Alibaba: A Top Contender in the Chinese E-Commerce Market

Alibaba (NYSE:BABA) stands out as a notable choice for investors eyeing major Chinese internet stocks. The main players in this arena—BABA, PDD, and JD—are currently trading at similar forward price-to-earnings (PE) ratios, all hovering around 11x.

According to J.P. Morgan analyst Alex Yao, Alibaba shines brighter than its competitors.

“We think Alibaba is the most attractive one among the three,” he said, highlighting two important reasons: “1) a number of high visibility catalysts expected in the coming quarters 2) a potential narrative change regarding the domestic e-commerce market, which may lead to a higher valuation.”

However, investors should remain cautious. Yao points out that Alibaba’s results for the upcoming September quarter could reflect a “weak consumption environment,” which may impact both revenue and profits.

The delicate economic conditions, according to Yao, are likely to weigh on China’s GMV (gross merchandise volume). The National Bureau of Statistics reported that growth in online physical goods sales for August slowed significantly to +4% year-over-year, down from +8% in July.

Considering these elements, Yao forecasts a 6% year-over-year increase in Alibaba’s quarterly revenue, which is slightly below consensus estimates by 1%. Although he anticipates a 2% decline in non-GAAP EPS compared to last year, his projections still exceed analysts’ expectations by 5%.

Looking ahead, Yao encourages investors to remain optimistic, noting that “a few positive drivers” could emerge in the coming quarters. He points to potential improvements in overall consumption thanks to government stimulus, along with faster core revenue growth due to new monetization strategies introduced in September. Furthermore, Yao expects increased buyer growth resulting from the integration of Weixin Payment (WeChat Pay) and steady inflow from recent inclusion in the HK Stock Connect.

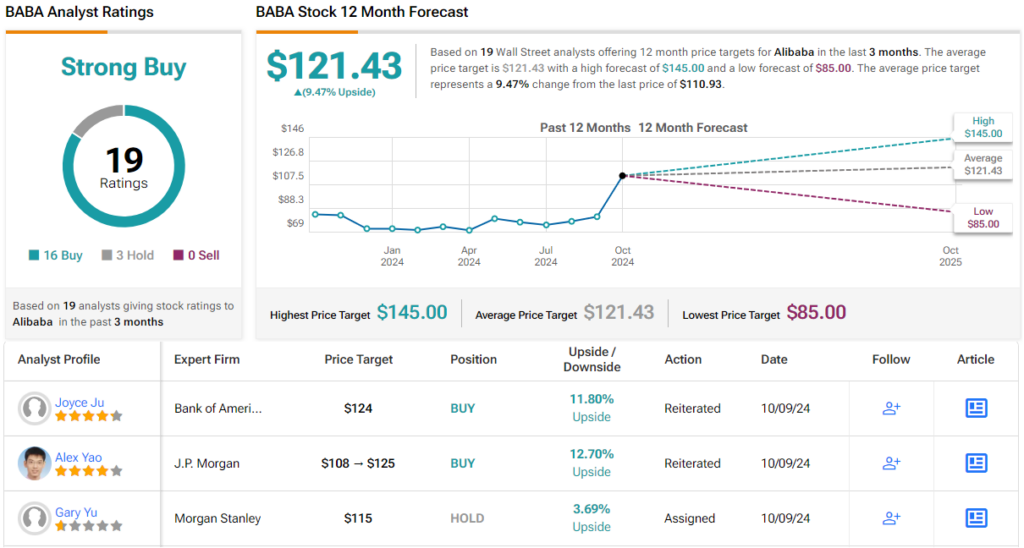

In light of this outlook, Yao rates BABA shares as Overweight (or Buy) with a price target of $125, indicating approximately 13% upside potential from current levels. (For a look at Yao’s track record, click here.)

Other Wall Street analysts seem to share this positive sentiment. Fifteen additional analysts have rated Alibaba a Buy, and with three Holds factored in, the overall consensus remains Strong Buy. The average price target stands at $121.43, suggesting a potential return of 9.5% in the coming months, just shy of Yao’s target. (See BABA stock forecast)

To discover attractive stock ideas, consider using TipRanks’ Best Stocks to Buy tool, which combines all of TipRanks’ equity insights.

Disclaimer: The views expressed in this article are solely those of the featured analyst. The content is intended for informational purposes only. It is crucial to conduct your own analysis before making any investment.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.