company | TTC | $81.62 | $97.40 | 19.33% |

Assessing Analyst Optimism

Are the analysts’ target prices realistic or overly optimistic for the next year? It’s vital to evaluate whether their expectations are based on recent trends in the industry and the companies. A high target price relative to a stock’s trading price indicates optimism, but could also hint at potential downgrades if those targets no longer reflect current realities. Investors would benefit from further research into these insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• SPIR Historical Stock Prices

• DX Historical Earnings

• Funds Holding AAAU

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.