Analysts See Significant Upside for iShares Dow Jones U.S. ETF

In our analysis of ETFs, we evaluated the trading prices of various holdings against the average analyst 12-month forward target price. For the iShares Dow Jones U.S. ETF (Symbol: IYY), the implied analyst target price is $160.34 per unit.

Current Trading Insights

Currently, IYY is trading at approximately $135.96 per unit. This suggests that analysts forecast a potential upside of 17.93% based on the average target prices of its underlying holdings. Notably, three holdings show considerable upside to their respective target prices: Church & Dwight Co Inc (Symbol: CHD), Etsy Inc (Symbol: ETSY), and Cousins Properties Inc (Symbol: CUZ).

Individual Holding Analysis

Church & Dwight Co Inc (CHD) is trading at $92.38 per share, while the average analyst target price is $110.74, indicating a 19.87% upside potential. Similarly, Etsy Inc (ETSY) has a recent price of $42.51, with an expected target price of $50.72, marking a 19.31% upside. Lastly, Cousins Properties Inc (CUZ) is trading at $27.77, but analysts project it could reach $33.00 per share, which is 18.83% higher from its current position.

Price Performance Summary

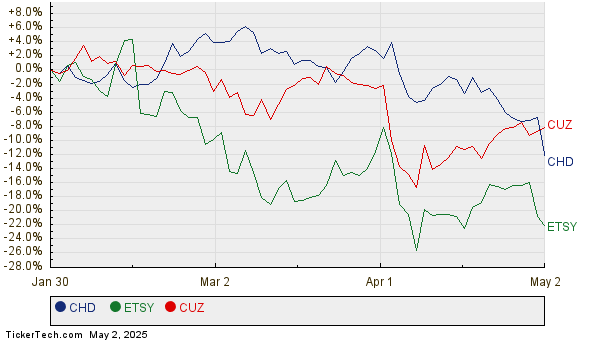

Below is a twelve-month price history chart comparing the performance of CHD, ETSY, and CUZ:

Analyst Target Price Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Dow Jones U.S. ETF | IYY | $135.96 | $160.34 | 17.93% |

| Church & Dwight Co Inc | CHD | $92.38 | $110.74 | 19.87% |

| Etsy Inc | ETSY | $42.51 | $50.72 | 19.31% |

| Cousins Properties Inc | CUZ | $27.77 | $33.00 | 18.83% |

Future Considerations

Investors may wonder whether the analysts’ price targets are realistic or overly optimistic. Validating these targets requires understanding recent developments within the companies and their industries. A high price target relative to a stock’s trading price may indicate future growth potential but could also lead to corrections if expectations are not met. Further research may help investors gauge the accuracy of these predictions.

Additional Insights:

• CVO Insider Buying

• MSA Split History

• Institutional Holders of GGAA

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.